2025 is predicted to be a "stormy" year for the Vietnamese textile and garment industry, facing a series of challenges from trade fluctuations, inflation, monetary policy...

Opportunities and risks are still in fierce competition.

2024 ends with many good signals for the textile industry Vietnam's export turnover recovered strongly, increasing by more than 11% to 44 billion USD, with the focus of growth in two key areas: fibers and textile products.

However, macroeconomic instability remains a shadow over growth prospects, putting the industry at an important crossroads in 2025. Against this backdrop, economic experts continue to maintain a neutral view on the prospects of the textile and garment industry this year, as opportunities and risks are still fiercely contested.

|

| Amidst opportunities and challenges, the Vietnamese textile and garment industry will need to flexibly adjust its strategy to maintain its competitive advantage, optimize its supply chain and ensure growth momentum in a volatile context (Illustration photo) |

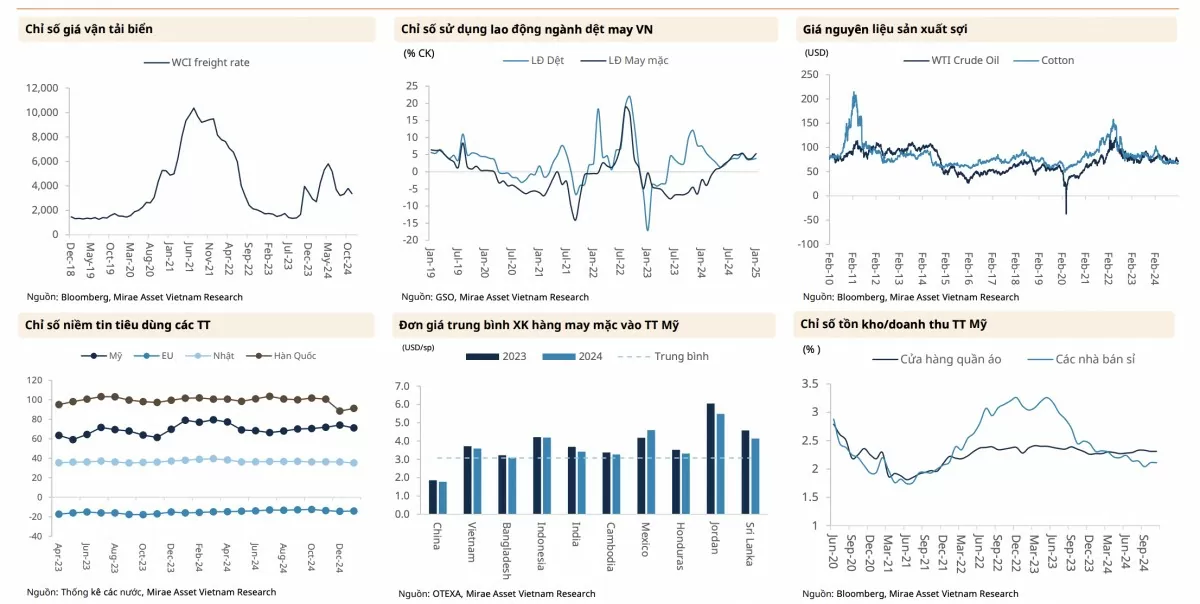

Regarding prospects, citing statistics from the World Bank, the analysis team of Mirae Asset Securities Vietnam (MASVN) said that key markets of Vietnam's textile and garment industry are likely to continue to maintain growth momentum in 2025, in which the US GDP is forecast to increase by 2.3%; Europe (EU) is forecast to increase by 1%; Japan is forecast to increase by 1.2%, and China is forecast to increase by 4.5%. This is a factor supporting the demand for textile and garment products in our country.

However, the textile industry will also face many difficulties and challenges because macro variables are extremely unpredictable. Along with geopolitical instability surrounding the Russia-Ukraine and Israel-Hamas wars, one of the biggest risks is the US-China trade war 2.0. Immediately after taking office, the Trump administration announced a series of new tariffs targeting China, Canada and Mexico, as well as plans to apply "reciprocal tariffs" to many other countries.

It is not impossible that Vietnam will be included in this "reciprocal tariff" list, threatening the competitive advantage of the textile and garment industry. Fortunately, the Trump administration has kept the negotiation channels open, with a 180-day preparation period, creating opportunities for Vietnamese businesses to take advantage of policy space, adjust their export strategies accordingly, and even avoid high tariffs.

|

| One of the biggest risks for the textile industry is the US-China trade war 2.0 (Illustration photo) |

Pressure from monetary policy and inventories

In addition, global monetary policy is creating mixed impacts, bringing significant challenges. In early 2025, a number of central banks around the world began to lower interest rates, but the US Federal Reserve (Fed) slowed down this progress, only expected to cut a maximum of 0.5 percentage points in 2025, due to concerns about rising inflation.

It can be seen that the Fed puts pressure on other central banks that want to continue lowering interest rates, especially in the Asian region, affecting currencies such as the Japanese Yen and the Korean Won. From there, it affects the purchasing power of these countries and indirectly reduces the value of orders of Vietnamese textile and garment enterprises.

Next, our country's textile and garment industry will also face a shortage of orders in 2025, when the inventory ratio at major brands such as Nike, Inditex, GAP, H&M, and Puma has shown signs of increasing since the end of 2024. This signal shows that order growth in 2025 will be difficult to surge, because the cautious trend is spreading at major fashion brands.

In the long term, labor cost pressures will continue to weigh on textile and garment enterprises. Vietnam is attracting more and more FDI capital, leading to increased labor demand and increasingly fierce wage competition. At the same time, the trend of Vietnamese workers seeking jobs abroad also pushes up domestic wages, causing manufacturing enterprises to face the problem of costs.

|

| Opportunities and challenges intertwine (Source: MASVN) |

According to MASVN, despite facing many fluctuations and challenges, some Vietnamese textile and garment enterprises are still demonstrating their ability to adapt flexibly, creating a solid foundation for breakthroughs in 2025. A typical example is Phong Phu Joint Stock Company (UPCoM: PPH), with revenue in 2024 reaching VND 2,240 billion, an increase of nearly 28% over the same period last year. Gross profit margin remains stable at over 19%, while after-tax profit reaches VND372 billion, up 17% compared to 2023. Similarly, Song Hong Garment Joint Stock Company (HOSE: MSH) is also considered a bright spot in the textile and garment industry in 2025. This enterprise closed 2024 with an impressive after-tax profit of VND440 billion, a sharp increase of 80% over the same period, although revenue increased by only 16% to VND5,280 billion - reflecting the ability to optimize costs effectively.

| Amidst opportunities and challenges, the Vietnamese textile and garment industry will need to flexibly adjust its strategies to maintain its competitive advantage, optimize its supply chain, and ensure growth momentum in a volatile context. Taking advantage of advantages and strictly controlling risks will be the key to helping the industry maintain sustainable growth momentum. |

Source: https://congthuong.vn/nganh-det-may-2025-co-hoi-an-sau-nhung-thach-thuc-374732.html

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)