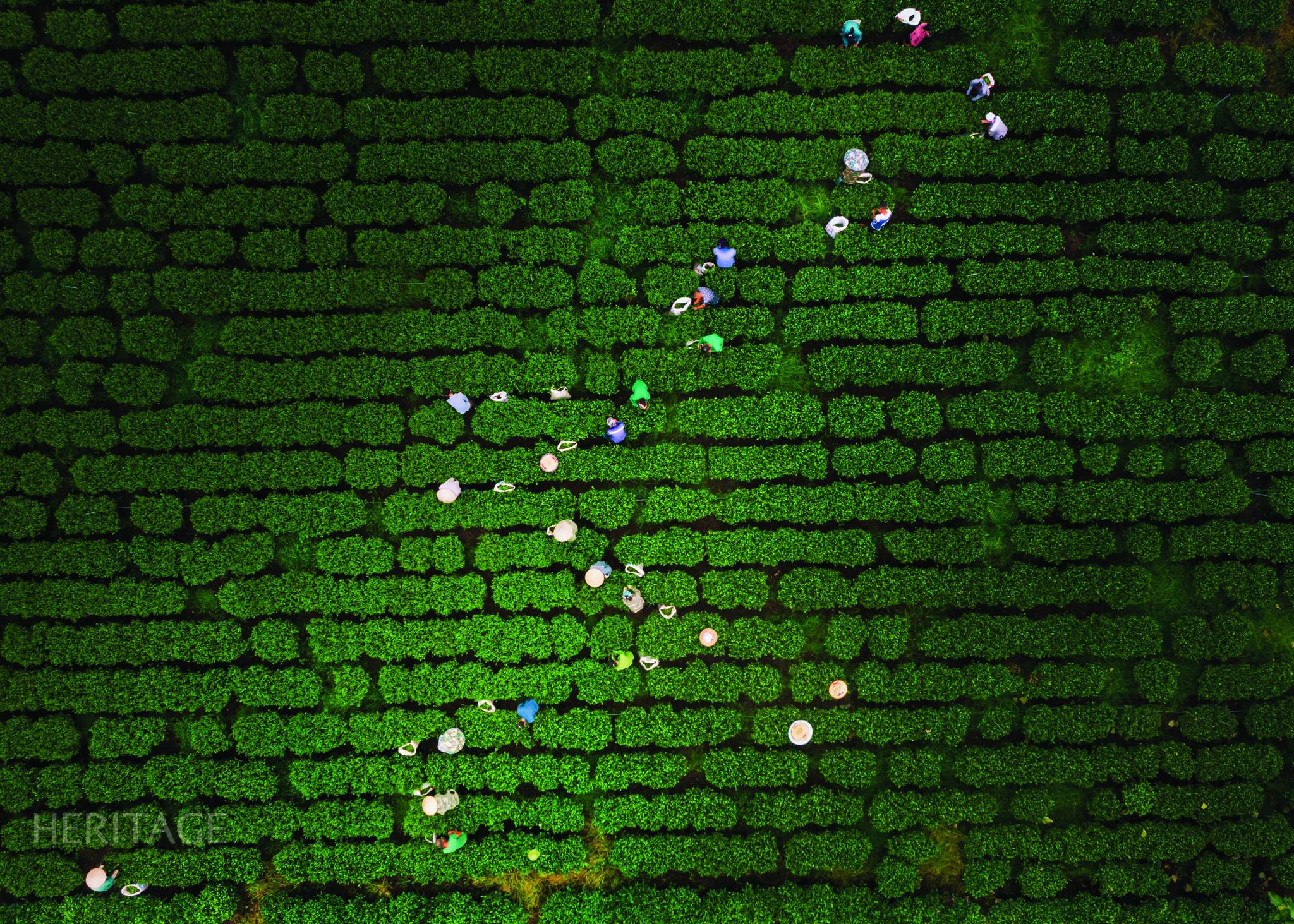

Credit institutions in Ha Tinh have restructured debt repayment terms and maintained debt groups for 114 customers.

In recent times, the State Bank of Ha Tinh province has regularly disseminated and directed credit institutions to strictly implement the policies, mechanisms and policies of the State, the industry and the Provincial People's Committee related to banking activities. At the same time, proactively implementing policies to remove difficulties for economic sectors.

Banks proactively implement customer support according to Circular 02.

In compliance with the direction of superiors, banks have focused on implementing Circular 02/2023/TT-NHNN (referred to as Circular 02) regulating credit institutions and foreign bank branches to restructure debt repayment terms and maintain debt groups to support customers in difficulty (effective from April 24, 2023).

Accordingly, the "banks" have stepped up communication about Circular 02 so that eligible customers can access and enjoy the policy; organize customer screening and receive requests; promptly resolve records on the basis of ensuring publicity and transparency, avoiding profiteering, taking advantage to conceal bad debts, reflecting the credit situation objectively and substantially.

According to data from the State Bank of Ha Tinh province, as of September 10, 2023, credit institutions in the area have restructured debt repayment terms and maintained debt groups for 114 customers (including 102 individuals and 12 businesses) with a restructured principal balance of VND 380.95 billion.

Circular 02 is expected to be a "medicine" to support people and businesses in Ha Tinh in the post-COVID-19 period.

According to financial experts, Circular 02 has the effect of supporting the business community in general and businesses in Ha Tinh in particular in the context of facing difficulties due to the impact of the world economy such as: increased production costs, decreased orders, slow product consumption...

Circular 02 not only supports production and business customers, but also those who are facing difficulties with consumer loans, have reduced income, and are not able to repay their debts, are also eligible for debt deferral and extension for up to 1 year. Therefore, the bank will continue to implement solutions to support customers to benefit from the policy, contributing to promoting the socio-economic development of Ha Tinh.

Thao Hien

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)