Recently, VPS Securities JSC introduced to investors a form of real estate investment divided into small lots right on the VPS SmartOne application.

According to research, VPS cooperated with FNEST JSC to deploy the FNEST feature - investing in real estate in small portions with a super small capital of only 10,000 VND. This form of investment is purchased directly on SmartOne/FNEST Website when the project is sold in the primary market. In addition to the primary market, investors can also buy and sell in the secondary market similar to stocks.

On the FNEST website, this unit introduces that investors receive monthly profits from real estate rental operations and can withdraw money from their accounts at any time. At each sale, the primary price of an FNEST has a face value of only 10,000 VND. Specifically, a villa is opened for sale with 2.55 million FNEST, equivalent to a valuation of 25.5 billion VND.

Currently, in the FNEST feature, there are about 10 codes for sale and all are announced as officially "sold out" and suggest that customers can continue secondary transactions.

Regarding the above real estate subdivision model, the reporter asked Mr. Bui Hoang Hai - Vice Chairman of the State Securities Commission about the transparency of this investment form at the regular press conference of the second quarter of 2024 of the Ministry of Finance.

Currently, all real estate codes introduced for sale on FNEST have been sold out.

According to Mr. Hai, the Securities Law has not yet defined the type of real estate division into a type of securities. The Securities Commission has monitored this model and found that this is a form of investment with many risks.

In foreign countries, there are regulations on controlling and managing risks for this model. However, in Vietnam, there are currently no regulations related to this form of investment. Therefore, the leaders of the Securities Commission assess that participating in this type of investment is relatively risky.

From the management function perspective, after receiving information that VPS was selling these certificates, the Securities Commission worked and requested VPS to immediately stop distributing real estate subdivision certificates.

Faced with the above situation, Deputy Minister Nguyen Duc Chi requested that the Securities Commission in the coming time need to monitor the activities of securities companies more closely. The services provided by securities companies must be within the industry and business areas licensed by the Securities Commission. If not, they must be stopped, comprehensively evaluated and reported to the Ministry of Finance for consideration from a financial management perspective .

Source: https://www.nguoiduatin.vn/bo-tai-chinh-noi-gi-ve-mo-hinh-bds-chia-nho-voi-von-tu-10-000-dong-a668922.html

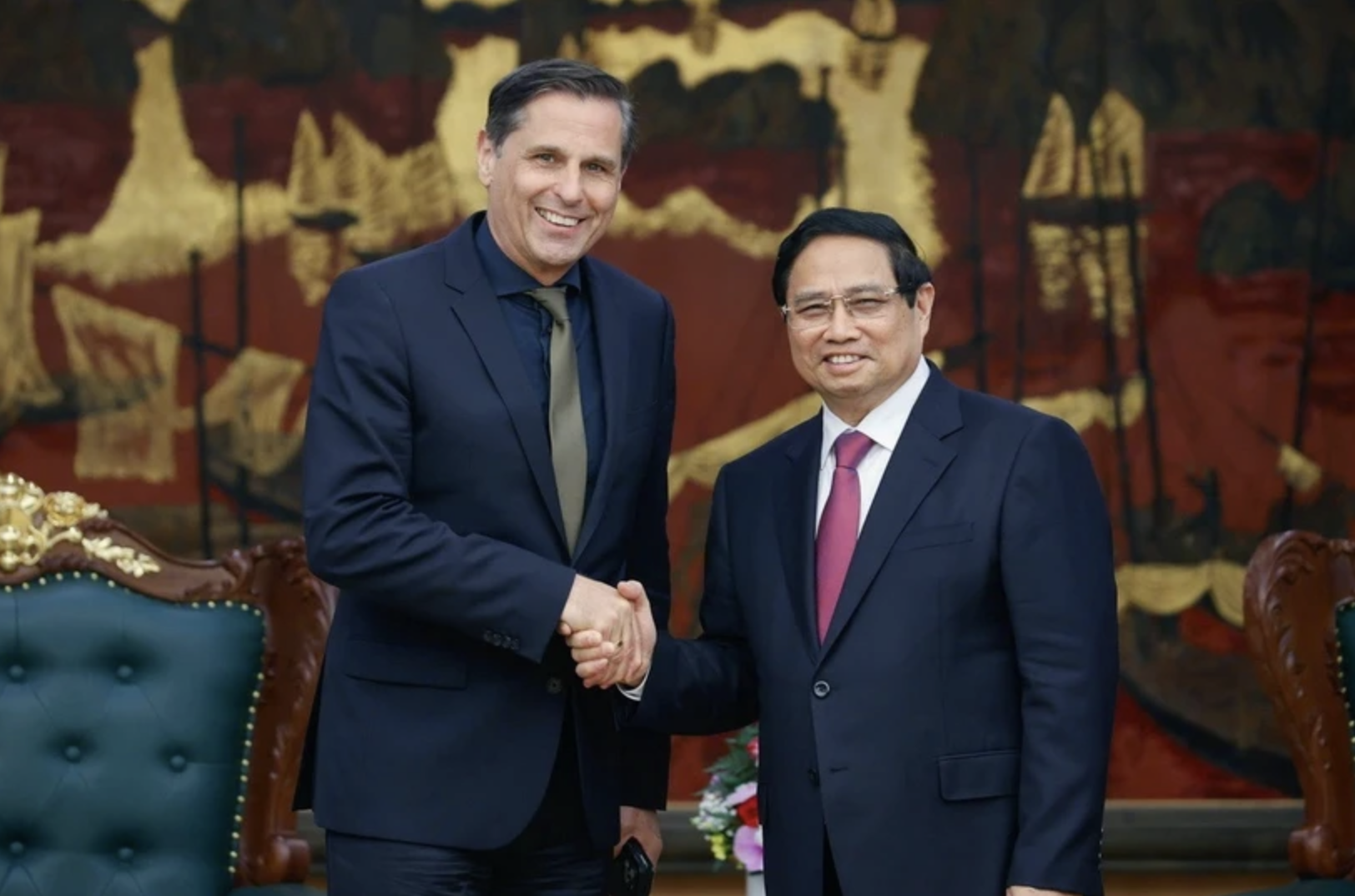

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

Comment (0)