Tet bonus is like idle money at the end of each year. If you choose a good investment channel that suits your taste and goals, it will help generate effective profits.

Le My (25 years old) has been working as an engineer for a foreign company in the chemical industry in Ho Chi Minh City for over two years. Receiving a one-month bonus of nearly 20 million VND, this young person plans to give 3 million VND to her family and 2-3 million VND to a travel fund. The remaining amount, My plans to save or invest.

Last year, My chose to save money because at that time, bank interest rates were over 8% per year. This year, she is still hesitant because interest rates are falling sharply. "For people like me who are only used to saving money, where to put the bonus to avoid losing value is a big question," she shared.

Like Le My, many people still do not know what to do with their Tet bonus. Although the value may vary, the common point of this amount of money is the surplus income of each worker, which can be considered as idle money at the end of the year. Therefore, in addition to spending for yourself and your family, Tet bonus is an ideal capital to accumulate and invest.

According to Ms. Le Thi Dieu My - Head of Customer Care Department of Vietcombank Fund Management Company (VCBF), to know how to manage Tet bonus, the first thing to do is to assess risk appetite based on age. Answer the question: What age are you and what stage of financial planning are you at?

The table below lists each person's stages and the appropriate risk appetite at each stage. This is the advice of Edward Jones - one of the leading financial services companies in the US.

(Stages in life:

- Teenager: just graduated from college, started first job, not married yet

- Stability: stable job and family building

- Development: high and stable income, building financial plans for children

- Middle age: financial planning for retirement

- Retirement: retirement)

Ms. My suggests using the following formula to assess your risk appetite:

| Risk acceptance ratio: (100 - current age) x 100% |

For example, if your age is 30, your risk tolerance will be (100-30) x100% = 70%. So, you can allocate 70% of your income to high-risk assets with high expected returns.

The second step is to determine current and future needs, from which to make a plan to balance income, spending and savings. Each person can set goals for the new year, from which to answer the question: What do I need? When do I need it? How much money do I need to achieve that goal?

VCBF experts suggest that you can refer to the 50:20:30 rule to create a budget. Of which, 50% is for essential living expenses, 20% is for savings and investment, and the remaining 30% is for activities such as entertainment, travel, and attending courses.

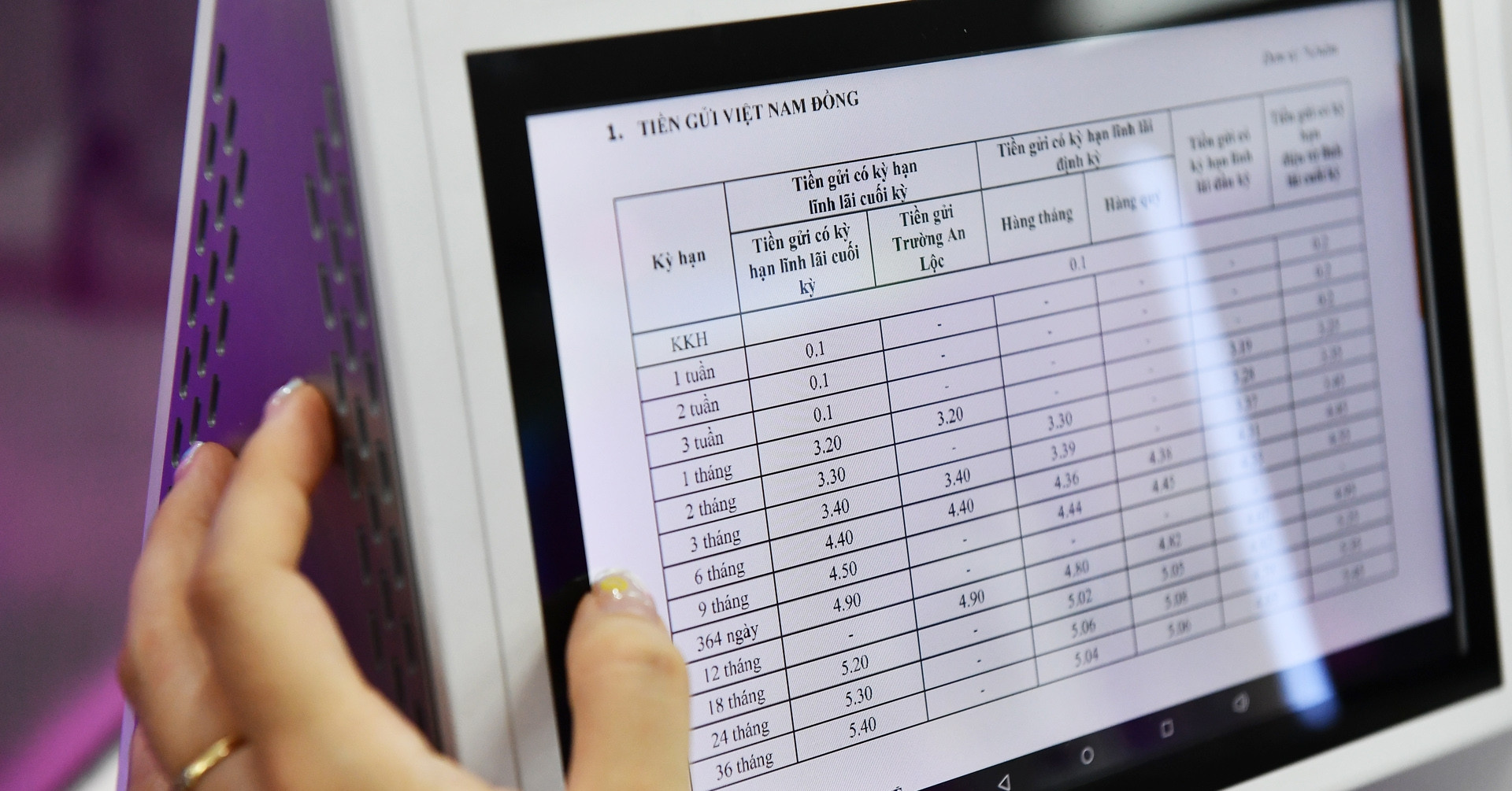

Transaction at a bank in Ho Chi Minh City. Photo: Thanh Tung

Next, research investment channels after determining your risk appetite and investment goals.

The first is savings . This is a fairly familiar and safe choice with stable interest rates, suitable for investors who do not accept high fluctuations. However, it should be noted that bank interest rates are currently at a record low, with a 12-month term of only around 4.5-5.5% per year.

Second, gold is considered one of the traditional and safe investment channels, used as a way to protect asset value during times of uncertainty or economic crisis. This form has high liquidity but does not have a fixed interest rate. Over the past two years, gold prices have fluctuated faster than before, many times setting new records and then falling in price in a short period of time. Domestic gold prices also differ greatly from world prices, often recording opposite developments. At the end of last year, SJC gold exceeded 80 million VND per tael but quickly fell to 75 million VND.

The third is the stock channel. Investing in stocks with long-term growth potential can be a good idea but requires a lot of time and knowledge. This form is for investors willing to accept high risks. According to analysis by many securities companies, the Vietnamese market is currently priced cheaper than in the past. With many prospects for general economic recovery and corporate profits, now can be considered a good time to invest in stocks.

In addition to direct capital investment, open-end funds are a popular form of indirect investment. This is a flexible choice, helping to diversify the investment portfolio. This form is suitable for all subjects from those with low to high risk tolerance with small investment capital and high liquidity. However, investors need to pay attention to filter out funds with good performance, suitable investment strategies and moderate fees.

Finally, real estate . The real estate channel can help diversify well, especially for those who have long-term investment plans. However, the limitation is that it requires a large amount of capital and low liquidity. Currently, many market observers believe that it takes more time for the real estate market to thaw, and that housing prices have decreased compared to before, but it is still difficult to filter out products that are legally guaranteed and of good quality. In general, the real estate market will still mainly focus on the segment with real housing needs.

According to VCBF experts, Vietnam's macro balance is showing many positive signs from inflation risks and falling exchange rates, the economy has many drivers for growth. Therefore, with an average Tet bonus of tens of millions of VND, investors can allocate it to the stock market or indirectly through open-ended funds.

Money will lose value due to inflation, but investment assets will not. If you choose the right channel, they will generate profits, making the size of your assets continuously increase. "In addition to Tet bonuses, whenever you have idle money, you can invest as soon as possible," the VCBF expert added.

Siddhartha

Source link

Comment (0)