ANTD.VN - The company that owns Temu has declared a tax return for the third quarter of 2024, in which it is declaring zero revenue and explaining that the revenue generated in October will be fully declared in the fourth quarter of 2024 declaration.

Closely monitor Temu's tax declaration

According to Deputy Director General of the General Department of Taxation Mai Son, e-commerce platform business activities in Vietnam are business activities that must be licensed and are subject to state management by the Ministry of Industry and Trade.

Regarding tax management activities, e-commerce platform managers (including Temu, Shein, Amazon...) must be responsible for registering, self-calculating, and self-declaring and paying taxes directly through the General Department of Taxation's Electronic Information Portal (TTĐT). This portal has been deployed since March 2022.

“If a foreign supplier is found to have declared incorrect revenue, the tax authority will compare data to determine revenue and request the foreign supplier to fulfill its obligations. Next, it will conduct inspections according to regulations when there are signs of fraud and tax evasion,” said the leader of the General Department of Taxation.

According to the General Department of Taxation, up to now, there have been 116 foreign suppliers registering to declare and pay taxes through the Foreign Supplier Portal with a cumulative revenue of 20,174 billion and in 2024 alone, this revenue is 8,600 billion, an increase of 25.7% compared to the average of the first 10 months of 2023.

|

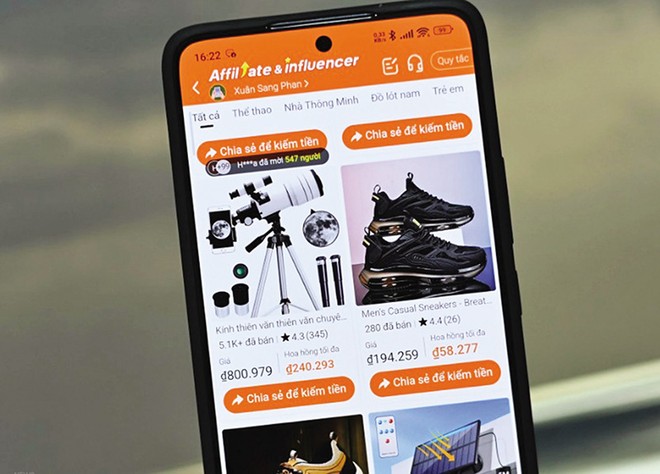

Temu's appearance in Vietnam attracts much attention |

Regarding Temu, Mr. Mai Son said that on September 4, 2024, Elementary Innovation Pte. Ltd, the owner of Temu e-commerce platform in Vietnam, registered for tax through the General Department of Taxation's Foreign Supplier Portal and was granted a tax code (MST: 90000001289). According to Circular 80/2021/TT-BTC of the Ministry of Finance, foreign suppliers must declare and pay taxes quarterly.

Accordingly, on October 30, 2024, Elementary Innovation Pte. Ltd. filed a tax return for the third quarter of 2024, in which it declared zero revenue and explained that the revenue generated in October would be fully declared in the fourth quarter of 2024.

“The Ministry of Finance has directed the General Department of Taxation to closely monitor Temu's revenue declaration in the fourth quarter of 2024 and the deadline for submission according to tax management law is January 30, 2025, ensuring state budget collection and full collection according to the law.

The Ministry of Finance also directed the General Department of Taxation to closely coordinate with state management information from the Ministry of Industry and Trade in licensing as well as state management agencies related to the activities of cross-border e-commerce platforms to coordinate in implementing tax management work promptly and fully," said Mr. Mai Son.

Regulations on e-commerce platforms declaring and paying taxes on behalf of others have proven effective in many countries.

In addition, for sellers, business households, and individuals doing business on e-commerce platforms in general, to perfect the institution, the Ministry of Finance has reported to the Government to submit to the National Assembly to amend and supplement the Law on Tax Administration. In which, it stipulates the responsibility of the organization that is the manager of e-commerce platforms, including domestic and foreign e-commerce platforms with payment functions, to deduct, pay taxes on behalf of, and declare tax obligations on behalf of business households and individuals doing business on the platform.

The Ministry of Finance said that this content is understood as when an e-commerce platform has the function of paying, deducting, and paying taxes on behalf of business individuals and households on the platform, it must declare to the tax authority the tax information of the business households and individuals that the platform has deducted and paid taxes on their behalf. The information that the e-commerce platform has declared to the tax authority is the basis and database for the tax authority to manage the tax obligations of business households and individuals.

“This regulation contributes to reducing the number of tax declaration points, and overall, it will reduce administrative procedure compliance costs for the whole society because only one point is needed, the e-commerce trading floor, to deduct, pay taxes on behalf of, and declare tax obligations on behalf of tens, hundreds of thousands of individuals and business households on the floor,” said the Ministry of Finance.

According to the Ministry, this regulation was proposed based on a synthesis of difficulties and problems from management practices such as: current management policies do not meet the requirements for effective tax management of e-commerce business activities, especially with the e-commerce platform model; the provision of information on e-commerce trading floors is still incomplete and not close to the actual situation, making it difficult to identify, fully manage subjects, and control revenue on the floor; at the same time, tax authority resources are limited compared to the number of business individuals.

In addition, regarding the implementation of the mechanism of e-commerce platforms declaring and paying taxes on behalf of sellers: this is a highly recommended content for implementation in documents and studies of OECD, other international organizations (IMF, ADB, ...), as well as proven practical implementation effectiveness of advanced countries in the world and in the region (UK, EU, Australia, Thailand ...).

Source: https://www.anninhthudo.vn/temu-ke-khai-doanh-thu-tinh-thue-thang-10-bang-0-post595043.antd

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)