| Commodity market today, March 8: MXV-Index reaches its highest level since late January Commodity market today, March 11: World raw material commodity market experiences a week of strong fluctuations |

21 out of 31 commodities increased in price, pushing the MXV-Index up 0.74% to 2,161 points. Notably, the price of an industrial raw material group such as cocoa, sugar, RSS3 rubber increased sharply by 2-5%. Meanwhile, most of the metal group's commodities received quite positive buying power. At the end of the trading day, the total trading value of the entire Exchange reached over VND7,400 billion.

Industrial raw materials lead the market price increase trend

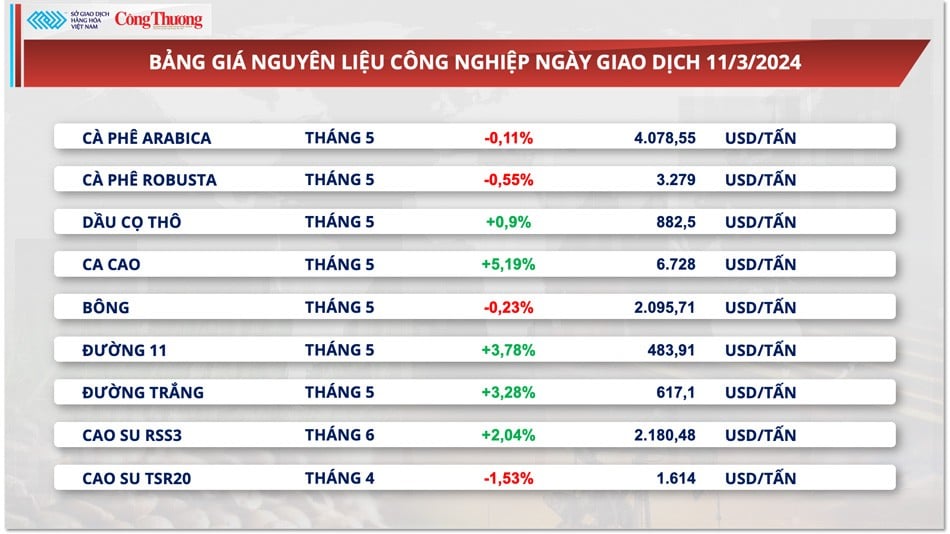

Sugar prices rose 3.78% at the close of trading on March 11 as the market reacted sharply to the poor crop outlook in Brazil. Datagro, a consultancy, forecast that sugar production in the 24/25 crop year in the Center-South region, Brazil’s main sugar producing region, will fall 4.8% from the previous season to 40.45 million tonnes. Below-average rainfall has raised concerns about tighter sugar supplies in the coming period.

|

| Industrial raw material price list |

Cocoa prices also continued to set a new record when they jumped 5.19% to $6,728/ton on yesterday's trading day. The International Cocoa Organization (ICCO) in its latest quarterly report said that the global cocoa deficit in the 2023/24 crop year (October 2023 - September 2024) will reach 374,000 tons. The main reason is that pests and diseases and the cocoa areas currently being harvested in the world's two largest cocoa growing countries, Ivory Coast and Ghana, have become old. ICCO forecasts that global cocoa stocks at the end of the 2023/24 crop year will fall to 1.395 million tons, equivalent to 29.2% of the volume of ground cocoa, the lowest level in the past 45 years.

|

| Cocoa prices also continued to set a new record when they jumped 5.19% to $6,728/ton. |

Market sentiment was affected by adverse weather information in Thailand and strong global rubber demand, pushing RSS3 rubber prices to $2,180/ton, up 2.04% from the previous day and the highest level since late December 2023.

Palm oil prices rose 0.62% from the reference price as demand gradually recovered. AmSpec Agri Malaysia estimated that Malaysia's palm oil exports in the first 10 days of March increased 6.2% compared to the same period last month.

Metals receive quite positive buying cash flow

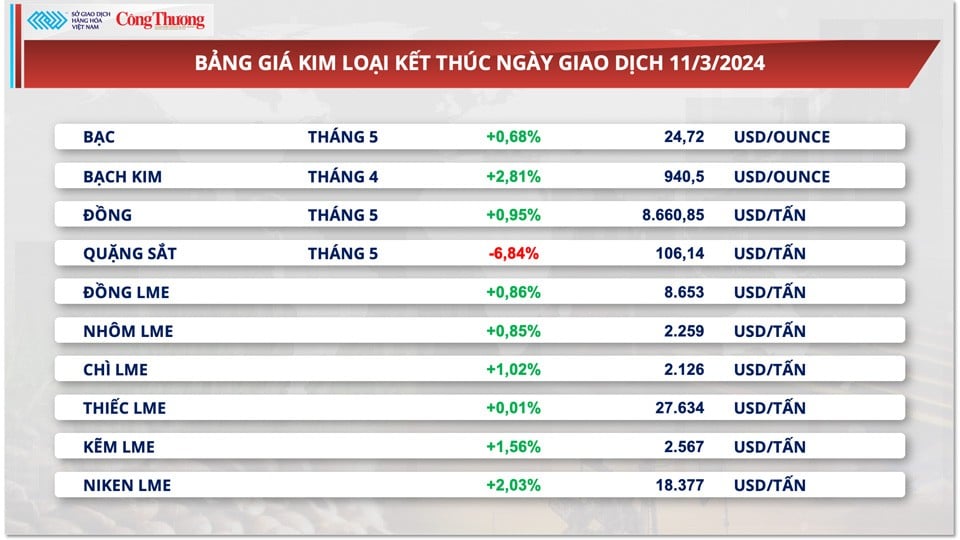

According to MXV, at the end of the trading day on March 11, most items in the metal group continued to receive relatively positive buying pressure, except for the more than 6% drop in iron ore prices. The precious metal group still received buying money after a strong increase last week. Silver prices increased slightly by 0.68% to 25.71 USD/ounce. Platinum broke out with an increase of 2.81% to 940.5 USD/ounce, the highest level since late January.

The two precious metals benefited from safe-haven buying ahead of U.S. inflation data. Investors cut risk assets, dragging down stocks, with all three major Wall Street indexes in the red. U.S. stocks had also fallen late last week after a U.S. nonfarm payrolls report failed to change expectations that the Federal Reserve would start cutting interest rates in June.

|

| Metal price list |

Comments from Fed Chairman Jerome Powell and European Central Bank (ECB) policymakers last week also raised expectations that interest rate cuts will begin this summer. Expectations for at least a 25 basis point cut at the June meeting are now above 70%. This has benefited silver and platinum as the opportunity cost of holding has decreased, prompting buying in the market earlier in the week.

For the base metals group, most commodities also received price increases in anticipation of the Fed preparing to enter the interest rate cut phase from the second half of this year. In addition, for COMEX copper, concerns about tight supply in the market have significantly supported prices. At the end of the session, COMEX copper prices increased by 0.95% to 3.92 USD/pound.

Codelco, the world's top copper producer, saw output fall nearly 16% year-on-year to 107,000 tonnes in January, according to data released by the Chilean Copper Commission (Cochilco). The state-owned miner is struggling to produce copper as expansion projects aimed at compensating for declining ore quality have been hampered by delays and high costs.

In addition, copper stocks on the LME system have fallen more than 30% to 110,850 tonnes since the end of December, also contributing to price support.

Prices of some other goods

|

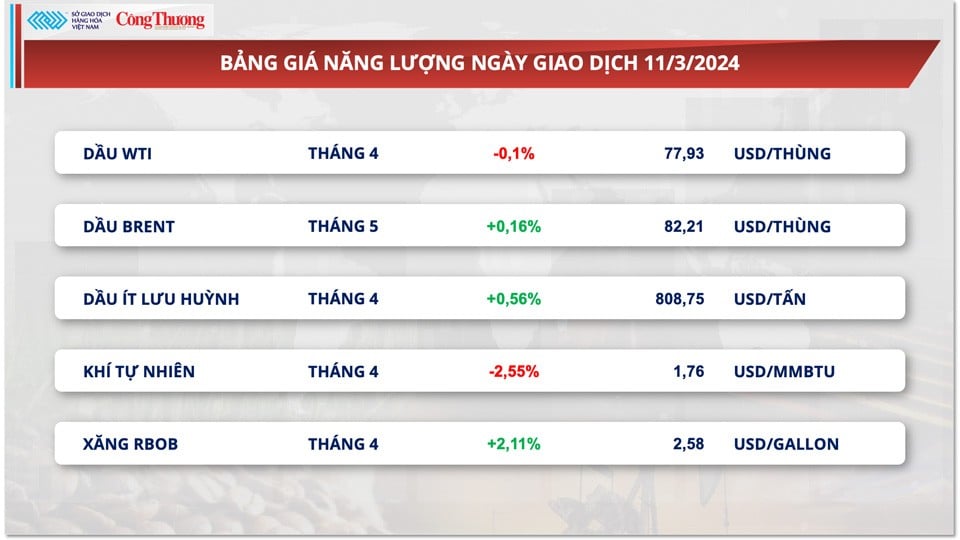

| Energy price list |

|

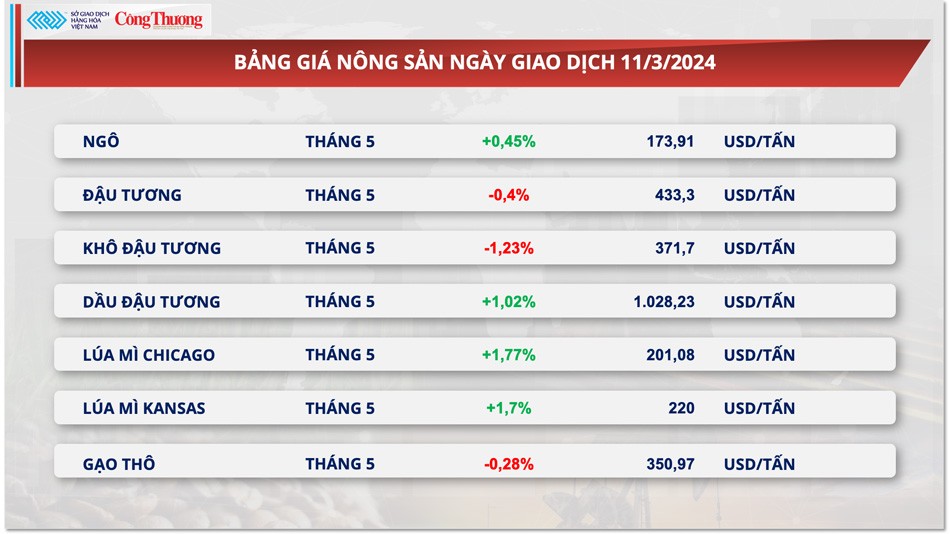

| Agricultural product price list |

Source

Comment (0)