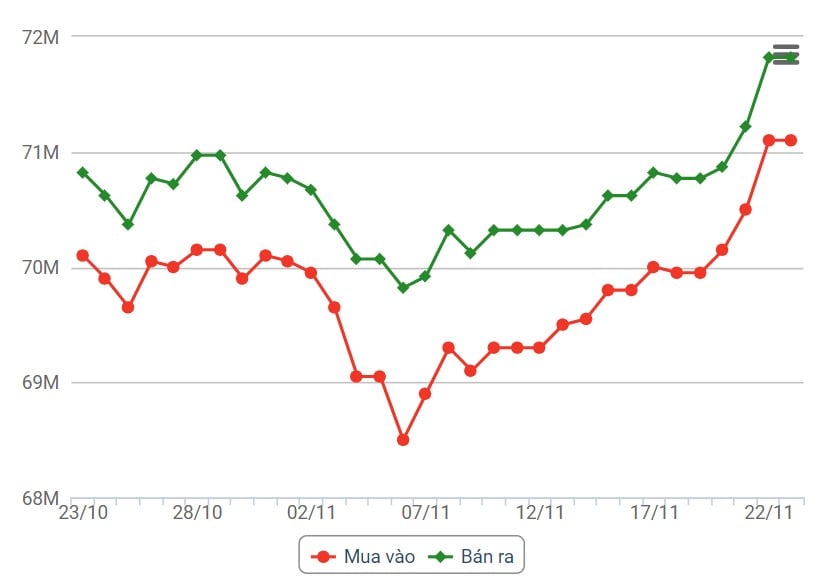

Domestic gold price

Domestic gold price fluctuations

World gold price fluctuations

World gold prices increased sharply, approaching the threshold of 2,000 USD/ounce in the context of the USD anchored at a low level. Recorded at 5:55 p.m., only The US Dollar Index, which measures the greenback's movements against six major currencies, was at 103.535 points (down 0.27%).

For now, many experts say, gold's decline has been limited by recent expectations that the US Federal Reserve (FED) has ended its interest rate hike cycle. Lower interest rates typically boost gold prices because they reduce the opportunity cost of holding non-yielding assets. Earlier, bullion hit a two-week high of $2,007.20 an ounce.

Gold received support as the yield on 10-year US Treasury bonds fell to a two-month low on November 22.

The number of Americans filing new claims for unemployment benefits fell more than expected last week, but that may not change views that the labor market is slowing amid high interest rates.

Speculation about a reversal in the rate-hike cycle has led to a continued weakening of the US dollar and long-term US bond yields, which should support gold prices, at least in the short term, said Kelvin Wong, senior market analyst for Asia-Pacific at foreign exchange trading firm OANDA.

The macroeconomic backdrop is turning supportive for gold, ANZ analysts said. Specifically, falling inflation has increased the prospect of the Fed completing its rate-hike cycle. Falling US yields and the US dollar are increasing the attractiveness of investing in gold.

Source

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)