VNDirect Shareholders' Meeting: "Hot" story about Trung Nam bonds and VND stock price

VNDirect is holding a large amount of Trung Nam bonds. This is a content that shareholders are particularly interested in at the 2024 General Meeting of Shareholders and is also considered by the company's leaders to be one of the reasons for the sharp decline in VND shares.

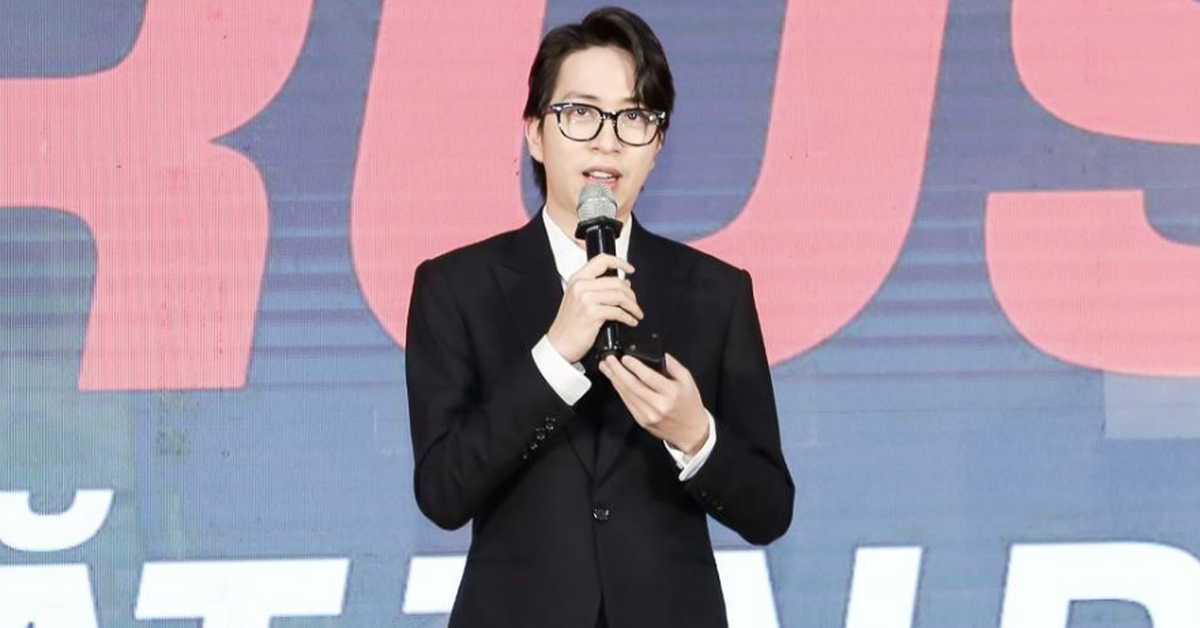

|

| VNDirect Securities Corporation holds the 2024 annual general meeting of shareholders |

Adjusted profit plan down after hacker incident

On the afternoon of June 28, VNDirect Securities Corporation (VNDirect, code VND - HoSE) held its 2024 annual general meeting of shareholders after being unable to hold it the first time due to the proportion of voting shares attending less than 50%.

Reporting at the General Meeting, the company's leaders said that the company plans to return to the "tradition" of paying dividends in cash. At the 2023 Annual General Meeting of Shareholders, this securities company was approved by shareholders to pay dividends in shares. It was not until May 29 that VNDirect finalized the right to receive dividends in 2022 in shares (100:5) with the right to buy shares issued to increase capital for existing shareholders, at a ratio of 5:1.

According to the profit distribution plan presented this year, the dividend rate for 2023 is 5%, all in cash.

In 2023, VNDirect recorded operating revenue of VND6,562 billion, down 6% compared to 2022. However, pre-tax profit still increased by 44% to VND2,482 billion. After-tax profit reached VND2,022 billion, up 48% compared to 2022.

According to the 2024 business plan submitted and approved by shareholders, VNDirect set a target profit after tax of VND 2,020 billion, a slight decrease of VND 2 billion compared to the implementation in 2023. Of which, capital market revenue decreased by 39%, to VND 1,897 billion; securities brokerage revenue decreased by 17%, to VND 720 billion; margin revenue increased by 18%, to VND 1,365 billion.

Sharing at the Congress, Mr. Nguyen Vu Long - General Director of VNDirect said that although the economy is generally seen to recover, the issue that needs to be raised is the speed of recovery. According to Mr. Long, through the reflection of many businesses, the current profit growth is mainly due to the low base level. The economy has recovered but there are many difficulties and challenges ahead when facing pressure on exchange rates and the risk of increasing interest rates.

According to VNDirect Analysis Center, the upcoming difficulties lie in the level of uncertainty and depend on the macro variables of the US and Vietnam.

The above reasons made VNDirect build a cautious plan. In addition, the hacker incident that occurred in April 2024 caused the profit plan to be adjusted down compared to the original plan built at the end of 2023, because the company introduced a customer support policy after the incident.

According to this CEO's update, VNDirect 's estimated pre-tax profit after the first 6 months of the year reached more than 1,300 billion VND. Despite additional activities to compensate customers for costs in April 2024, the company has now completed more than 50% of the plan presented to shareholders today.

“There are still many challenging events from now until the end of the year. The company’s operations have prepared for scenarios to a certain extent. We are confident that we can complete the set plan,” Mr. Long also said.

Continue the plan to issue shares to increase capital

Also at the meeting, VNDirect submitted to shareholders for approval the contents of private share offering; offering shares under the employee stock ownership plan (ESOP) and issuing bonus shares to employees. In addition to issuing dividend shares and offering shares to existing shareholders which are being implemented, the above three options have all been approved by the 2023 Annual General Meeting of Shareholders but have not been implemented.

Regarding the private offering plan, VNDirect has submitted this plan to shareholders since the 2022 General Meeting of Shareholders with an expected issuance rate of 20%. According to the plan submitted in 2023 and this year, VNDirect plans to implement a private issuance plan for 1-10 professional securities investors, with a rate of 15% after issuance. The company's leaders said they hope to find professional partners in this issuance.

Regarding the issuance plan for employees, the company continues to submit a plan to offer 30 million shares under the employee stock option program (ESOP) at a price of VND 10,000/share and issue 15 million bonus shares to employees. The expected implementation period is from 2024 to 2026.

At the Congress, issuing ESOP was also one of the questions raised by shareholders. According to Ms. Pham Minh Huong, this option has actually been proposed by VNDirect many times to bring employees into the development of the organization, especially in an environment where "human resources are very scarce". "VNDirect wants to find people with different DNA, including considering recruiting more leaders of stature and international experience. Because we are competing in a global environment. This is also consistent with the fact that VNDirect is a very large-scale company that requires increasingly higher professional capacity while the current team is still too young", Ms. Huong also revealed.

"Hot" story of Trung Nam bonds and VND stock price plummets

Besides the question about the capital increase plan, the story related to Trung Nam bonds continued to be raised by many shareholders at this General Meeting. Along with that, there was also the decline in VND stock prices, especially in the last half month.

Responding to shareholders, Chairwoman Pham Minh Huong also shared that she did not have time to look at the board and was also very surprised to learn about the recent stock price movements. According to Ms. Huong, VND shares are generally "covered" by legal risks related to Trung Nam. The stock market always has rumors and investors often like and listen to them.

VNDirect currently has a large balance of Trung Nam bonds. Ms. Huong also admitted that the company's board of directors has the responsibility to clarify this content not only to shareholders but also within the company.

“As for the question of whether Trung Nam will go bankrupt if VNDirect goes bankrupt, the answer is no. We always calculate everything we do,” the Chairman of VNDirect’s Board of Directors affirmed. According to Ms. Huong, the current status of Trung Nam’s bond holdings is mainly in power projects that have been put into operation, different from projects without cash flow. Therefore, Trung Nam’s risks lie more in legal rumors, difficulties of projects, changes in government policies and general difficulties of businesses in the investment phase.

Ms. Huong also affirmed that she regularly updates the leaders of Trung Nam and continuously builds scenarios if risks occur. In fact, these risks have been prepared for 2 years ago, with backup plans ready. In the case of the Trung Nam bond batch requesting an extension, VNDirect's leaders said that this happened because the enterprise was in the investment phase, leading to an imbalance in cash flow, not financial risks or bankruptcy risks. As for the possibility of legal risks, the story would involve an individual who could not influence such a large enterprise. In addition, Ms. Huong also said that Vietcombank is a co-guarantor with VNDirect in the wind power bond batch, and a number of other banks are also lending to Trung Nam's power project...

"There will be losses if risks occur, not that there won't be any, but they won't be large. Everything we do has enough limits to take into account the worst case scenario. VNDirect has the ability to generate sustainable profits. Currently, the company has set aside uncollected profits. The provision is an organizational discipline to not be too optimistic with the numbers and to record the appropriate provisions," said Ms. Huong.

Responding further to this content, Mr. Long said that the investment sector may face legal risks, the story of the bond market in the past also made it difficult to re-mobilize capital, causing a disruption in the capital market. Many bonds could not pay principal and interest after the SCB event. In the case of Trung Nam, the company still has a steady cash flow and revenue. Trung Nam's current problem is to rearrange debt repayment with lenders, with a schedule that fits the production and business schedule, and appropriate costs.

According to the company's leaders, VNDirect chose the electricity industry because it determined that this is an industry that needs capital and has cash flow from issuance and production to pay interest. The driving force of the economy is FDI, both of which are large electricity consuming sectors.

“When investing in Trung Nam, we believed in the need for electricity development, infrastructure investment capacity, and implementation capacity of Trung Nam. At that time, foreign investors were also very interested in the electricity industry. We participated in the transaction with Credit Suisse to advise Trung Nam, but unfortunately Credit Suisse collapsed. The change in energy security policy also made it more difficult to find foreign investors.”

Regarding the story of VND stock price, Mr. Long said that information such as the hacker incident and Trung Nam's difficulties have affected the stock price in the short term. The CEO of VNDirect assessed that VND stock is currently undervalued compared to stocks in the same industry on the market. However, according to him, the business results in the first half of the year are showing good results and the ability to complete the plan is positive when reaching more than 50% of the year's target .

“We are committed to making every effort to rebuild after the events that occurred. We believe that the financial results still ensure the business efficiency of the enterprise and the most important thing in stock valuation is the profitability ratio. Regarding issues of shareholder relations and communicating the company's business strategy, we will try to do better in IR communication so that the market price reflects the true value of the company,” the CEO of VNDirect also emphasized.

At the Congress, the reports were approved.

Source: https://baodautu.vn/dhdcd-vndirect-nong-cau-chuyen-trai-phieu-trung-nam-va-gia-co-phieu-vnd-d218842.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)