Closing the trading session, coffee prices continued to benefit from the context of declining supply in leading supplying countries including Vietnam and Brazil.

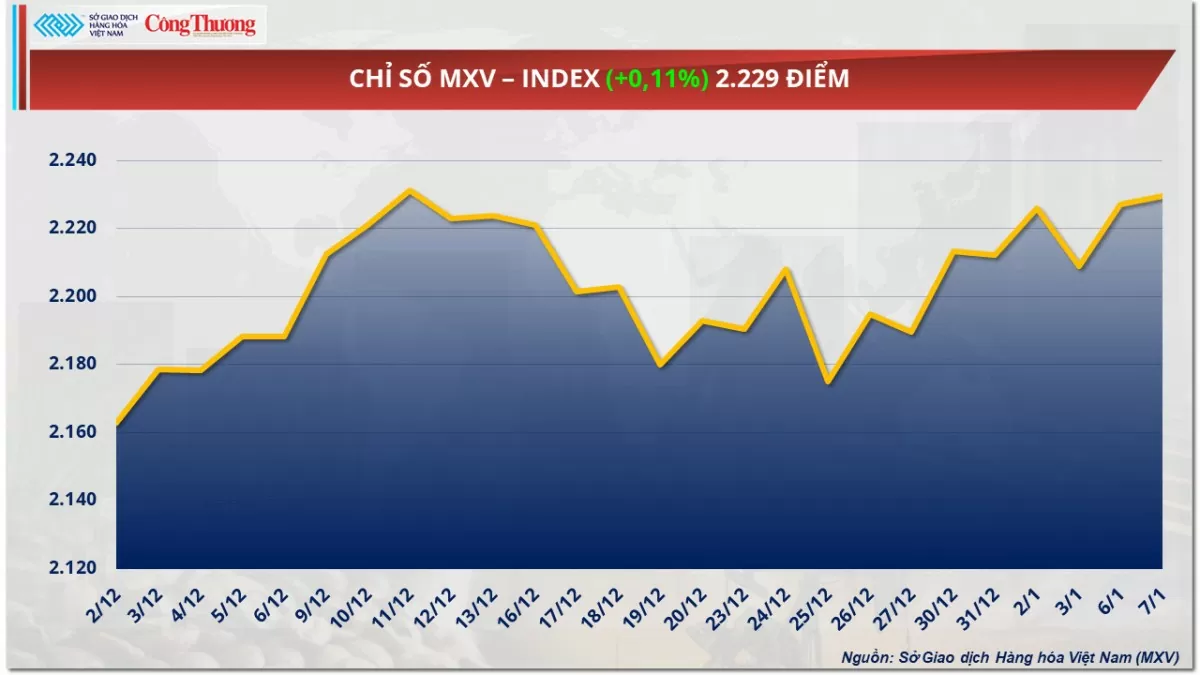

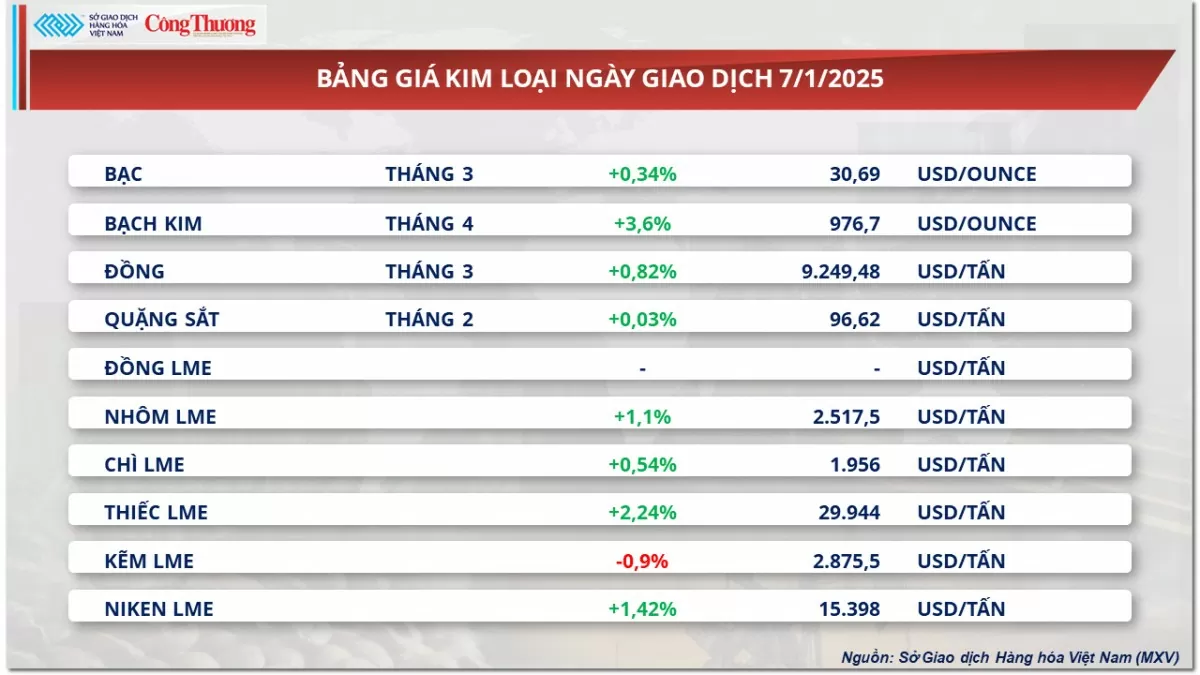

According to the Vietnam Commodity Exchange (MXV), in yesterday's trading session (January 7), the prices of most metal commodities increased simultaneously. Notably, the price of platinum increased by 3.6%, reaching its highest level in the past 7 weeks. In addition, in the industrial raw materials market, the prices of two coffee commodities also recovered positively in the context of concerns about supply shortages in major producing countries such as Brazil and Vietnam. At the close, the dominant buying force pulled the MXV-Index up 0.11% to 2,229 points.

|

| MXV-Index |

Precious metal prices rise

At the end of yesterday's trading session, green dominated the price list of metal commodities. Precious metal prices maintained a strong recovery, led by platinum with a 3.6% increase to 976.7 USD/ounce. The buyers also dominated the silver market but closed with a slight increase of 0.34% to 30.7 USD/ounce.

|

| Metal price list |

Platinum prices have risen to a seven-week high on renewed optimism about the economic outlook in China, the world’s largest platinum importer, which has recently rolled out a series of large-scale economic stimulus measures, including monetary and fiscal policies.

This is expected to boost platinum demand in the automotive and clean energy sectors. In addition, platinum prices are also supported by the risk of supply shortages. According to the US Department of Energy, future demand for platinum is expected to exceed market supply. Therefore, the possibility of a market deficit in 2025 is certain, especially when mining and production output from major supplying countries such as South Africa and Russia decreases.

Platinum prices were also supported yesterday by concerns about supply disruptions in South Africa, the world's largest platinum producer. According to Bloomberg, state-owned electricity company Eskom is having a lot of trouble operating because they have not been fully paid. According to statistics, as of November this year, the company has not been paid a debt of 95.4 billion rand (5.1 billion USD). Experts say this could cause Eskom to delay electricity supply in the near future, thereby disrupting platinum production in this country.

Silver prices broke above $30 an ounce, hitting a near three-week high, following a rally in most metals. Gains were capped by a stronger dollar after solid jobs data that could prompt the Fed to slow the pace of interest rate cuts. Data showed U.S. payrolls unexpectedly rose in November, although hiring slowed. The number of jobs increased by 259,000 to 8.098 million on the last day of November, according to official data.

Arabica and Robusta coffee prices both increased

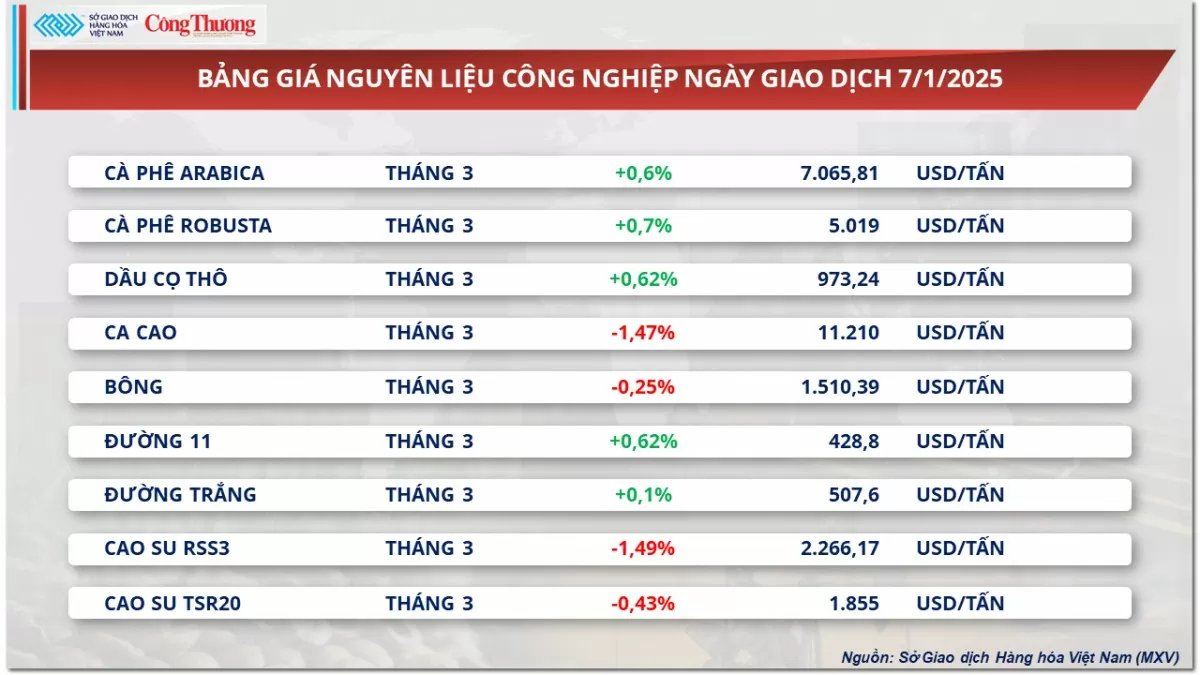

According to MXV, the industrial raw material group continued to experience a relatively mixed session. However, the prices of most items witnessed quite modest changes, increasing or decreasing by no more than 1%.

Coffee prices continued to benefit from the decline in supply in leading supplying countries including Vietnam and Brazil. At the end of the session, Arabica and Robusta coffee prices both increased by over 0.6%, closing at $7,065/ton and $5,019/ton, respectively.

|

| Industrial raw material price list |

Specifically, according to preliminary estimates from the General Statistics Office of Vietnam (GSO), Vietnam exported over 125,900 tons of coffee in December last year, down 39.3% compared to the same period in 2023. In the whole year of 2024, Vietnam exported 1.34 million tons of coffee, down 17.2% compared to 2023.

In addition, in Brazil, data released by the government also shows that the country exported 200,000 tons of coffee in December, down 17.1% compared to the same period in 2023. Moreover, industry experts have warned that coffee exports in Brazil are being disrupted due to difficulties in logistics at export ports. Specifically, according to a survey by the Brazilian Coffee Exporters Council (Cecafé) with 27 affiliated companies, accounting for 75% of total exports, continuous delays and changes in the size of export vessels, combined with frequent cargo turnover, have caused 1.615 million 60kg bags of coffee to be held at ports and not exported by November 2024.

On the other hand, the March 2025 cocoa contract fell more than 1% after a relatively volatile session. Prices continued to be supported by a sharp decline in supply in major producing countries. Moreover, data also showed that global cocoa inventories continued to decline. Specifically, yesterday, cocoa inventories monitored by the Intercontinental Exchange (ICE) held at US ports fell to a 20-year low of 1.345 million bags.

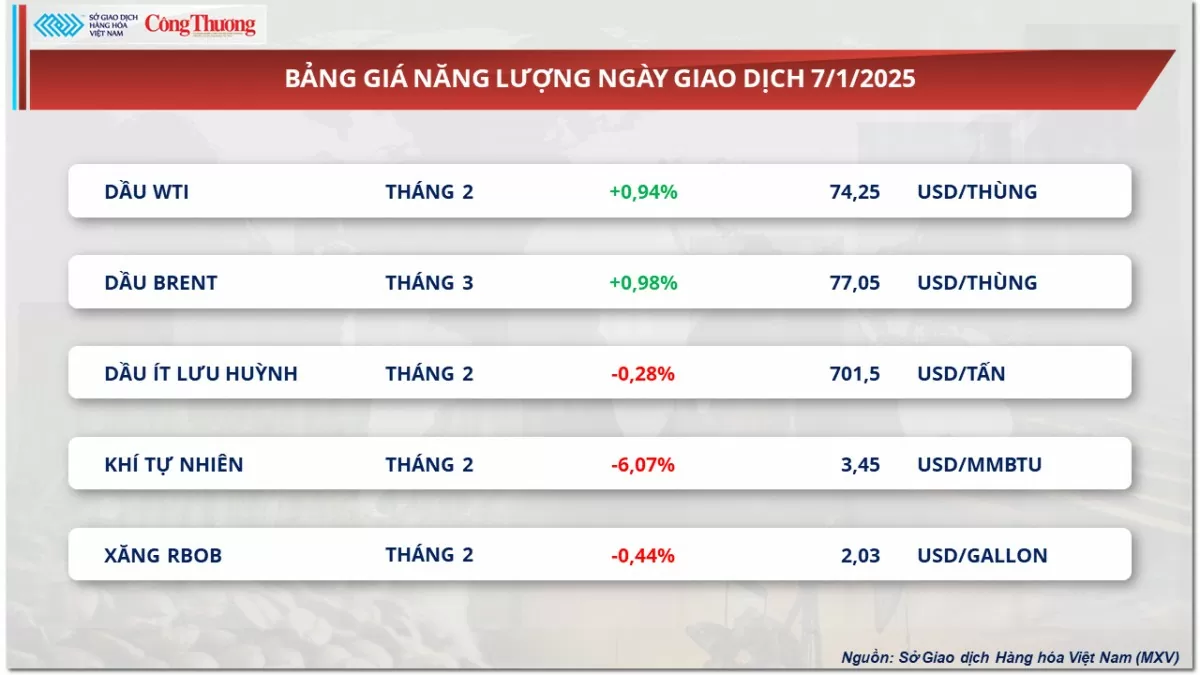

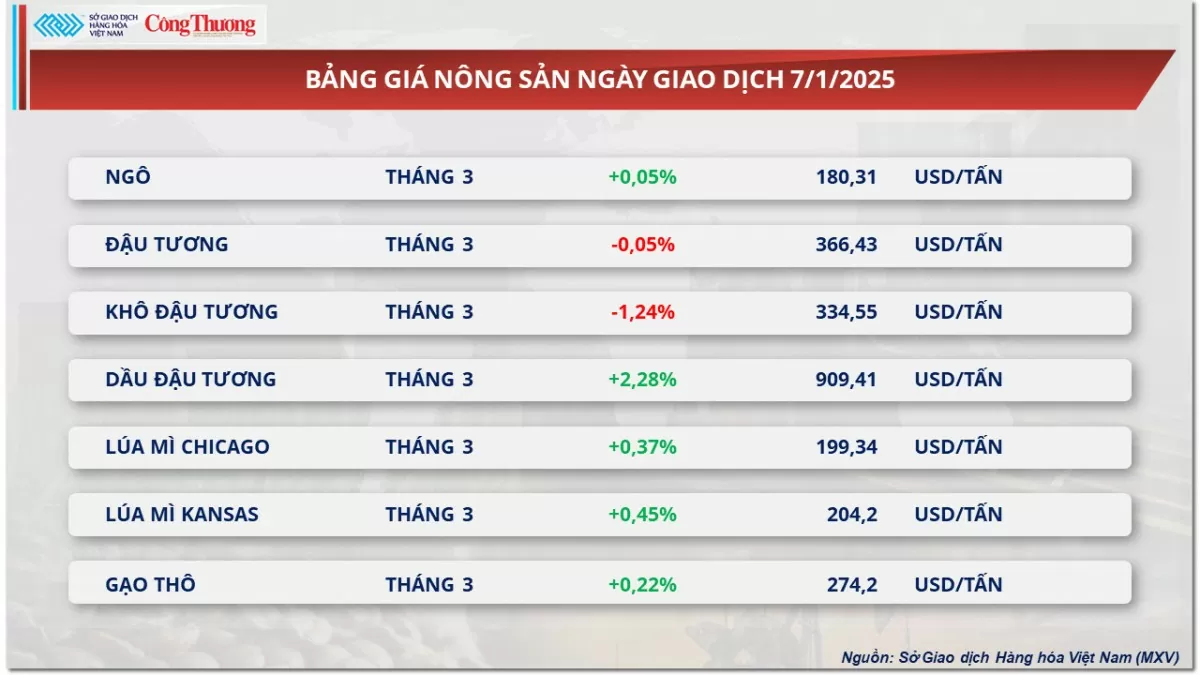

Prices of some other goods

|

| Energy price list |

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-81-gia-ca-phe-duoc-huong-loi-368491.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)