Recently, SSI Securities has published the Vietnam Stock Market Outlook Update Report for 2023. The analysis team said that when the stock market is simultaneously reflecting the prospect of a sharp interest rate cut this year along with the weak profit outlook of listed companies, the market trend will fluctuate in an upward direction from now until the end of the year.

Accordingly, in terms of profit prospects, SSI Research has revised down its 2023 profit growth estimate, as listed companies will continue to face challenges in the second and third quarter business results season.

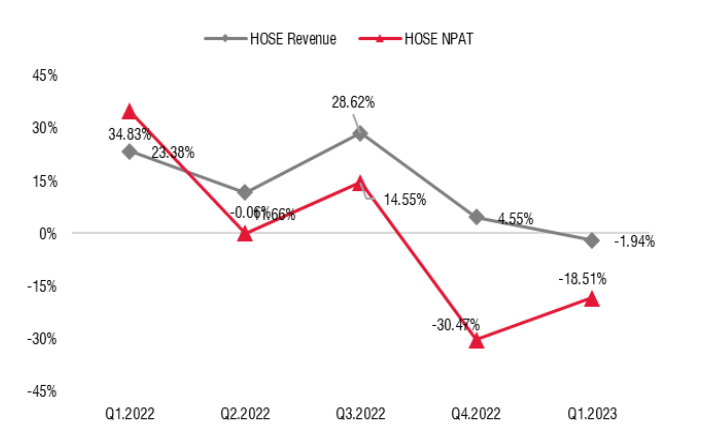

In fact, the profits of companies listed on the HoSE have recorded a significant decrease compared to the same period, and this process started quite early from the second quarter of 2022 to the first quarter of 2023, in which the profit margins of many businesses decreased sharply mainly due to increased costs, while revenue growth remained quite stable until the first quarter of 2023.

Quarterly profits of listed companies on HoSE (Source: SSI Research).

However, the risk is that revenue growth may show signs of decline from Q2/2023 due to weak domestic and foreign demand. In SSI's view, domestic consumption may not recover until Q4/2023, which can be measured through credit growth and import situation.

In the previous cycle of the stock market, the market recovered strongly when interest rates peaked and the State Bank directed a strong interest rate reduction in 2012. The question is whether this will be repeated at the present time or not?

The VN-Index rose 5.63% as of May 26, 2023, and has risen 2.28% since the SBV first cut interest rates in March. Although interest rates have fallen faster than expected so far compared to most estimates from the beginning of the year, the rate cut has been accompanied by low credit demand and a stable exchange rate due to weak import activity.

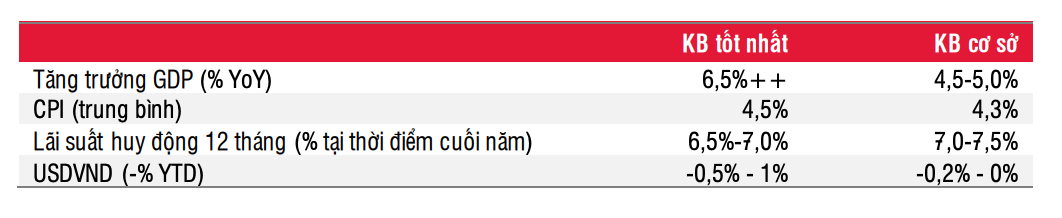

Key indicators in the baseline and best case scenarios (Source: SSI Research).

Regarding the interest rate outlook, according to the baseline scenario, SSI believes that interest rates may decrease by another 50-100 basis points from now until the end of the year and will continue to decrease in 2024.

While deposit interest rates have decreased by 250 - 300 basis points compared to the beginning of the year, the adjustment of home purchase interest rates has not been much because home purchase loans are considered quite risky related to issues in the corporate bond and real estate markets.

With current mortgage rates hovering around 13%, a further 150-200 basis point cut in mortgage rates may be needed to stimulate demand in the real estate market, and this is likely to happen by 2024. By then, liquidity will be better as the government’s measures to ease the real estate market and corporate bond market come into effect.

In 2023 alone, Decree 08 allows corporate bond issuers to extend their payment obligations by up to 2 years, and a number of banks said they are preparing to provide additional capital to project investors with the necessary legal status. This also contributes to gradually stabilizing liquidity in the system.

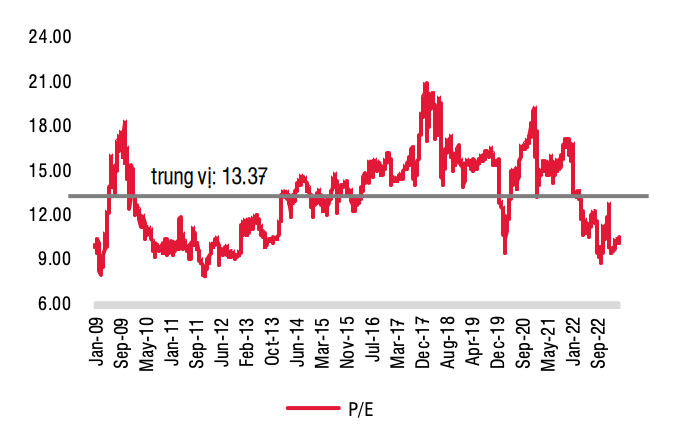

Projected P/E (Source: SSI Research).

As the stock market simultaneously reflects the prospect of a sharp interest rate cut this year along with the weak profit outlook of listed companies, SSI predicts that the market trend will be in a tug-of-war with increasing momentum from now until the end of the year. The volatility of the stock market will remain quite high.

Factors to watch that could affect the stock market include interest rate developments, new government policies, and the implementation of current policies that will help the economy overcome the risk of a global economic downturn and gradually recover. The positive point is that by the third quarter of this year, most industries will be able to pass the bottom point in their profits.

From that basis, SSI Research recommends long-term investors gradually accumulate stocks, especially when the VN-Index is around 1,000 points.

SSI Research maintains a neutral recommendation for the two sectors with the largest capitalization proportions, including banking and real estate, but for banking stocks, the time to review this group of stocks is from the fourth quarter, because at that time investors will have a better understanding of debt restructuring and provisioning activities of banks, thereby being able to estimate the time to absorb all bad debts of banks for this cycle.

On the other hand, with the real estate industry, priority should be given to choosing real estate stocks that are less related to the corporate bond market .

Source

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

Comment (0)