Many banks are stepping up real estate sales - from land, townhouses to apartment projects - in the context of rapidly increasing bad debt in recent times.

The Bank for Agriculture and Rural Development of Vietnam (Agribank) Ho Chi Minh City Branch has just auctioned off the debt of Ha Long Seafood Company Limited at this bank with a book value of more than VND 31.3 billion to handle and recover the debt. The collateral for the debt is the right to use a 256 m2 land plot in Binh Thanh District, Ho Chi Minh City and a townhouse attached to the land.

Auction of real estate, apartments

The above debt is auctioned in its original condition (including secured assets, legal status and potential risks...) with a starting price of just over VND 19.5 billion.

Other branches of Agribank such as Saigon Center, Nha Be, South Saigon, East Ho Chi Minh City... also simultaneously advertised for sale debts with real estate as collateral, including vacant land, land for perennial crops, townhouses, residential land in rural areas...

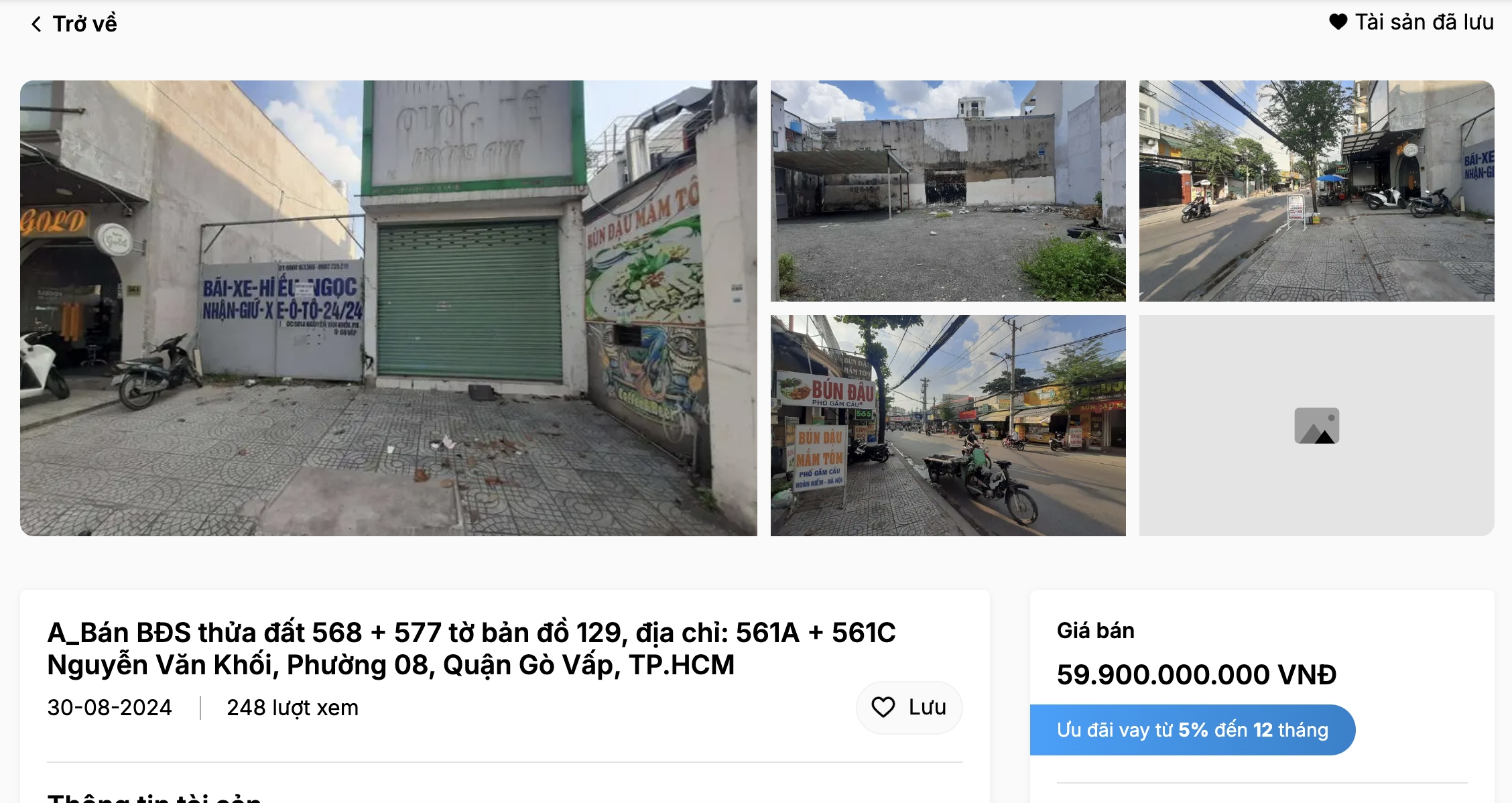

For the International Bank (VIB), the number of real estate assets for sale alone has reached more than 800, including: residential land, townhouses, apartments, land plots... in all localities across the country. Many plots of land cost from several billion VND to several tens of billion VND. A typical example is a plot of land in Ward 8, Go Vap District, Ho Chi Minh City with an area of 536 m2, which is being sold by this bank with a starting price of nearly 60 billion VND.

Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) is also selling a number of properties in Can Tho, Long An, Hau Giang, Kien Giang, and Ho Chi Minh City at prices ranging from several billion to several tens of billions of VND to recover debts, totaling 67 properties. Many of these properties are located on busy urban streets with dense populations. For example, Sacombank is selling properties in Ninh Kieu District, Can Tho City with an area of over 1,158 square meters, starting at 114.1 billion VND.

A series of other banks such as PVcomBank, KienlongBank, Vietcombank, BIDV, VietinBank... have also continuously announced the liquidation of mortgaged real estate assets to handle and recover loans. Asset auction activities are being promoted by banks because the real estate market has begun to recover in some segments, and at the same time to control the bad debt ratio.

Dr. Huynh Phuoc Nghia, Ho Chi Minh City University of Economics (UEH), said that banks have been promoting the sale of mortgaged assets for about a year now, not just recently. Although the real estate market has not recovered strongly, depending on the nature of the real estate, whether it is a townhouse, land plot, apartment or location, there are still investors in each corresponding segment participating.

"The current difficulty is whether the market can absorb the amount of real estate and apartments that are being liquidated or not. If banks want to quickly liquidate and recover debts and sell mortgaged assets at low prices, borrowers who cannot repay their debts and have to auction off their mortgaged assets will suffer losses," Dr. Huynh Phuoc Nghia analyzed.

Many commercial banks simultaneously sell debts and mortgaged assets at the end of the year.

Bad debt increases rapidly

Banking industry update reports recently released by many securities companies show that bad debt is increasing as the asset quality of the banking system has weakened significantly since the real estate and corporate bond crisis in 2022-2023.

Mr. Cao Viet Hung, Director of Financial Industry Analysis - ACBS Securities Company, informed that the bad debt ratio of listed banks has remained high for 4 consecutive quarters and increased by 4 percentage points in the third quarter of 2024, including restructured debt according to Circular 02/2023/TT-NHNN. The group of banks specializing in lending to individuals and small and medium enterprises has a higher bad debt ratio and group 2 debt ratio than the group specializing in lending to large enterprises. Notably, the buffer for bad debt risk is no longer thick and is only at the same level as before the COVID-19 pandemic.

Data provided by the State Bank at the National Assembly session in November 2024 also showed that bad debt tends to increase. According to State Bank Governor Nguyen Thi Hong, as of the end of September 2024, the on-balance sheet bad debt ratio was at 4.55%, almost equal to the end of 2023 and an increase compared to 2022.

"This is a reality due to the impact of the COVID-19 epidemic, which has seriously affected all aspects of social life. Businesses and people are facing difficulties, and reduced income has led to even more difficulties in debt repayment," the Governor of the State Bank explained.

Mr. Cao Viet Hung said that although the bad debt ratio has increased for two consecutive quarters, there are some signs that it has peaked and may improve in 2025. Many banks have proactively made full provisions for restructured debts according to Circular 02. For restructured debts affected by storm No. 3, banks are allowed to extend the provisioning schedule to the minimum level according to the roadmap in the coming time.

According to the analysis team of SSI Securities Company (SSI Research), in the first 3 quarters of 2024, banks have handled 73,300 billion VND of bad debt, such as: VPBank 19,400 billion VND, VietinBank 17,400 billion VND, BIDV over 15,900 billion VND and MBB 7,100 billion VND - accounting for 0.84% of total outstanding customer debt. This is the highest level ever recorded.

"Despite active handling, the bad debt ratio is still high, fluctuating at 2% in the third quarter of 2024, mainly in industries such as construction materials, construction companies, real estate (investors and home loan lenders), trade and manufacturing. Debt repayment capacity is still weak, which affects debt collection of banks. However, banks will step up bad debt handling in the fourth quarter of 2024, helping the bad debt ratio decrease to 1.9% by the end of the year" - SSI Research experts commented.

Mr. Dao Hong Duong, Director of Industry and Stock Analysis - VPBank Securities Company, commented that the rate of bad debt formation is decreasing, through the rate of debt increase in groups 2 and 4.

Group 2 debt has decreased for the second consecutive quarter, showing a slowdown in the trend of bad debt formation. Total bad debt in the industry has remained stable at 2.2%. The bad debt coverage ratio (about 80%) shows signs of bottoming out but has decreased significantly from the end of 2022 to present.

Consider extending Circular 02

Governor Nguyen Thi Hong said that in order to control bad debt, the State Bank has required credit institutions to carefully assess and evaluate customers' ability to repay when lending, ensuring control of newly arising bad debt.

For existing bad debts, it is necessary to actively handle them through urging customers to pay debts, debt collection, asset auctions... The State Bank also creates a legal framework for debt trading companies to be able to participate in handling bad debts.

One of the solutions that the banking industry has applied to control bad debt is to extend Circular 02 for about 6 months (until the end of 2024), restructure the debt repayment period and maintain the debt group to support customers in difficulty.

Dr. Huynh Phuoc Nghia said that the Government and the State Bank are prioritizing supporting businesses and promoting credit growth to boost economic growth. With this goal in mind, it is possible to consider extending Circular 02 on debt restructuring.

Because if this circular expires on December 31, 2024, banks will have to make full provisions, "correctly and fully" calculate the debts that have been restructured in the past, the risk of bad debt will increase.

Source: https://nld.com.vn/ngan-hang-o-at-rao-ban-no-196241226211625999.htm

![[Photo] Solemn Hung King's Death Anniversary in France](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/786a6458bc274de5abe24c2ea3587979)

![[Photo] Vietnamese rescue team shares the loss with people in Myanmar earthquake area](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/ae4b9ffa12e14861b77db38293ba1c1d)

Comment (0)