CEOs of US chip companies on July 17 joined a meeting with top US administration officials to discuss China's policies as the US considers new restrictions.

Secretary of State Antony Blinken spoke with chip company executives about the industry and supply chains following his recent trip to China, a department spokesperson told reporters.

Commerce Secretary Gina Raimondo, National Economic Council Director Lael Brainard, and National Security Council Director Jake Sullivan were among the officials who attended the meeting with representatives from Qualcomm, Intel, and Nvidia, three companies that rely heavily on China for 60%, 25%, and 20% of their sales, respectively.

"Risky" market

The meeting between US officials and chip industry CEOs came after China announced restrictions on exports of gallium and germanium, two metals used in chip manufacturing. This was also one of the contents of the discussion between Mr. Blinken and US leaders with the CEOs of the above companies.

At the event, Mr. Blinken shared his views on the semiconductor sector and supply chain issues, especially after his recent visit to China.

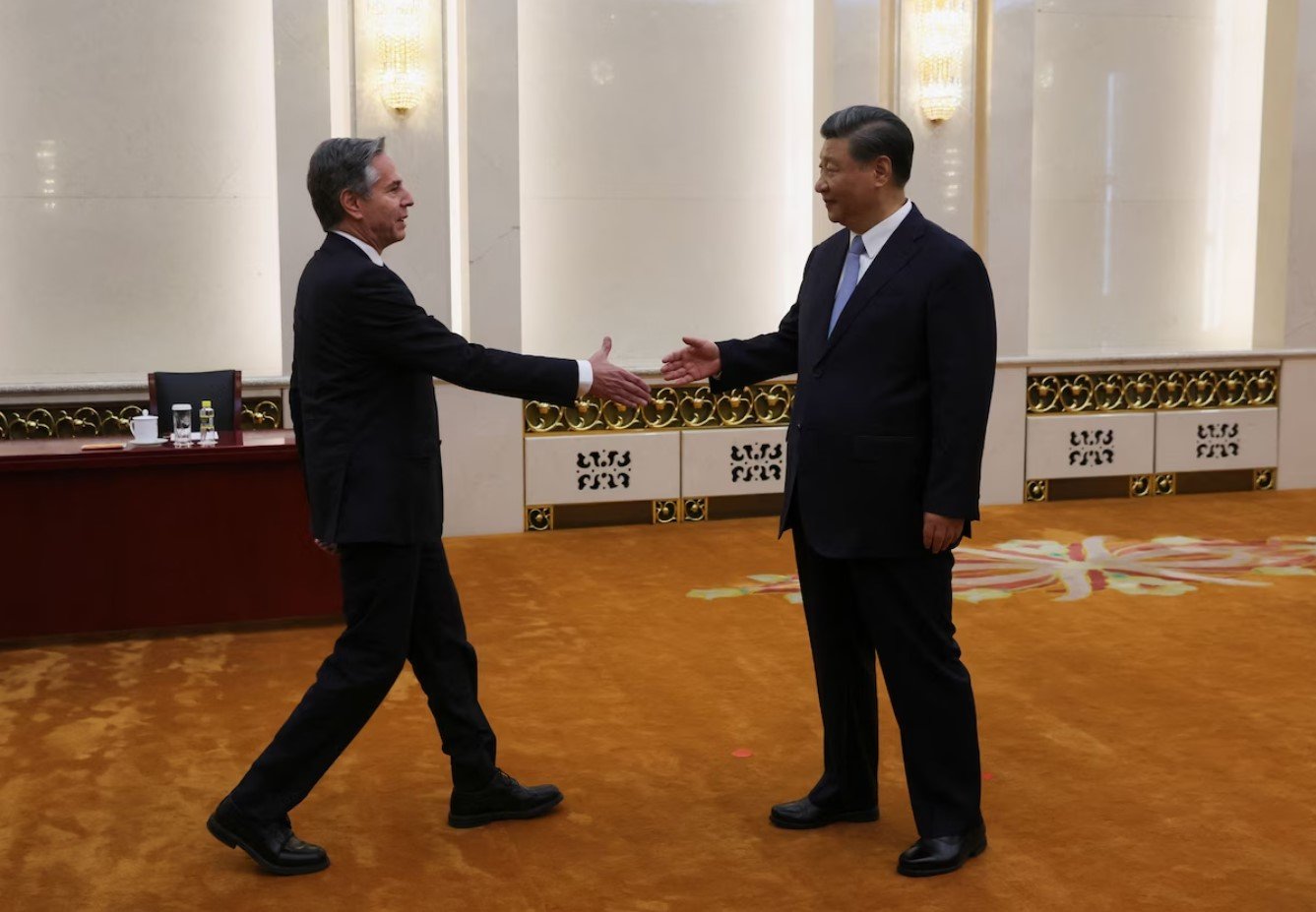

US Secretary of State Antony Blinken met with Chinese President Xi Jinping during a visit to Beijing in June. Photo: Washington Post

"In addition, he also listened to companies share their views on supply chain issues as well as business operations in China," US State Department spokesman Matthew Miller said at a press briefing.

The CEOs also want to push for the release of government money for semiconductor companies in the Science and Chips Act, while ensuring US policy does not prevent chip companies from entering “lucrative” markets like China, Reuters said.

In October 2022, the US Commerce Department issued regulations that would ban semiconductor manufacturers from selling certain tools to China, as well as ban the export of certain chips used in artificial intelligence applications. The announcement sent shockwaves through the semiconductor industry.

The US administration believes that restricting China’s access will strengthen national security and curb Beijing’s efforts to advance its military capabilities. According to Bloomberg, the US is considering new restrictions that would update and improve measures announced last year.

Dialogue solution

The participation of senior administration officials in the meeting reflects the pressure the Biden administration is facing from chipmakers, who fear that new restrictions on sales to China will cut them off from their largest market and undermine U.S. leadership in the semiconductor industry.

“Overly broad, vague, and sometimes unilateral restrictions risk undermining the competitiveness of the U.S. semiconductor industry, disrupting supply chains, causing significant market uncertainty, and inviting further retaliation from China,” the Semiconductor Industry Association (SIA) said on July 17.

While expanding measures to restrict China's access to advanced chips, the US also decided to spend more than $52 billion to boost the semiconductor industry through the Science and Chips Act, which President Joe Biden signed into law in August 2022. Photo: Washington Post

SIA calls on the US administration to refrain from further restrictions until it has engaged more broadly with experts to assess the impact of the current restrictions to determine whether they are narrow enough, clear enough, applied consistently, and coordinated with allies.”

SIA also called on the US and Chinese governments to “ease tensions and seek solutions through dialogue, avoiding escalation.”

In response to SIA, a White House National Security Council spokesperson said: “Our actions are carefully calibrated to focus on technology relevant to national security and are designed to ensure that US and allied technologies are not used to undermine our national security.”

“We have carefully considered the exercise of this authority, through public comment on the regulations and through close coordination with allies and partners, Congress, industry and other stakeholders,” the person said .

Nguyen Tuyet (According to Bloomberg, Reuters, Al Jazeera)

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)