Most of the banks' collateral is real estate - Photo: QUANG DINH

Red book: The most popular type of mortgage in banks

The Bank for Agriculture and Rural Development (Agribank) recently announced its consolidated financial report for 2024.

The report notes show that the total value of mortgaged and pledged assets of customers at Agribank has reached nearly VND 3.19 million billion, an increase of more than 9% compared to 2023.

Of which, real estate is still the main collateral asset at this bank, reaching more than 2.92 million billion VND, an increase of more than 10% compared to the end of last year. In addition, real estate and valuable papers account for 190,000 billion VND and 54,663 billion VND respectively.

In terms of total value of collateral, Agribank is still lower than its two "brothers" in Big4, BIDV and VietinBank.

At BIDV, total assets, valuable papers accepted for mortgage, pledge and discount amounted to VND 3.32 million billion by the end of 2024. At Vietinank, this figure is also not "inferior" when reaching nearly VND 3.29 million billion.

However, if the collateral is only real estate, no "competitor" has surpassed Agribank.

In total, the amount of real estate collateral of customers at the 15 banks listed below reached nearly 15.54 million billion VND, accounting for the majority of total mortgaged assets in general.

Data: Audited consolidated financial statements 2024

The former deputy general director of a bank in Hanoi said that collateral assets at banks are quite diverse, from factories to goods, savings books, stocks, hydroelectric plants, foreign wine, and even funeral homes.

However, the most popular asset for the banking industry has long been real estate. The advantage of this type of collateral is that it is not subject to damage or loss, and even increases in value over time.

According to this person, the value of collateral is always higher than the outstanding loan balance to ensure risk. This explains why at Agribank, the total outstanding loan balance to customers reached more than 1.72 million billion VND at the end of 2024, but the collateral in real estate alone was much larger.

Real estate's revival will help improve liquidity

Mr. Tran Tanh - Yuanta Vietnam Securities analyst - also said that most of the collateral assets of banks are real estate. Therefore, the real estate market's revival will help improve liquidity and sell collateral assets to handle bad debts, thereby helping to stabilize asset quality.

Recent real estate market risks are the main reason why bank stocks are undervalued, according to Mr. Tanh. Therefore, the recovery cycle of the real estate market is expected to lead to higher valuations of bank stocks in 2025 when asset quality is better.

Regarding the issue of bad debt, in a recently published analysis report on the banking industry, the MBS Securities analysis team pointed out that the average bad debt ratio of listed banks (excluding Agribank) at the end of the fourth quarter of 2024 decreased by 34 basis points compared to the previous quarter, down to 1.91%, after 4 consecutive quarters of increase.

In addition, the bad debt formation rate decreased by 10.1% compared to the previous quarter. Meanwhile, the group 2 debt ratio (debt overdue from 10 - 90 days) also recorded the fourth consecutive quarter of decrease, down to 1.6% in the fourth quarter of last year.

According to MBS, boosting credit growth in parallel with banks' active handling of bad debts in the last quarter of last year contributed to improving the asset quality of the entire industry in 2024.

In addition, the listed bank's bad debt coverage ratio (LLR) improved to 91.6% by the end of 2024 thanks to increased provisioning and a lower bad debt formation rate.

However, speaking to Tuoi Tre Online , the leader of a credit rating company is worried that the capital safety ratio of Vietnamese banks is still low, only 12.5% on average at the end of 2024. This level is lower when compared to many countries in the region.

Not to mention this year, banks are under pressure to increase credit growth to support the economy, but are limited in their ability to mobilize capital while maintaining low interest rates, and must meet the short-term capital utilization ratio for medium and long-term loans.

According to this person, the slow growth of deposits in the past two months has caused significant pressure on liquidity, and banks must increase equity capital, issue bonds, etc. to balance capital sources.

Source: https://tuoitre.vn/gan-3-trieu-ti-dong-bat-dong-san-the-chap-loi-the-cua-agribank-trong-xu-ly-va-thu-hoi-no-xau-20250413210708329.htm

![[Photo] Ho Chi Minh City: full of flags and flowers before the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/ab41c3d5013141489dee6471f4a02b96)

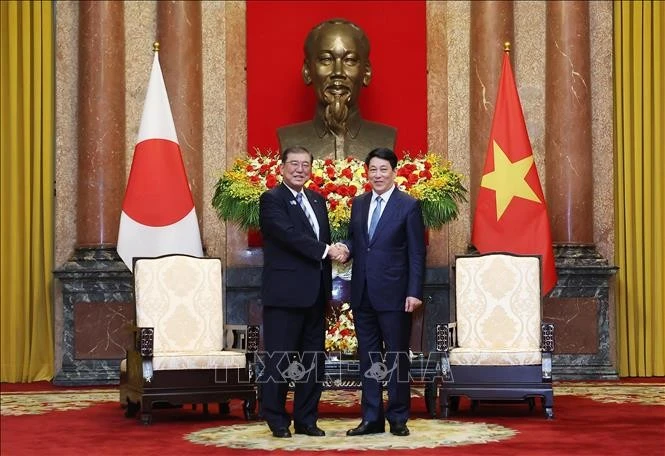

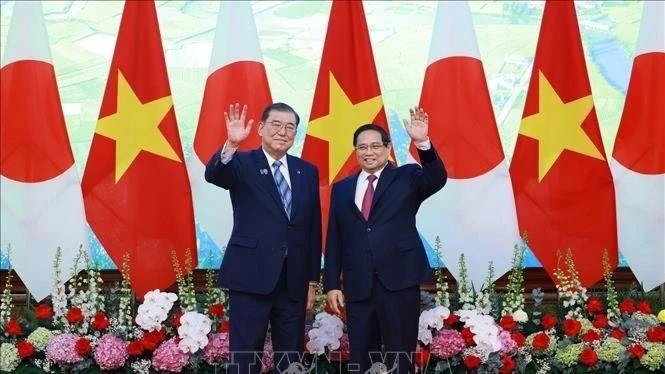

![[Photo] President Luong Cuong receives Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/44f0532bb01040b1a1fdb333e7eafb77)

Comment (0)