After a week of continuous decline, VN-Index returned to the starting point of 2024 at 1,174.85 points. The market is said to show no signs of recovery.

Participating in the stock market since the beginning of this year, Ms. Nguyen Thi Nga (34 years old, Hoang Mai District, Hanoi) sighed and shared: "The market has been red all week, my heart is burning like fire. Although I expected the market to recover quickly, today, along with the not-so-positive economic news: USD price increases, gold is about to be auctioned, ... so I had to accept a loss of tens of millions of VND to sell my goods."

In addition to Ms. Nga's case, some investors are still buying more stocks with the mentality of "buying the bottom", but today's session's developments have caused many people to fall into a situation of "loss upon loss".

The market has been red all week, many investors are "restless"

At the end of the weekend trading session (April 19), VN-Index continued its long downward streak with a decrease of more than 18 points, to 1,174.85 points.

Liquidity reached VND 23,682 billion transferred, equivalent to 1,070 million matched shares, up 25% compared to the previous trading session on April 17.

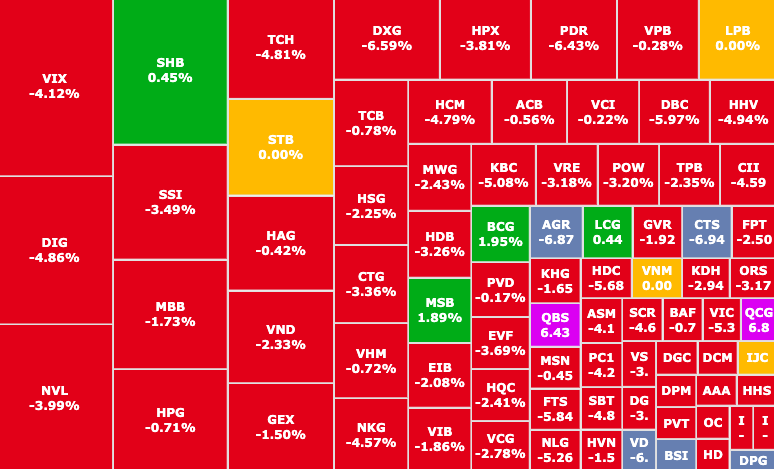

In today's session, the market continued to be on fire with the selling side dominating, the decrease ranged from 2-6%.

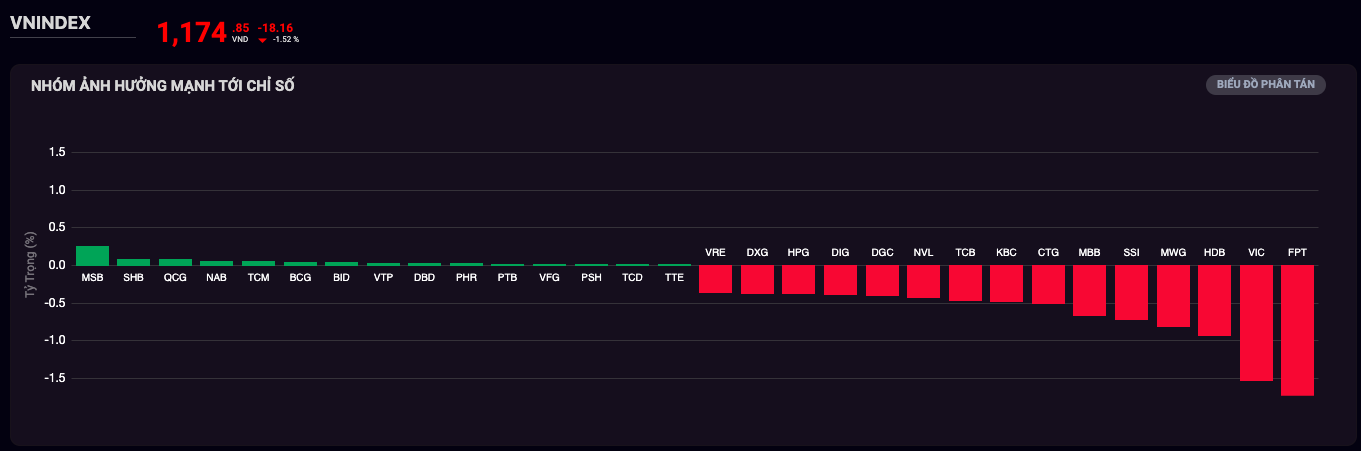

FPT (FPT, HOSE) topped the group with the most negative impact on the VN-Index when it decreased by 2.5%, contributing 1.73 points to the decrease. Next were VIC (Vingroup, HOSE), HDB (HDBank, HOSE),...

Large-cap stocks cause the market to continue to decline deeply (Source: SSI iBoard)

Although most bank stocks continued to decline sharply, on the positive side, banks improved slightly as they were no longer a drag on the market, and some stocks tended to increase slightly, among the stocks with the most positive impact on the market.

Focus on MSB (MSB, HOSE) increased by 1.9% at the market price of VND 13,450/share. Next is SHB (SHB, HOSE) increased slightly by 0.45%, NAB (Nam A Bank, HOSE) increased by 0.63%,...

Another bright spot appeared in foreign investors when they unexpectedly net bought 683 billion VND. Buying power focused on stocks: VNM (Vinamilk, HOSE) reached 94 billion, DIG (DIC Group, HOSE) reached 92 billion,...

The negative developments of VN-Index are being placed in the context of many unfavorable information flows from the economy.

Thus, after just one week of trading, VN-Index lost a total of nearly 102 points , losing the efforts after the entire first quarter, returning to the starting point of 2024.

Blue-chip stocks continued to play a role in causing the market to fall sharply, with many stocks quickly losing nearly 20% of their value in just one week.

NVL (Novaland) lost 18.36% of its value after just 1 week (Photo: SSI iBoard)

Typically, real estate, securities, public investment and retail groups: NVL (Novaland, HOSE) decreased by 18.36%, DXG (Dat Xanh Real Estate, HOSE) decreased by 21.21%, VND (VNDirect Securities, HOSE) decreased by 13.9%, PNJ (Phu Nhuan Jewelry, HOSE) decreased by 11.25%,...

However, on the contrary, many investors remain calm and optimistic about the market.

Investing in stocks for more than 5 years, Ms. Tran Minh Ngoc (49 years old, Ba Dinh District, Hanoi) said: "The market has decreased sharply, but I invest long-term, so I mainly look at the operations and development potential of the business I am investing in. In addition, the market is currently decreasing compared to the beginning of this year, this can also be considered a positive signal, VN-Index still has many factors to recover, so I am not buying or selling at the moment."

VN-Index is still in a negative trend, securities companies all commented that the market cannot be optimistic in the short term, mainly due to investors' psychology reacting to many not-so-positive information. At the same time, they recommended that investors should take advantage of the recovery to reduce the proportion of stocks to a safe level, and should not buy at the bottom because the market has not shown any signs of stopping falling.

Source

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

Comment (0)