No new projects recorded for sale

On March 12, DKRA Group announced the report on the residential real estate market in Ho Chi Minh City and surrounding areas in January & February 2024.

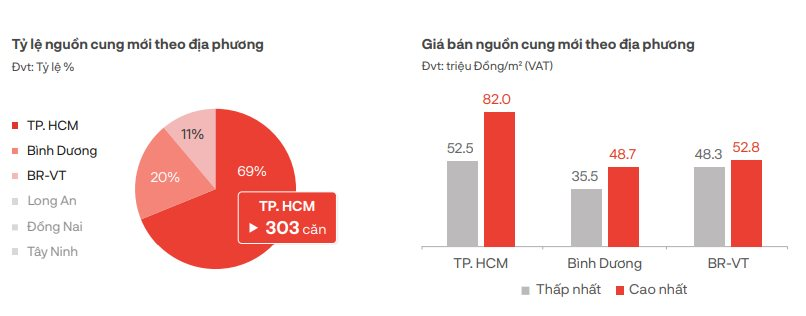

Accordingly, in the apartment segment, new supply in the first two months of the year decreased, only 66% compared to the same period in 2023, concentrated in the period before Lunar New Year, mainly distributed in Ho Chi Minh City, Binh Duong and Ba Ria - Vung Tau.

In the first two months of the year, Ho Chi Minh City and its surrounding areas had no new apartment projects launched for sale. Current supply comes from projects that have been launched before.

Notably, in the first two months of this year, the apartment market in Ho Chi Minh City and its surrounding areas (Binh Duong, Dong Nai, Ba Ria - Vung Tau, Long An and Tay Ninh) did not record any new projects for sale. During this period, the market supply came from 6 projects, but all were in the next phase of sale.

Accordingly, the supply of apartments in Ho Chi Minh City accounts for the majority with more than 300 units. The remaining nearly 140 units are mainly concentrated in Binh Duong and Ba Ria - Vung Tau provinces. Thus, the number of apartments for sale in the first 2 months of this year is still down 34% compared to the same period in 2023.

Although many investors have applied promotional policies such as quick payment discounts, extended payment terms, opening gifts... to stimulate market demand, the consumption of new apartments in the past period still decreased by 53% compared to the same period last year due to the impact of the long Lunar New Year holiday.

In particular, class B apartments continue to lead the market, accounting for 93% of new consumption and mainly concentrated in the West of Ho Chi Minh City.

In the context of a sluggish market, policies of quick payment discounts, extended payment terms, and opening gifts continue to be applied by most investors to stimulate market demand.

Primary selling prices did not fluctuate much, locally recording an increase of 3% - 6% in some projects in Ho Chi Minh City with complete legal procedures, quick construction progress and handover.

New apartments in Ho Chi Minh City are currently priced from 52.5 to 82 million VND/m2. Meanwhile, in Binh Duong province, new apartment prices range from 35.5 to 48.7 million VND/m2. In Ba Ria - Vung Tau province, new apartment prices range from 48.3 to 52.8 million VND.

In the resort real estate segment - resort villas and resort real estate - Condotel, the market also did not record any new projects in the first 2 months of the year, each segment only recorded 1 project in the next opening phase, supply and consumption rate both decreased sharply.

The land segment became a rare bright spot in the market, but only recorded 1 new project and 3 projects in the next sales phase, supplying 138 plots to the market, down 14% compared to the same period in 2023.

New supply is expected to be very positive.

According to DKRA Group, in the first two months of 2024, the supply and consumption of new land plots decreased by 14% and 25% respectively compared to the same period in 2023.

In particular, transactions focused on product groups with an average price of about 21.5 million VND/m2. Long An province is the main force in terms of the proportion of new supply and consumption in the market with the rates reaching 60% and 58% respectively.

Ho Chi Minh City is the market leader with a proportion of 52% of supply and 94% of new consumption.

The primary selling price level tends to remain the same compared to the end of 2023. The selling price of new land in Long An is from 17.2 - 54.9 million VND/m2, in Binh Duong the selling price fluctuates from 14.5 - 16 million VND/m2 and in Dong Nai the selling price is from 12.3 - 13.7 million VND/m2.

In another development, the secondary market tends to move sideways compared to the end of 2023. Market liquidity is at an average level, projects with completed infrastructure, legal documents, high market creation level, etc. attract the attention of investors.

DKRA Group expects new supply in the coming months to be very promising, with most of the products concentrated in areas bordering Ho Chi Minh City.

Source

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)