Kinh Bac Urban Development Corporation - JSC (stock code: KBC) has just announced its consolidated financial report for the third quarter of 2023.

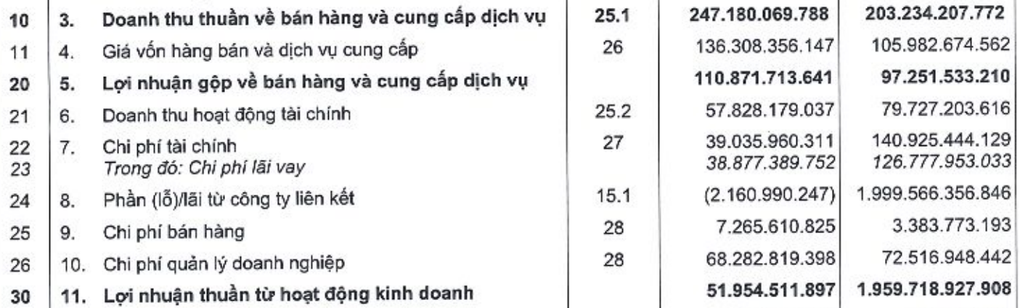

Specifically, in the last quarter, the company had net revenue of VND 247.2 billion, an increase of 21.7% over the same period last year. Accumulated for 9 months, net revenue was nearly VND 4,798 billion, 3.7 times higher than the same period in 2022.

Sales expenses in the third quarter were VND7.3 billion, 2.2 times higher than last year. Business management expenses decreased slightly by 5.8%, reaching VND7.3 billion. Most notably, financial expenses dropped sharply from nearly VND141 billion to only VND39 billion.

After deducting expenses, the after-tax profit of tycoon Dang Thanh Tam reached 18.5 billion VND, down 99%. In the third quarter of last year, this company made a huge profit of more than 1,935 billion VND.

The company explained that the profit after tax decreased by more than VND1,916 billion mainly because during the period, it had not yet handed over land to customers in the Nam Son Hap Linh, Quang Chau and Tan Phu Trung industrial parks, with a total area of 50 hectares signed. The total value of signed contracts is up to VND1,700 billion and is expected to be handed over in the fourth quarter of this year.

The financial report shows that the profit difference comes from the loss/profit from the associated company. In the third quarter of last year, Kinh Bac earned a profit of nearly 2,000 billion VND from this item. Meanwhile, this year, the loss from the associated company was 2.2 billion VND.

Kinh Bac's third quarter profit dropped sharply due to no more profit from affiliated companies (Source: Corporate financial statements).

This extraordinary profit comes from the difference in income between the ownership share in the net assets of the acquired party and the cost of the business combination, more simply understood as the extraordinary profit due to the difference in valuation of this investment.

Accumulated in the first 9 months of the year, the company's after-tax profit reached nearly 2,087 billion VND, a slight decrease of 2.2% compared to last year.

The company's net cash flow from operating activities in the first 9 months reached nearly VND2,402 billion. In the same period last year, this item was negative VND936.2 billion.

Strong cash flow has led to businesses actively repaying loans. Specifically, Kinh Bac spent more than VND4,260 billion to repay loan principal. Net cash flow from financial activities in the first 9 months was negative VND3,401.8 billion, compared to VND200.6 billion in the same period last year.

Comparing the balance sheet, it can be seen that the company's short-term loans as of September 30 were at VND570.8 billion, only 1/7 compared to the beginning of the year. Previously, in the second quarter, this item was recorded at VND904 billion.

Other short-term payables were nearly VND3,095.3 billion, down nearly VND734.5 billion. Long-term loans also recorded VND3,296.5 billion, down nearly VND391 billion.

As of September 30, the total assets of the enterprise reached over VND33,747.1 billion, down over VND1,159 billion compared to the beginning of the year. Inventory was at VND12,257.9 billion, accounting for the largest proportion with over 36% of total assets. Trang Cat Urban Area and Industrial Park still accounted for the largest proportion with over VND8,098 billion; followed by Tan Phu Trung Industrial Park, Phuc Ninh Urban Area, Nam Son Hap Linh Industrial Park.

Source

Comment (0)