Besides increasing loans for investors to buy stocks on the stock exchange, VNDirect's mobilized cash flow shows signs of pouring strongly into the bond market.

|

Shareholders must continuously pay money

Reaching a short-term peak on September 20, 2023 at VND 25,250/share, VND shares of VNDirect Securities Corporation then continuously declined, especially after a system error that prevented investors from trading on the entire system at the end of March 2024 (lasting more than 1 week), leading to a price plunge, reaching a short-term bottom on April 19 at VND 18,900/share, 25.1% lower than the peak on September 20, 2023.

However, recently, VND shares have recovered to VND 21,900/share on May 17 (closing price on May 22 was VND 21,300/share), attracting cash flow again when the Company announced the approval of offering shares and increasing charter capital.

According to the capital increase plan recently approved by the State Securities Commission, VNDirect plans to offer nearly 244 million shares to existing shareholders at a ratio of 5:1, meaning that shareholders owning every 5 shares will have the right to buy 1 new share, the offering price is 10,000 VND/share. With this plan, the Company estimates to collect nearly 2,440 billion VND, used to expand its margin lending capacity, capital market source business capacity, bond issuance underwriting capacity, etc.

In addition, VNDirect was also approved to pay stock dividends at a rate of 5%, equivalent to issuing nearly 61 million additional shares. Thus, if the two issuances are completed, the Company's charter capital will be increased from VND12,178 billion to nearly VND15,223 billion.

VNDirect is one of the few securities companies that have continuously offered shares to raise capital from shareholders in recent years. From 2018 to March 31, 2024, VNDirect's charter capital increased 6.86 times, from VND 1,549.98 billion to VND 12,178.4 billion, becoming one of the listed securities companies with the fastest charter capital increase rate on the floor.

Investing in financial assets

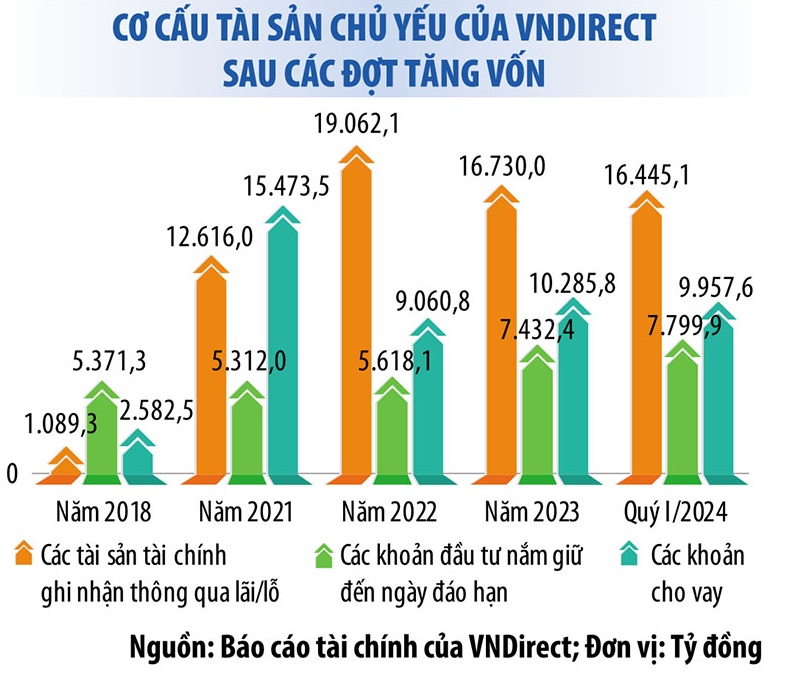

In fact, from 2018 to 2022, after capital increases, along with raising additional debt, VNDirect focused on allocating mobilized capital to financial assets recognized through profit/loss (FVTPL), investments held to maturity (HTM), and loans. In which, FVTPL and loans have a rapid growth rate.

As of March 31, 2024, the above 3 items recorded VND 34,202.6 billion, accounting for 82.7% of VNDirect's total assets. Of which, FVTPL assets recorded VND 16,445.1 billion, HTM assets VND 7,799.9 billion and loans VND 9,957.6 billion.

In addition, in terms of asset allocation, in addition to increasing loans for investors to buy stocks on the stock exchange, VNDirect's mobilized cash flow shows signs of pouring heavily into the bond market. If at the end of 2019, the corporate bond investment portfolio only recorded VND 105.45 billion, but by March 31, 2024, the value of unlisted bond investment reached VND 8,698.1 billion, an increase of 81.5 times. In particular, VNDirect did not explain in detail the bonds it was holding.

However, in response to recent bond market developments, in her most recent statement at the 2023 General Meeting of Shareholders, explaining the investment in Trung Nam bonds, Ms. Pham Minh Huong, Chairwoman of VNDirect, said that the Company chose Trung Nam because it is a representative enterprise in the energy industry, has the capacity to implement project development and the ability to find investment projects. Although the transaction with Trung Nam was carefully researched, the enterprise also encountered difficulties like most enterprises issuing bonds in the previous period.

“Many investors are concerned that VND shares are associated with the story of Trung Nam, and this is true. However, VNDirect assesses that Trung Nam only faces temporary liquidity risks, not economic model risks. Of course, there are also some policy-related risks, but these were assessed by VNDirect before deciding to participate in the underwriting. The only risk that VNDirect did not foresee was the resale of investors, forcing the Company to buy back a large amount of bonds to protect investors and the market,” Ms. Huong emphasized.

Self-employed portfolio increased more than 10 times

Returning to the hot capital increase, the continuous attraction of money from investors has helped VNDirect's asset size increase sharply from 2018 to present. However, along with the growth in asset size, the Company is expanding its stock and bond portfolios too quickly, culminating in the expansion of the bond portfolio related to businesses showing signs of cash flow difficulties in the real estate and renewable energy sectors.

Of which, from 2018 to March 31, 2024, the total value of self-investment increased 10.1 times, equivalent to an increase of VND 14,968.8 billion, to VND 16,445.1 billion and accounting for 39.8% of total assets (at the beginning of the period, it only accounted for 14%).

In addition, the system crash at the end of March 2024 raised many questions related to the system not being invested in and secured commensurate with the Company's growth scale.

It is known that in 2024, VNDirect plans to focus on two areas, including capital market services and investment asset management; securities trading services.

It can be seen that, along with increasing debt and raising capital from shareholders to expand the scale of capital sources, VNDirect is promoting its proprietary investment portfolio in stocks and bonds, while also increasing outstanding loans for individual investors.

Source: https://baodautu.vn/vndirect-do-von-vao-trai-phieu-d215896.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

Comment (0)