The turning point of identity change

Vietnam Maritime Commercial Joint Stock Bank (MSB), formerly known as Maritime Bank, was established in 1991 in Hai Phong City with initial charter capital of 40 billion VND.

Over the past 33 years of establishment and development, this bank has continuously expanded its charter capital. Up to now, the bank's charter capital has increased 500 times compared to the original to 20,000 billion VND, which is in the middle range among the total of 28 commercial banks today.

In 2024, MSB plans to issue up to 600 million additional shares, with a maximum issuance ratio of 30%, equivalent to shareholders owning 100 shares will receive 30 new shares, thereby increasing charter capital from VND 20,000 billion to VND 26,000 billion.

During the days when the logo was still blue, the major shareholders present at MSB also had a strong maritime character when Vietnam National Shipping Lines (Vinalines) owned more than 163.1 million shares, equivalent to 10.88% of capital, United Shipping Agency Joint Stock Company (Gemadept) held 99.8 million shares, equivalent to 6.66% and Vietnam Ocean Shipping Company (VOSCO) held nearly 93 million shares, equivalent to 6.2%.

In addition, Vietnam Posts and Telecommunications Group (VNPT) also owns more than 298.6 million shares, equivalent to 19.91% of the bank's capital.

On January 14, 2019, MSB officially changed its brand identity and abbreviation from Maritime Bank to MSB, launching a 5-year strategy for 2019-2023 to make MSB the most trustworthy, customer-friendly and profitable bank in Vietnam.

MSB changes brand identity.

More than 2 years of preparation for HoSE

At the end of December 2020, more than 1.17 billion shares of MSB were officially listed on the Ho Chi Minh City Stock Exchange (HoSE) with a reference price on the first trading day of VND 15,000/share, equivalent to a market capitalization value of more than VND 17,625 billion. However, to achieve that result, the bank had to undergo a long preparation process.

In 2018, MSB's annual general meeting of shareholders approved the plan to register for stock listing on HoSE with the expected time being the first quarter of 2019.

However, in October 2018, the bank's IPO consulting partner, Ho Chi Minh Securities Corporation (HSC), recommended implementing the IPO according to one of two implementation roadmap options to optimize the benefits of shareholders and investors, while taking advantage of favorable market developments to enhance MSB's image.

Accordingly, with the developments in the financial and stock markets from late 2018 to early 2019 not showing positive signs for an official listing, MSB's leadership has decided to implement the plan to list shares on HoSE in the third quarter of 2019.

MSB said that the IPO implementation will help the Bank diversify its investment portfolio (increase the proportion of foreign shareholders), increase its market capitalization value after listing and is expected to reach about 1.1 billion USD after selling all treasury shares to selected investors.

In November 2019, HoSE announced that it had received MSB's listing application. However, the annual general meeting of shareholders in May 2020 approved the suspension of the first listing application at HoSE and decided to restart the listing of shares at a favorable market time.

Before officially being listed on HoSE in December 2020, the bank released a lot of positive information.

Accordingly, MSB announced its business results for the first 9 months of 2020 with total consolidated assets reaching more than VND 166,000 billion, fulfilling nearly 98% of the set plan; pre-tax profit reached VND 1,666 billion, exceeding the previous plan of VND 1,439 billion.

Most notably, by the end of the third quarter of 2020, MSB had settled all bad debts sold to VAMC. Previously, in June 2020, the bank still recorded nearly VND 1,185 billion in face value of special bonds issued by VAMC. Thus, within just 3 months, the bank successfully cleared its debt at VAMC.

According to the financial report, in 2016, MSB recorded nearly VND8,874 billion in special bonds issued by VAMC. Then, as of December 31, 2017, MSB's bad debt sold to VAMC increased to VND9,319 billion.

By 2018, the value of special bonds issued by VAMC decreased sharply from VND 6,000 billion to nearly VND 3,314 billion and was reduced to VND 1,533 billion at the end of 2019.

December 23, 2020 marked the event when 1.175 billion shares of Vietnam Maritime Commercial Joint Stock Bank with stock code MSB were officially listed on the Ho Chi Minh City Stock Exchange.

To date, after more than 3 years of listing shares on the Ho Chi Minh City Stock Exchange, MSB has reached a charter capital of more than 1 billion USD. The increase in charter capital in 2024 will continue to create momentum to improve the bank's competitive position in terms of scale, support capital buffers, maintain a high capital safety ratio (CAR) and contribute to promoting credit flow.

Strategic Partner

In 2007, ROX Group (formerly known as TNG Holdings Vietnam) expanded its field to financial investment, becoming a partner of Maritime Bank (MSB). By 2020, the Group had developed and managed more than 100 companies, 11 industrial parks, 5 urban complexes, 4 residential areas, 6 commercial centers, and 6 office buildings.

Introduction on ROX Group website.

In the financial report of a company in the ROX Group ecosystem, ROX Key Holdings JSC (formerly TNS Holdings), the first member of ROX Group to be listed on the stock exchange with the code TN1, it shows that at the end of the first quarter of 2024, this company had a short-term financial investment in MSB shares with an original price of more than 518 billion VND, the fair value of more than 707 billion VND.

In addition, in 2020, ROX Cons Vietnam Construction Investment Joint Stock Company (formerly TNCons Vietnam Construction Investment Joint Stock Company) also announced a financial report recording nearly VND 490 billion in capital investment in MSB.

Before MSB went public, in 2018, the company bought 29 million MSB shares and in 2020, the company bought and sold 23.9 million MSB shares.

MSB has published documents of the General Meeting of Shareholders on the Resolution/Decision of the Board of Directors in 2019, which shows that this bank once provided a guarantee for Saigon Garment - Match JSC, and many times provided credit to Nha Trang Bay Construction Investment JSC.

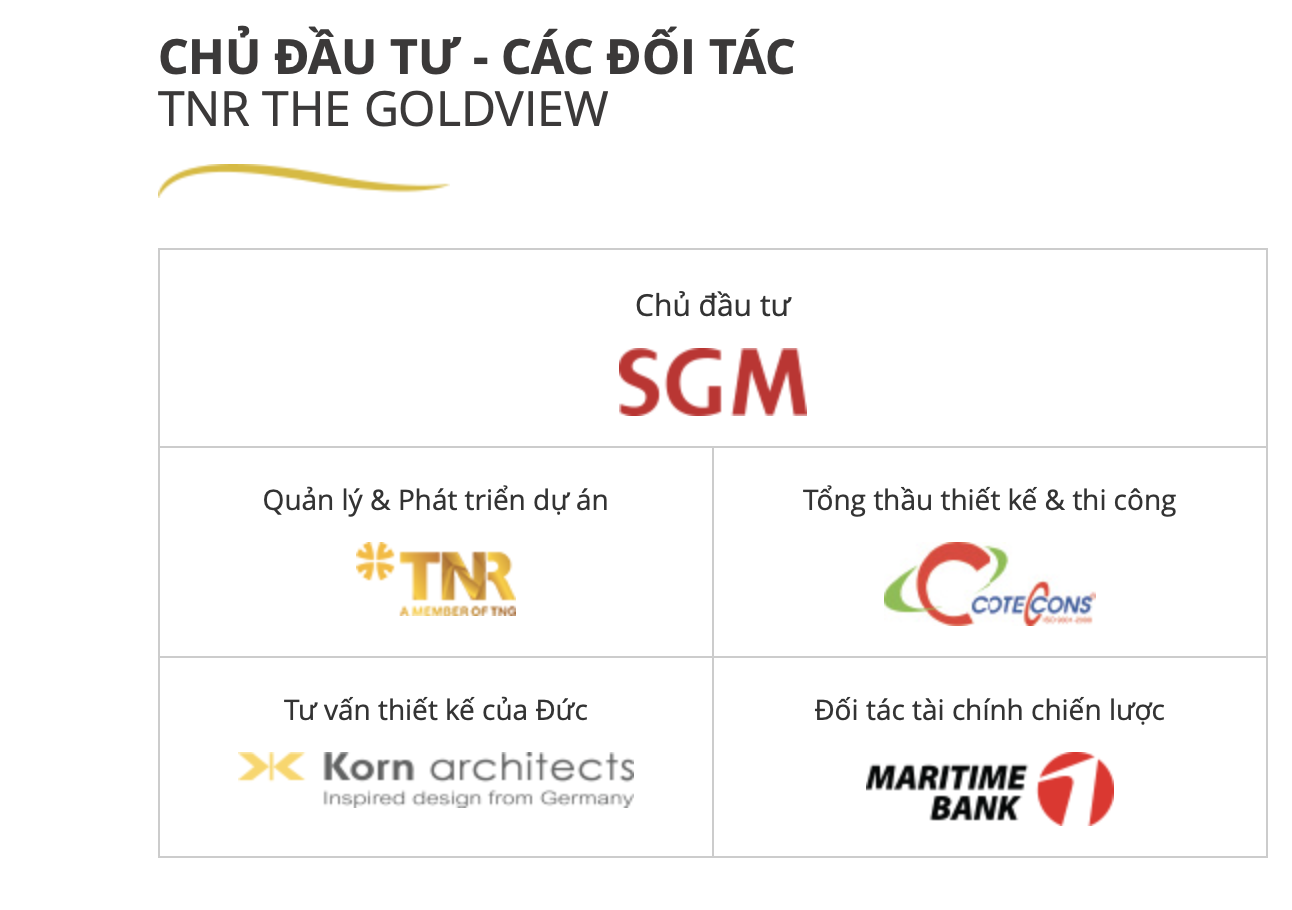

May - Diem Sai Gon is known as the investor of The GoldView project with a total land area of 23,061m2, located at 346 Ben Van Don, Ho Chi Minh City. The GoldView project has a total investment of more than 3,600 billion VND, and was completed in December 2017.

The project website shows that the project management and development unit is TNR Holdings Vietnam (currently ROX Living). At the same time, the familiar strategic financial partner is MSB, which was then called Maritime Bank.

Information on The GoldView project website.

Nha Trang Bay Investment and Construction Joint Stock Company is the investor of Phuoc Huu solar power plant project. This is also a typical project of TNPower Energy Joint Stock Company, a private enterprise operating in the field of investment, development and operation of power plants under ROX Group .

The project is designed to include a direct grid-connected photovoltaic solar power plant with an installed capacity of 50MW and connected to the national power system via a 110kV voltage level. The project uses photovoltaic cell technology, a central inverter with an installed capacity of about 65MWp - 50MWac, with a total investment of nearly 1,200 billion VND.

In the most recent developments in MSB stock trading, ROX Living JSC - a legal entity of ROX Group, registered to sell nearly 58.8 million MSB shares with the purpose of restructuring the investment by negotiation method in the period from May 30 to June 28, 2024.

Before the transaction, ROX Living was holding nearly 76.8 million MSB shares, equivalent to 3.84%. If the transaction is successful, the company will reduce its ownership ratio to 18 million shares, equivalent to 0.9% of the bank's capital.

In MSB's 2023 governance report, in addition to ROX Living, organizations related to ROX Group such as ROX Key own 48.6 million MSB shares, equivalent to 2.4% of capital, TN Property Management owns 15.6 million MSB shares, equivalent to 0.8% of capital .

Source: https://www.nguoiduatin.vn/hon-mot-thap-ky-no-luc-tro-lai-top-dau-cua-msb-a669809.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)