Affected by economic shocks

Gen Y (born between 1981 and 1996) was once considered a generation that did not know how to accumulate assets, squandering money on personal entertainment in the context of financial recession. However, they are still identified as the group of people who will own a larger amount of assets than previous generations.

According to the 2024 Wealth Report by global real estate consultancy and trading firm Knight Frank, Gen Y could inherit trillions of dollars worth of assets passed down from their parents in the next 20 years. In the US alone, that figure could reach around $90 trillion.

According to Yahoo Finance , previous generations were able to leave large fortunes and real estate to their children and grandchildren. Therefore, Gen Y could be the generation that receives the most and become the richest people in history.

However, while waiting to move assets, many people of Generation Y were heavily affected by many major events such as the 2008 economic crisis, the Covid-19 pandemic, the cost of living crisis, the Russia-Ukraine conflict...

Most recently, the Israel-Hamas conflict and Houthi attacks in the Red Sea have also contributed to increased economic and geopolitical instability.

Recent research by the UK's independent think tank Resolution Foundation also found that Gen Y is struggling to catch up with the living standards of older groups.

The cost of living crisis has also left many millennials saying they are living paycheck to paycheck and finding it difficult to set aside savings.

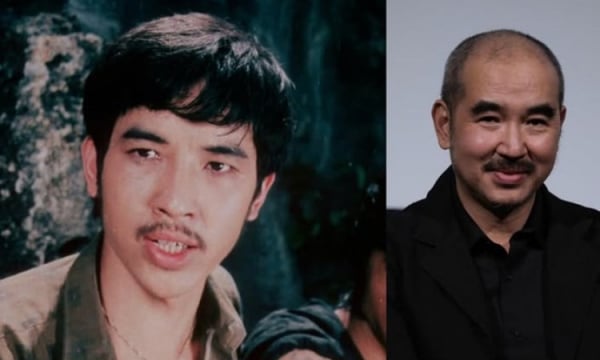

Gen Y owns more assets than previous generations due to inheritance (Photo: Money).

Gen Y is more optimistic about income growth

It's not all doom and gloom, however. Liam Bailey, head of global research at Knight Frank, says the transition will bring about significant changes in how wealth will be spent in the future.

Gen Y's wealth opportunities don't just come from inheriting family fortunes, some have the potential to become self-made millionaires, Mike Pickett, director at asset management firm Cazenove Capital, said in the report.

According to Pickett, Gen Y's opportunities to get rich are quite diverse, this generation has seen the emergence of countless content creators who have created assets worth tens of millions of dollars.

Investors also feel that central banks' anti-inflation policies have worked well so far. The prospect of rate cuts by several major central banks this year has added to the positive sentiment.

Despite some economic shocks, some US stocks have still recorded good growth. Artificial intelligence companies such as Nvidia have been among the most successful businesses on the market in recent times.

“The improved interest rate outlook, strong US economic performance and positive stock market growth have helped create wealth globally,” Mr Bailey told the Guardian .

This trend is expected to continue, with the number of wealthy individuals worldwide expected to increase by 28.1% by 2028, according to the Wealth Report. Malaysia is expected to see 35% growth, Indonesia 34%, India 50% and China 47%.

Gen Y is also more optimistic about rising real estate prices as this could significantly increase the value of their assets as they inherit from previous generations.

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)