Vietnam Export Import Commercial Joint Stock Bank (Eximbank, stock code: EIB) was established on May 24, 1989 and officially started operating in January 1990. Eximbank was then one of the first joint stock commercial banks in Vietnam.

This is also the name associated with the upper-level disputes over the past decade. Deep divisions among shareholder groups have made it impossible for the bank to successfully organize a congress to elect the Board of Directors (BOD) many times.

Sumitomo Mitsui Banking Corporation (SMBC) became a strategic shareholder of Eximbank in 2007, after investing 225 million USD to buy 15% of the bank's shares. This was a "cheap purchase" by SMBC, as it only had to buy each Eximbank share worth 20,150 VND, equal to 30% of the market price at that time.

Japan's leading financial group once considered it "one of the leading commercial banks in Vietnam". In fact, Eximbank is also part of the trillion-VND profit club of the banking system when in 2011 its profit reached more than VND4,000 billion.

After SMBC became a "family member" of Eximbank, the "king" stock fell into turmoil. However, the Japanese bank was still "comforted" by the large dividend rate that Eximbank gave to shareholders.

In the first year, Eximbank paid dividends of up to 82.55%, of which 12% was in cash and 70.55% in shares. Thus, SMBC received nearly VND230 billion in cash and more than 133 million shares, equivalent to about VND3,600 billion.

4 years later, although not maintaining the high rate as in 2008, Eximbank still kept the dividend at a relatively high level, respectively 12% (2009), 13.5% (2010), 19.3% (2011) and 13.5% (2012).

2013 was a pivotal year when Eximbank’s dividend payout ratio plummeted to just 4%. But then the real trouble began when the bank’s profits also began to plummet. In 2015, the business situation deteriorated even further.

10 years: 9 times changing president

The turmoil began when former Chairman Le Hung Dung withdrew. On behalf of the Board of Directors, Mr. Dung apologized to shareholders for business results that were not as expected. He himself resigned and did not run for a new term.

Mr. Dung withdrew, and every group of shareholders wanted to "have a seat" in the Board of Directors and the Board of Supervisors, so the bank had to postpone the General Meeting of Shareholders many times.

After two unsuccessful attempts, in mid-December 2015, Eximbank "finalized" its personnel at the extraordinary shareholders' meeting. Mr. Le Minh Quoc was elected as Chairman of the Board of Directors.

In early April 2016, several senior leaders at Eximbank suddenly resigned, causing the "royal battle" to resume. Because the major shareholder groups could not find a common voice, the 2016 Annual General Meeting of Shareholders was canceled many times, at the same time, there was a request to replace the current Board of Directors.

After two stable years in 2017 and 2018, in early 2019, internal conflicts within Eximbank broke out again. At that time, Ms. Luong Thi Cam Tu, former General Director of Nam A Bank, was elected as the new Chairwoman of the bank's Board of Directors for the 2015-2020 term.

The decision has not yet been fully resolved but has already been met with controversy because Mr. Le Minh Quoc - who was dismissed as Chairman of the Board of Directors - said that the meeting was conducted against regulations.

Afterwards, Eximbank issued a statement denying Mr. Le Minh Quoc's accusation and affirmed that the meeting held by the Board of Directors of Eximbank on March 22 to appoint Ms. Luong Thi Cam Tu was in accordance with the provisions of the Enterprise Law and Eximbank's charter.

In May 2019, Mr. Le Minh Quoc withdrew his lawsuit and resigned from the position of Chairman of the Board of Directors. Afterwards, Mr. Cao Xuan Ninh took his place. Before joining the Board of Directors of Eximbank, Mr. Cao Xuan Ninh was the Head of the State Bank Representative Office in Ho Chi Minh City and worked for many years at Vietcombank.

Eximbank's annual meeting that same year was "stirred up" by fierce debates among shareholder groups surrounding the legality of the resolution to elect the Chairman of the Board of Directors. Mr. Ninh affirmed that his position as Chairman of the Board of Directors at this bank was legal, while SMBC said that the high-level personnel conflict showed that shareholders did not trust Mr. Ninh, so they proposed a re-election.

And just one year later, in June 2020, Eximbank announced its new Chairman, Mr. Yasuhiro Saitoh, who previously held the position of Vice Chairman of the bank. This is also the first time Eximbank has a foreign Chairman of the Board of Directors. He used to be the representative of strategic shareholder SMBC, holding 15% of the bank's capital.

On April 13, 2021, the storm arose again before the 3rd annual general meeting of shareholders in 2020 of EximBank when the bank's Board of Directors continuously had confusing rotating resolutions with 3 changes of "hot seats", from Mr. Yasuhiro Saitoh to Mr. Nguyen Quang Thong and back to Yasuhiro Saitoh. This is a "spiral" of chairman, a record for changing hot seats of a bank.

In July 2021, Eximbank's extraordinary general meeting of shareholders proposed to dismiss a series of personnel. The proposal was made by a group of shareholders including Rong Ngoc Joint Stock Company, Helios Investment and Service Joint Stock Company, Thang Phuong Joint Stock Company, Ms. Thai Thi My Sang and Ms. Luu Nhu Tran. The number of shares of this group of shareholders at that time accounted for 10.36% of the total number of common shares with voting rights at Eximbank for a continuous period of at least 6 months.

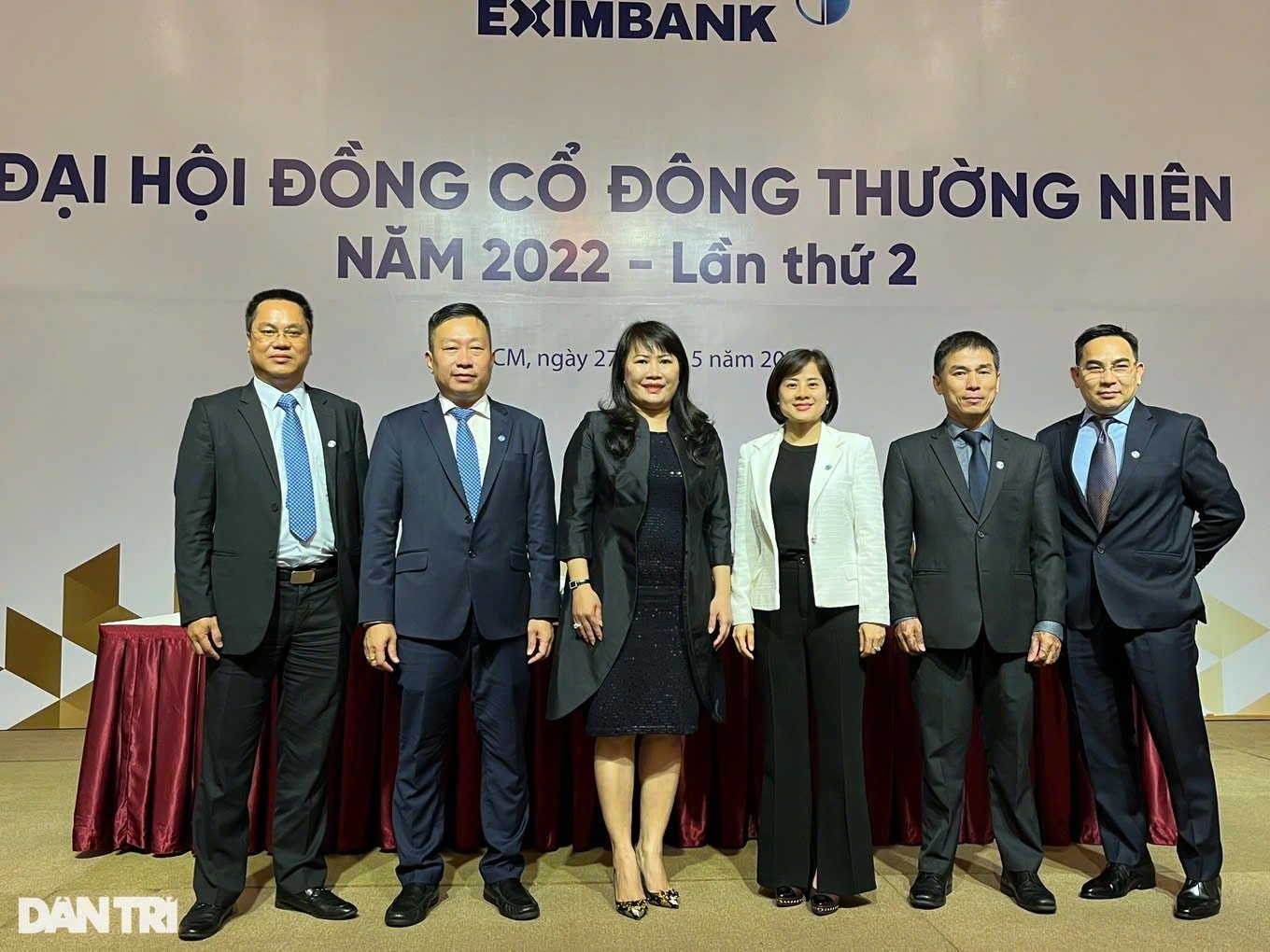

Also here, Ms. Luong Thi Cam Tu was re-elected as Chairwoman of Eximbank. In the list of members of the Board of Directors, there are two notable members, Mr. Dao Phong Truc Dai and Ms. Le Hong Anh, related to Thanh Cong Group, a multi-industry enterprise in the fields of automobile industry, real estate, and trade.

Mr. Dao Phong Truc Dai (far left), one of two representatives of Thanh Cong group in Eximbank's Board of Directors, was elected in February this year (Photo: VD).

It was thought that the situation at Eximbank was stable after the election of a new Chairman and Board of Directors, but this was followed by a series of capital withdrawals by shareholder groups.

In mid-September 2022, Eximbank announced that Mr. Vo Quang Hien is no longer a member of Eximbank's Board of Directors because Mr. Hien is no longer an authorized representative of SMBC shareholders. By January 2023, SMBC announced that it was officially no longer a major shareholder at the bank. In fact, after many years of not being able to make arrangements at Eximbank's top management, SMBC withdrew its representative from the bank since late 2019. In February 2022, Eximbank officially stopped its strategic alliance cooperation with SMBC at the request of this foreign fund.

By October 2022, the group of shareholders related to Thanh Cong will successively divest capital at Eximbank with groups including Thanh Cong Joint Stock Cooperative, Phuc Thinh Joint Stock Company, and Ms. Nguyen Thi Hong Ngoc.

In April 2023, before the 2023 Annual General Meeting of Shareholders, Eximbank received resignation letters from Mr. Nguyen Hieu and Mr. Nguyen Thanh Hung, both for personal reasons. They are members of the bank's Board of Directors.

Mr. Hung was nominated by a group of shareholders including Thang Phuong Joint Stock Company, Helios Investment and Service Joint Stock Company, Ms. Le Thi Mai Loan and Mr. Nguyen Ho Nam. Mr. Nguyen Ho Nam is the Chairman of Bamboo Capital Group and Ms. Le Thi Mai Loan was a key employee of this enterprise.

On the evening of June 28, 2023, information about the dismissal of Ms. Luong Thi Cam Tu and her replacement by Ms. Do Ha Phuong was suddenly announced by Eximbank.

But just 2 days later, a representative of a group of shareholders sent a request to the Board of Directors to withdraw the nomination and dismiss Ms. Do Ha Phuong. Previously, Ms. Phuong was nominated by this group of shareholders to join the Board of Directors for the 2020-2025 term.

Former 8x female president Do Ha Phuong (Photo: Eximbank).

In April 2024, Eximbank once again replaced its chairman with Mr. Nguyen Canh Anh. He was elected to the bank's Board of Directors at an extraordinary meeting at the end of 2023. Before joining Eximbank, Mr. Canh Anh had many years of working at large corporations and financial institutions such as Techcombank, Viettel, Vingroup and most recently EVN Finance.

Eximbank fluctuations are not over yet?

The market recently circulated a document "urgently requesting and reflecting on serious risks leading to unsafe operations and the risk of collapse of the Eximbank system". Several trading sessions after that recorded the phenomenon of investors dumping large amounts of EIB shares on the stock exchange.

Eximbank later confirmed that this document did not originate from the bank and had not been authenticated. However, the bank did not make any statement that the information being circulated was false.

It is expected that at the end of November, this bank will hold an extraordinary shareholders meeting to approve the change of headquarters. This is the first time this bank has held an extraordinary shareholders meeting in Hanoi, instead of in Ho Chi Minh City as before.

Eximbank was established and developed for more than 30 years in Ho Chi Minh City. The distribution of branches and the majority of the bank's staff also live and work in the South. According to the bank's annual report, by the end of last year, the bank had 16 branches in Ho Chi Minh City but only 6 branches in Hanoi.

However, when looking at the major shareholder structure of Eximbank after a period of fluctuations, we will see that the two major shareholders of Eximbank are headquartered in the North.

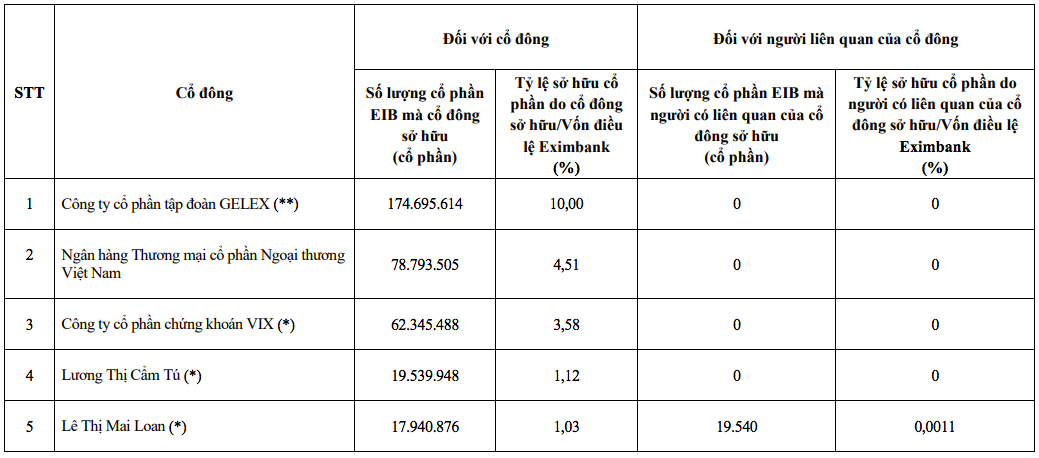

Specifically, according to the latest list of shareholders owning 1% of charter capital, Gelex Group is the largest shareholder of Eximbank with 174.7 million shares, equivalent to owning 10% of capital. Gelex first appeared on the list of shareholders of Eximbank in July this year. After that, this enterprise increased its ownership ratio, from 4.9% to 10%. The Group is headquartered in Hai Ba Trung district, Hanoi.

General Director Nguyen Van Tuan Gelex is one of the largest shareholders of Gelex. He used to hold a large number of shares in VIX Securities Joint Stock Company but withdrew all of them in 2022. According to Eximbank's announcement, VIX Securities currently owns more than 62.3 million shares, equivalent to 3.58% of the bank's capital.

Eximbank shareholder structure (Screenshot).

Most recently, Gelex said that the company did not nominate any capital representatives to join the Board of Directors or Executive Board of Eximbank.

Vietcombank is Eximbank's second largest shareholder with a 4.51% ownership ratio. The bank is headquartered in Hoan Kiem District, Hanoi. In fact, Vietcombank has owned a large amount of Eximbank shares for more than ten years. Before 2012, Vietcombank held more than 8.19% of Eximbank's capital, but then reduced its ownership ratio to 4.5% at the request of the State agency.

Two other individuals, Ms. Luong Thi Cam Tu (Vice President of Eximbank) and Ms. Le Thi Mai Loan, hold 1.12% and 1.03% of the bank's capital, respectively.

Source: https://dantri.com.vn/kinh-doanh/thap-ky-roi-ren-cua-eximbank-9-lan-thay-chu-tich-20241025141925447.htm

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)