(Dan Tri) - For those participating in compulsory social insurance, the lowest pension is equal to the basic salary. With the current basic salary of 2.34 million VND/month, many people are compensated to reach the minimum pension.

Current lowest pension

Before July 1, 2025, the method of calculating the monthly pension of employees participating in compulsory social insurance (SI) will be applied according to the provisions of Article 56 of the 2014 Social Insurance Law. Accordingly, the lowest monthly pension is equal to the basic salary.

According to Decree 73/2024/ND-CP of the Government, from July 1, 2024, the basic salary is 2,340,000 VND/month. Compared with the regulation that the minimum pension is equal to the basic salary, from this point on, the lowest monthly pension of employees participating in compulsory social insurance will also be set at 2,340,000 VND.

Currently, the lowest monthly pension is equal to the basic salary (Illustration: Pham Nguyen).

This provision does not apply to the cases specified in Point i, Clause 1, Article 2 (part-time workers in communes, wards and towns) and Clause 3, Article 54 (female workers who are full-time or part-time workers in communes, wards and towns participating in social insurance when they retire with 15 to less than 20 years of social insurance contributions and are 55 years old).

In addition, this regulation is applied when calculating pensions for employees at the time of retirement. Therefore, in reality, there are still many people receiving pensions lower than the basic salary.

The case of Ms. Le Thi Tu, born in 1961, retired from January 1, 2018 with 20 years of compulsory social insurance (SI) payment is an example.

At the time of retirement, Ms. Tu received a pension of 1,300,000 million VND. By July 2024, after many adjustments, Ms. Tu's pension was 2,070,000 VND/month, lower than the current basic salary (2,340,000 VND/month).

According to Vietnam Social Security, Ms. Tu's pension was settled on January 25, 2018 with a total monthly pension of VND 1,300,000.

In particular, Ms. Tu's actual pension calculated according to her social insurance contribution period is 748,266 VND. After that, her pension was adjusted to increase by 7.27% according to the pension adjustment policy for female employees who started receiving pension in the period 2018-2021 with a social insurance contribution period of 20 years to 29 years and 6 months. The pension after adjustment is 802,665 VND/month.

Because the above salary is lower than the basic salary at this time, Ms. Tu is compensated with an additional 497,335 VND/month to ensure that the actual salary received is equal to the basic salary according to the provisions of Clause 5, Article 56 of the Law on Social Insurance 2014.

Thus, the minimum pension provision was implemented when Ms. Tu retired. After that, her pension was only adjusted to increase according to the Government's decision.

Specifically, the most recent adjustment was according to Decree No. 75/2024/ND-CP, her pension from July 2024 will be increased by 15%.

Ms. Tu's pension in June 2024 is 1,800,000 VND/month. By July 2024, her pension will increase by 15% compared to June 2024, which is 2,070,000 VND/month.

Lowest pension from 1/7/2025

From July 1, 2025, the Social Insurance Law 2024 officially takes effect, replacing the Social Insurance Law 2014. Therefore, the monthly pension of retirees from this date onwards will be calculated according to the provisions of Article 66 of the Social Insurance Law 2024.

The important change in the pension calculation method according to Article 66 of the Social Insurance Law 2024 is that there is no longer a regulation on the lowest monthly pension level.

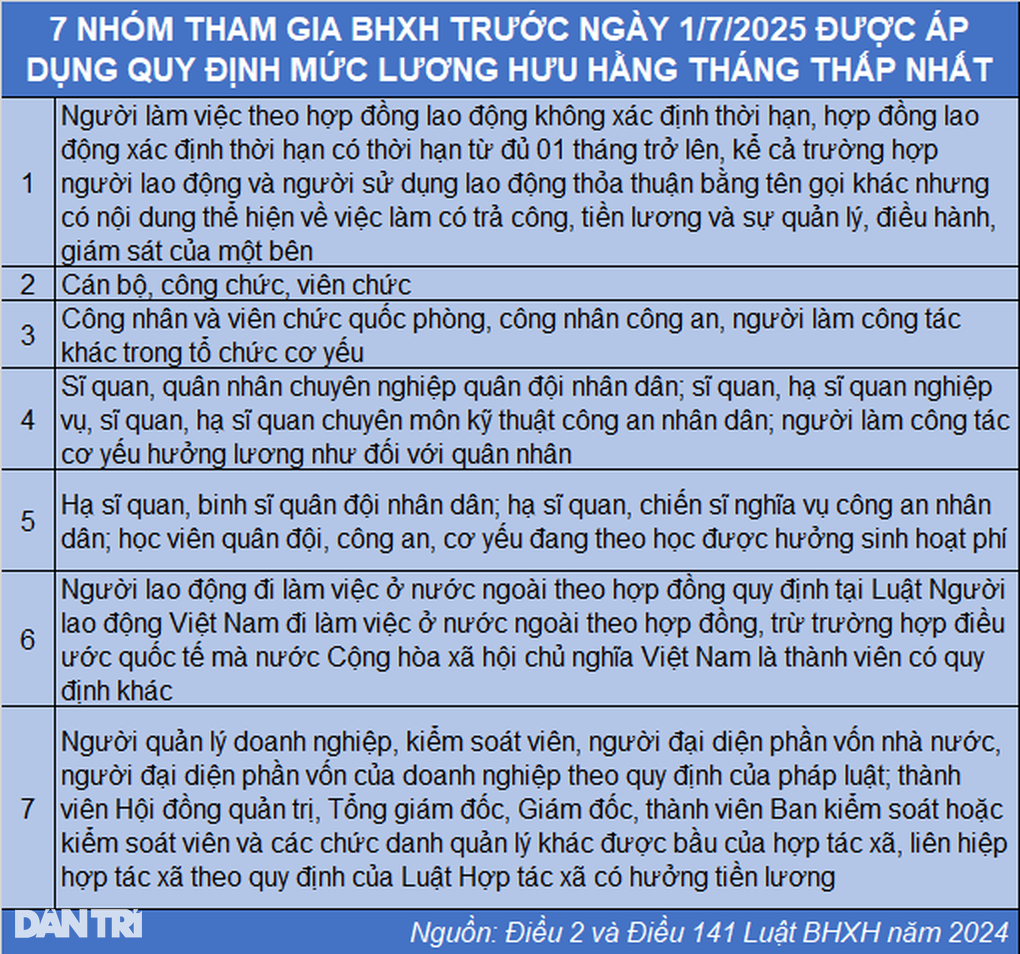

According to Clause 11, Article 141 of the 2024 Law on Social Insurance, the right to receive the lowest monthly pension is only applicable to 7 groups of employees who participated in social insurance before July 1, 2025.

The lowest monthly pension is no longer calculated based on the basic salary but instead on the reference level.

The condition for the above 7 groups of workers to be granted compensation to achieve the lowest monthly pension equal to the reference salary (in case at the time of retirement, the actual pension is lower than the reference level) is that they have paid compulsory social insurance for at least 20 years.

The reference level is stipulated in Article 7 of the Law on Social Insurance 2024. Accordingly, the reference level is the amount of money decided by the Government to calculate the contribution level and the benefit level of some social insurance regimes.

According to Clause 13, Article 141 of the Law on Social Insurance 2024, when the basic salary has not been abolished, the reference level is equal to the basic salary. At the time the basic salary is abolished, the reference level is not lower than that basic salary.

Source: https://dantri.com.vn/an-sinh/nguoi-luong-huu-thap-duoc-bu-lon-de-dat-muc-toi-thieu-nam-2025-20241216154110984.htm

![[Photo] Dong Ho Paintings - Old Styles Tell Modern Stories](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/317613ad8519462488572377727dda93)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to urge highway projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/6a3e175f69ea45f8bfc3c272cde3e27a)

![[Photo] Prime Minister Pham Minh Chinh and Brazilian President Luiz Inácio Lula da Silva attend the Vietnam-Brazil Economic Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/f3fd11b0421949878011a8f5da318635)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)