Last weekend, the Ministry of Finance held a regular press conference for the first quarter of 2024 to receive and answer questions of public concern from the press.

Increased coordination in unprecedented times

Monetary policy and fiscal policy are two of the general economic sectors that play an important role in the development of the national economy. In response to a question from a reporter from the Banking Times about the coordination between the State Bank's monetary policy and the Ministry of Finance's fiscal policy, Deputy Minister of Finance Nguyen Duc Chi affirmed the role of coordination between monetary policy and fiscal policy, which has been raised to a new level in an unprecedented context.

|

| Deputy Minister of Finance Nguyen Duc Chi affirmed that the coordination between monetary policy and fiscal policy has been raised to a new level. |

Accordingly, monetary policy and fiscal policy have a close and inseparable organic relationship. In an unprecedented context, the Government has also used unprecedented fiscal and monetary policies to support people and businesses, while supporting growth, controlling inflation, and stabilizing the macro-economy. In the recent meeting of the National Financial and Monetary Policy Advisory Council, it was also assessed that over the past 4-5 years, the coordination between the two fiscal and monetary policies has been raised to a new level, achieving efficiency.

Analyzing more closely this special combination, Deputy Minister Nguyen Duc Chi said that monetary policy in recent times has been flexible in the face of very difficult circumstances; fiscal policy has been more stable, overcoming difficulties to achieve impressive growth; success in implementing financial and state budget targets; public debt and government debt have been controlled much lower than the set targets, budget revenue has ensured the Government's spending needs, supporting people and businesses to overcome difficulties.

Thanks to that, "in the face of major and unpredictable fluctuations, we still operate fiscal and monetary policies to support the economy, ensure social security and national defense stability, and ensure economic growth," Deputy Minister Nguyen Duc Chi emphasized.

The representative of the Ministry of Finance said that in the coming time, it will continue to closely monitor the socio-economic situation; continue to research and propose policy solutions on budget collection, from which there will be appropriate tax policy solutions to remove difficulties for businesses and people, promoting economic growth.

Solving practical problems

At the press conference, the issue that the public is most concerned about today is the difficulties in implementing tax code closure procedures, affecting the implementation of administrative procedures in tax payment of people. Sharing about this issue, the representative of the Ministry of Finance said that through the process of reviewing and standardizing personal tax code data implemented according to Decision No. 06/QD-TTg of the Prime Minister: Approving the Project on developing applications of data on population, identification and electronic authentication to serve national digital transformation in the period of 2022 - 2025, with a vision to 2030, the tax authority discovered cases where an individual (an identification number) corresponds to multiple tax codes, because the individual or organization paying income when performing tax obligations used a different identification number from the registered tax code number, leading to the individual being issued a new tax code different from the previously issued tax code, meaning that the taxpayer has 2, or even more tax codes.

To facilitate people in carrying out tax procedures, the Tax Authority has instructed taxpayers to change their identification information. Since January 2024, the General Department of Taxation has instructed Tax Departments to handle cases where a taxpayer has multiple tax codes in the direction that the MS tax management system has removed the condition of checking for duplicate ID/CCCD numbers, so taxpayers can simultaneously carry out tax administrative procedures, pay taxes to the State budget to complete administrative procedures on land transfer, vehicle purchase... in cases where there is more than 1 tax code. At the same time, the General Department of Taxation has instructed people to close/cancel tax codes according to regulations or update accurate information of existing tax codes...

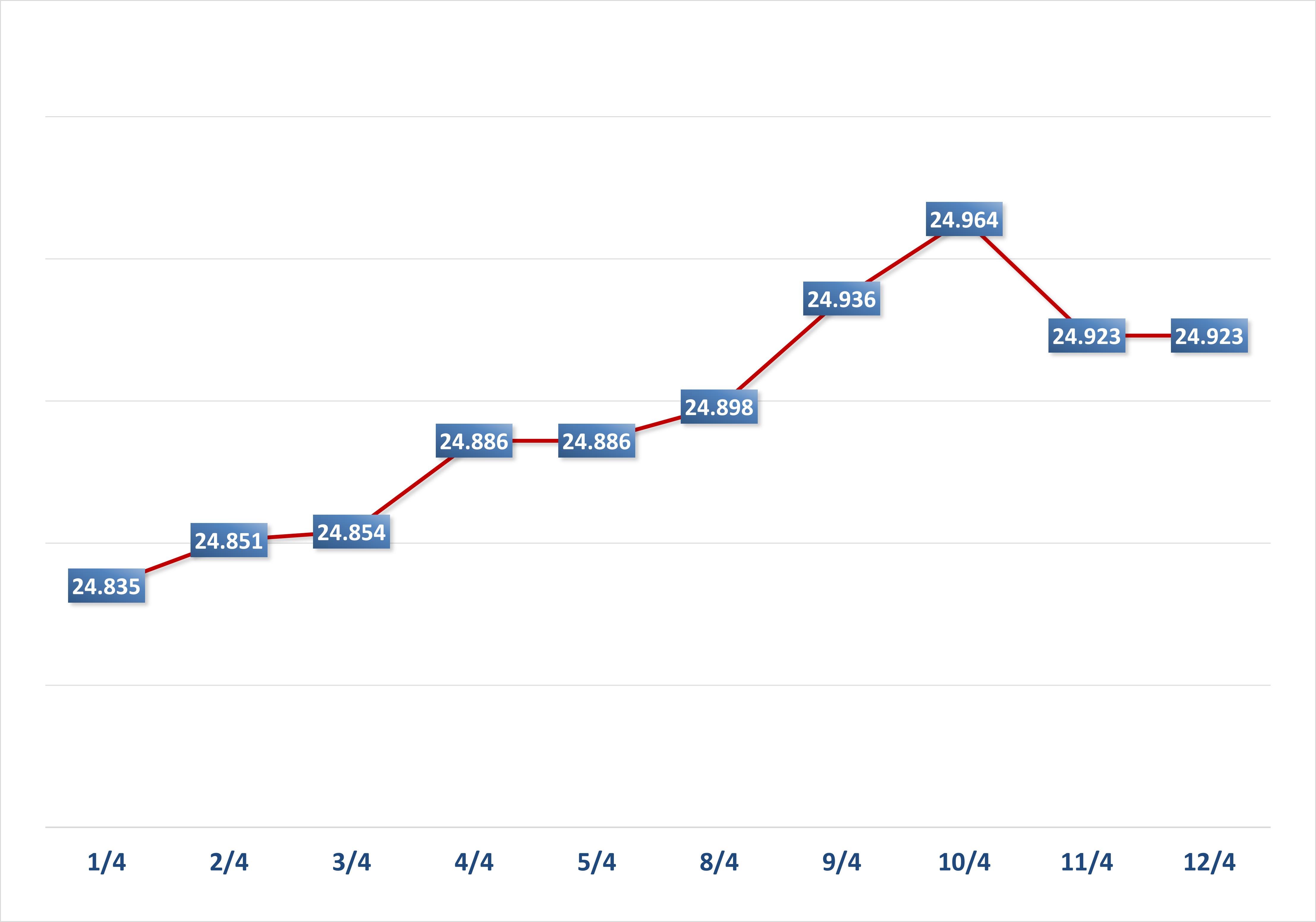

Regarding the desire to soon adjust the family deduction level, Mr. Truong Ba Tuan, Deputy Director of the Department of Tax, Fee and Charge Policy Management and Supervision (Ministry of Finance) said that the Law on Personal Income Tax stipulates that if the consumer price index fluctuates by more than 20% compared to the time the law takes effect or the time the most recent family deduction level is adjusted, the Government will submit to the National Assembly Standing Committee to adjust the family deduction level. Since 2009, when the Law on Personal Income Tax took effect, the Ministry of Finance has always proactively reviewed and advised the National Assembly and the National Assembly Standing Committee to adjust the family deduction level in accordance with reality.

However, the consumer price index from 2020 to now has fluctuated less than 20%. The Ministry of Finance continues to monitor the development of this index to proactively propose according to regulations in the coming time. Regarding the amendment of the Law on Personal Income Tax, the roadmap is 2025 and has been reported by the Ministry of Finance to competent authorities. When amending this Law, the Ministry will amend the overall contents including taxable income, taxable income, and family deductions.

Source link

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)