The decision to partially divest capital at VNECO3 was made right before the plan to offer shares to existing shareholders at a ratio of 1:1.

|

| Illustration |

Vietnam Electricity Construction Joint Stock Corporation (code VNE - HoSE) has just announced that it has completed the transaction of selling 382,766 VE3 shares of VNECO 3 Electricity Construction Joint Stock Company (code VE3 - HNX), equivalent to nearly 29% of VNECO 3's capital to restructure its investment portfolio.

Recent transaction data statistics show that there have been negotiated transactions with the transfer volume exactly equal to the amount sold by VNECO. Accordingly, 382,766 VE3 shares were traded by VNECO in the session on September 24, with a value of VND 3.83 billion, each share costing an average of VND 10,000, 8.7% higher than the closing price of the same day (VND 9,200/share) and much higher than the closing price of the stock at the end of last week (VND 7,500/share).

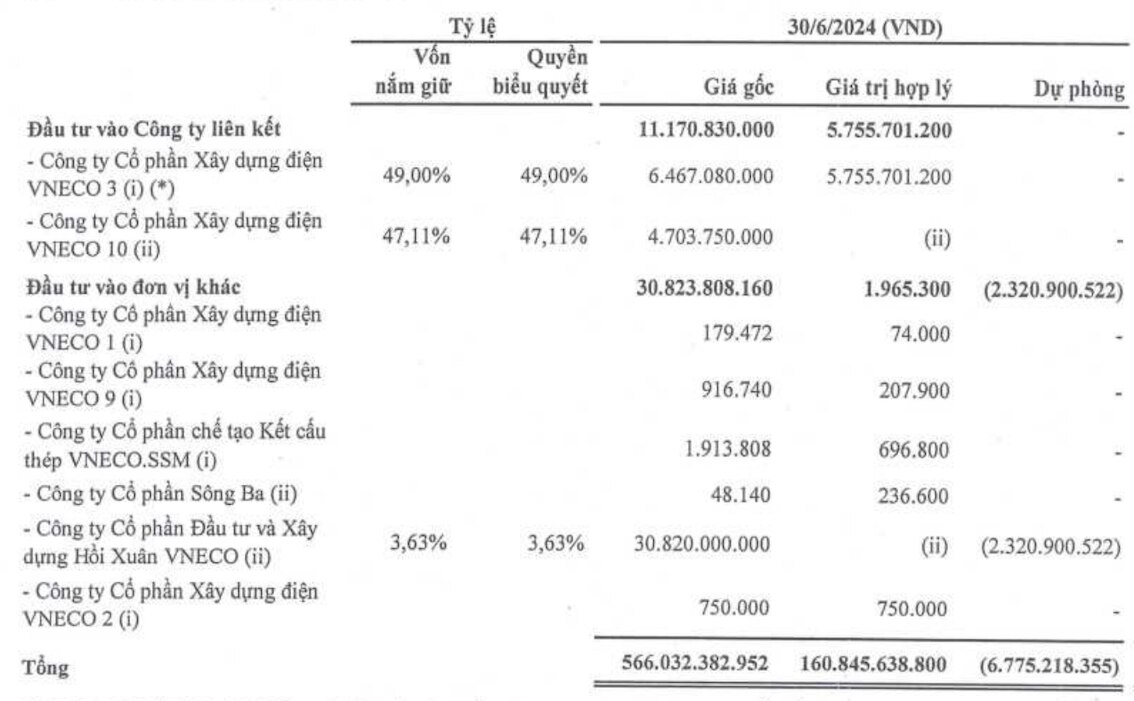

With the sale price at par value, VNECO breaks even when reducing its ownership in this enterprise. VNECO used to be the parent company that owned the controlling stake in VNECO3. However, the company reduced its ownership in the fourth quarter of 2023. With the recent transaction, VNECO's ownership ratio therefore decreased from 49% of capital to 20%. VNECO3 continues to be an associate company of VNECO. Despite continuously selling shares, VNECO is still the largest shareholder of this enterprise.

|

| List of companies in which VNECO owns less than 50% of shares. |

On the other hand, VNECO3 has a new major shareholder, Mr. Hoang Cao Son. This investor bought 66,766 shares, equivalent to nearly 18% of VNECO's shares sold. After the transaction, from a small shareholder owning 1.96% of capital, Mr. Son is now the second largest shareholder with a 7.02% ownership ratio, just after VNECO.

Currently, Mr. Dao Ngoc Quynh - Chairman of the Board of Directors of VNECO 3 is also the representative of the capital contribution of Vietnam Electricity Construction Joint Stock Corporation.

The decision to divest part of its capital at VNECO3 was made right before the plan to offer shares to existing shareholders. Previously, VNECO 3 announced the Board of Directors' Resolution on implementing the plan to offer additional shares to existing shareholders. Accordingly, the company plans to offer nearly 1.32 million shares at a ratio of 1:1 (shareholders owning 1 old share have the right to buy 1 new share). The issue price is equal to the par value of VND 10,000/share. The capital raised from the share offering is expected to be allocated to supplement working capital to restructure short-term loans at banks.

VNECO 3 operates in the field of construction of industrial works, irrigation works, power plants, power lines and transformer stations. The company operates mainly in the Central and Northern regions such as Nghe An, Ha Tinh, Phu Tho, etc.

Regarding business performance, in the first half of 2024, VNECO 3 recorded more than VND54 billion in net revenue, up 77.5% over the same period last year. However, revenue increased mainly in the trading segment, while this is a segment with a thin gross profit margin, even operating below cost price in the first half of this year. VE3's core business of construction and installation only increased slightly compared to the same period. Gross profit in the first 6 months of the year was only nearly VND3.1 billion, down nearly 3% over the same period. Financial expenses increased by 15% but management expenses decreased sharply by 30%, so the company recorded a profit after tax of more than VND78 million, while in the same period it lost VND395 million.

As of June 30, 2024, VNECO 3's total assets were VND 107.6 billion, down 13.6% compared to the beginning of the year. Of which, short-term assets decreased from VND 116 billion to VND 99 billion. Short-term receivables from customers decreased by 24% to nearly VND 34 billion. Short-term debt decreased by 16% to VND 88.5 billion, of which short-term payables to suppliers decreased by 43% to nearly VND 30.5 billion. The company still has VND 3.35 billion in undistributed profits.

Comment (0)