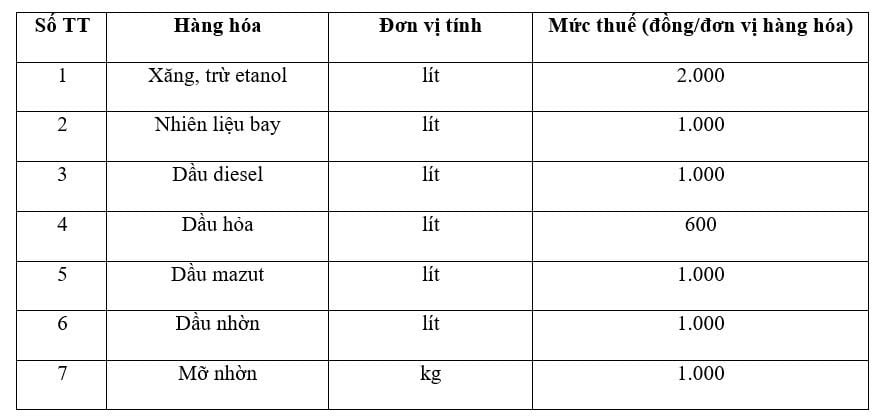

On December 24, 2024, the National Assembly Standing Committee issued Resolution No. 60/2024/UBTVQH15 on environmental protection tax rates for gasoline, oil, and grease. Accordingly, Article 1 of Resolution 60/2024/UBTVQH15 stipulates the environmental protection tax rates for gasoline, oil, and grease from January 1, 2025 to December 31, 2025 as follows:

Resolution No. 60/2024/UBTVQH15 takes effect from January 1, 2025. Resolution No. 42/2023/UBTVQH15 dated December 18, 2023 of the National Assembly Standing Committee on environmental protection tax rates on gasoline, oil, and grease ceases to be effective from the effective date of Resolution No. 60/2024/UBTVQH15. The environmental protection tax rates on gasoline, oil, and grease specified in Section I, Clause 1, Article 1 of Resolution No. 579/2018/UBTVQH14 dated September 26, 2018 of the National Assembly Standing Committee shall not apply from January 1, 2025 to December 31, 2025.

Nguyen Nhung - Tax Department

Source

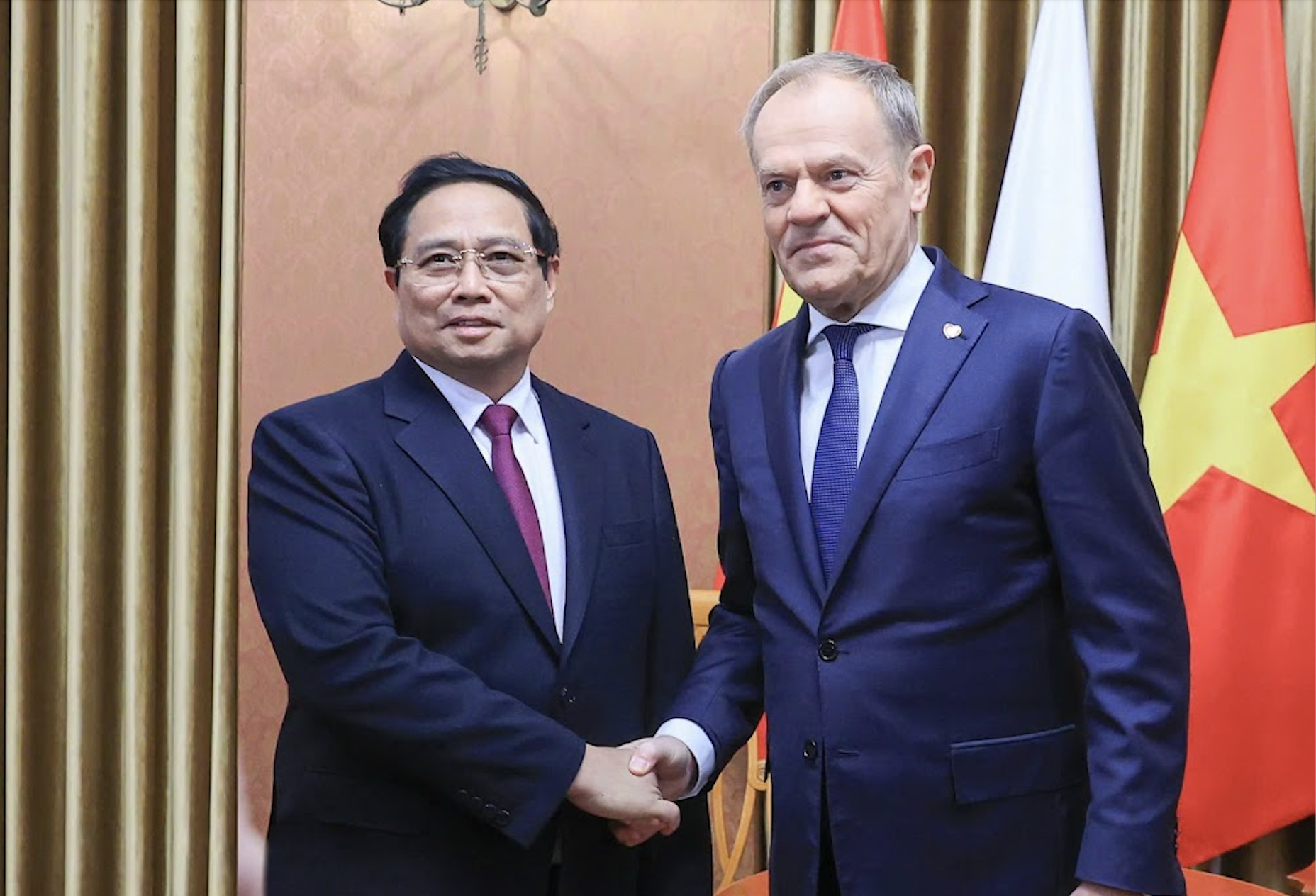

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)