Domestic gold price today April 12, 2025

At the time of survey at 4:30 a.m. on April 12, 2025, the domestic gold price increased sharply, exceeding 105 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 102.2-105.2 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both buying and selling compared to yesterday. For the whole week, the gold price increased by 3.4 million VND in buying price and 3.9 million VND in selling price.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 102.2-105.2 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 102.5-104.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1.8 million VND/tael for both buying and selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by the enterprise at 102.2-105.2 million VND/tael (buying - selling), an increase of 1.6 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 102-105.2 million VND/tael (buy - sell), gold price increased by 2 million VND/tael in buying direction - increased by 1.6 million VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 100.2-103.8 million VND/tael (buy - sell); unchanged in the buying direction - increased 600 thousand VND/tael in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 100.9-104.5 million VND/tael (buy - sell); increased 200 thousand VND/tael for buying - increased 800 thousand VND/tael for selling.

The latest gold price list today, April 12, 2025 is as follows:

| Gold price today | April 12, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 102.2 | 105.2 | +1600 | +1600 |

| DOJI Group | 102.2 | 105.2 | +1600 | +1600 |

| Red Eyelashes | 102.5 | 104.5 | +1800 | +1800 |

| PNJ | 102.2 | 105.2 | +1600 | +1600 |

| Vietinbank Gold | 105.2 | +1600 | ||

| Bao Tin Minh Chau | 102.2 | 105.2 | +1600 | +1600 |

| Phu Quy | 102 | 105.2 | +2000 | +1600 |

| 1. DOJI - Updated: April 12, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 102,200 ▲1600K | 105,200 ▲1600K |

| AVPL/SJC HCM | 102,200 ▲1600K | 105,200 ▲1600K |

| AVPL/SJC DN | 102,200 ▲1600K | 105,200 ▲1600K |

| Raw material 9999 - HN | 100,000 | 102,900 ▲600K |

| Raw material 999 - HN | 99,090 | 102,800 ▲600K |

| 2. PNJ - Updated: April 12, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| HCMC - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Hanoi - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Hanoi - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Da Nang - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Da Nang - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Western Region - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Western Region - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Jewelry gold price - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Jewelry gold price - Southeast | PNJ | 100,800 ▲900K |

| Jewelry gold price - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 100,800 ▲900K |

| Jewelry gold price - Kim Bao Gold 999.9 | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - Jewelry gold 999.9 | 100,800 ▲900K | 103,300 ▲900K |

| Jewelry gold price - Jewelry gold 999 | 100,700 ▲900K | 103,200 ▲900K |

| Jewelry gold price - Jewelry gold 9920 | 100,070 ▲890K | 102,570 ▲890K |

| Jewelry gold price - Jewelry gold 99 | 99,870 ▲890K | 102,370 ▲890K |

| Jewelry gold price - 750 gold (18K) | 75,130 ▲680K | 77,630 ▲680K |

| Jewelry gold price - 585 gold (14K) | 58,080 ▲530K | 60,580 ▲530K |

| Jewelry gold price - 416 gold (10K) | 40,620 ▲370K | 43,120 ▲370K |

| Jewelry gold price - 916 gold (22K) | 92,220 ▲820K | 94,720 ▲820K |

| Jewelry gold price - 610 gold (14.6K) | 60,660 ▲550K | 63,160 ▲550K |

| Jewelry gold price - 650 gold (15.6K) | 64,800 ▲590K | 67,300 ▲590K |

| Jewelry gold price - 680 gold (16.3K) | 67,890 ▲610K | 70,390 ▲610K |

| Jewelry gold price - 375 gold (9K) | 36,390 ▲340K | 38,890 ▲340K |

| Jewelry gold price - 333 gold (8K) | 31,740 ▲300K | 34,240 ▲300K |

| 3. SJC - Updated: 12/4/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 102,200 ▲1600K | 105,200 ▲1600K |

| SJC gold 5 chi | 102,200 ▲1600K | 105,220 ▲1600K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 102,200 ▲1600K | 105,230 ▲1600K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 101,100 ▲1300K | 104,400 ▲1600K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 101,100 ▲1300K | 104,500 ▲1600K |

| Jewelry 99.99% | 101,100 ▲1300K | 103,900 ▲1400K |

| Jewelry 99% | 99,071 ▲586K | 102,871 ▲1368K |

| Jewelry 68% | 67,009 ▲152K | 70,809 ▲952K |

| Jewelry 41.7% | 39,680 ▼216K | 43,480 ▲583K |

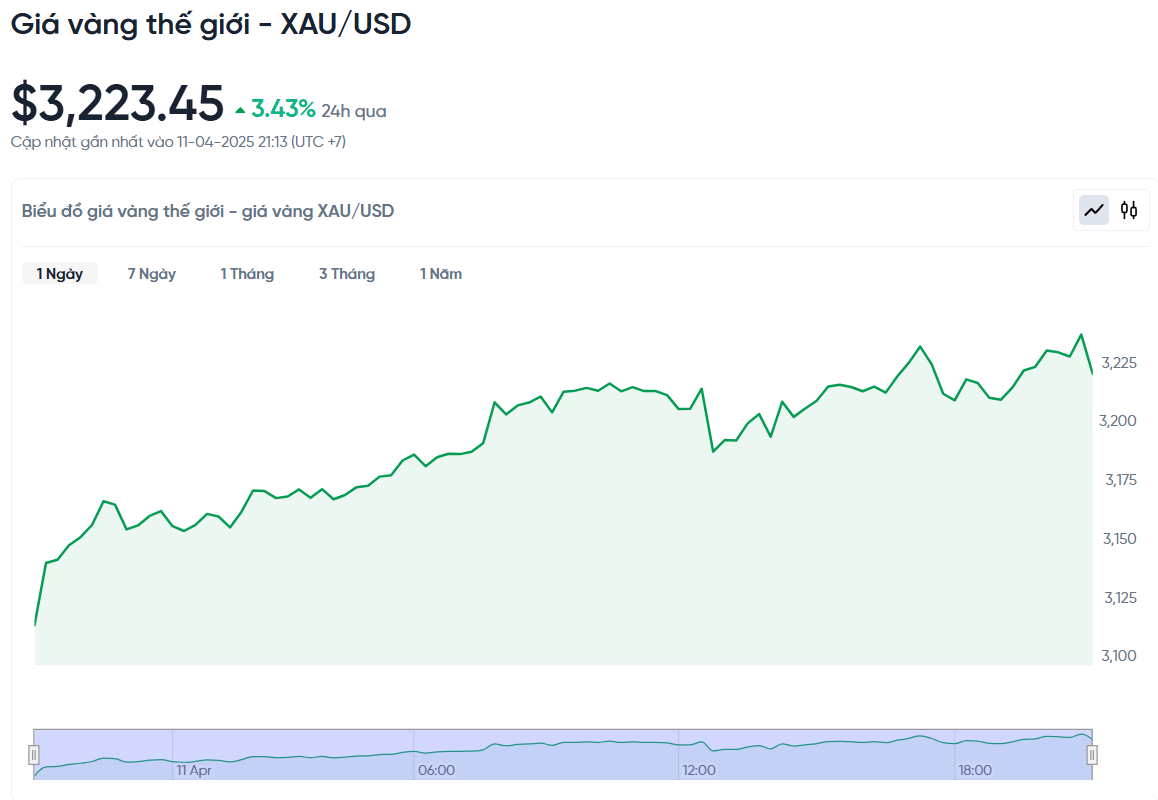

World gold price today April 12, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,223.45 USD/ounce. Today's gold price increased by 111 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (25,920 VND/USD), the world gold price is about 101.78 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.42 million VND/tael higher than the international gold price.

The world gold price has skyrocketed, surpassing the threshold of 3,200 USD, reaching a new record due to the weakening USD and escalating US-China trade tensions, causing many investors to rush to gold as a safe haven. The gold price yesterday reached a peak of 3,237.56 USD/ounce. Meanwhile, the price of gold for delivery in the US also increased by 1.8% to 3,234.9 USD.

Gold prices remain high despite recent economic data showing a sharp decline in US inflation, suggesting investors are now prioritizing safe-haven assets over short-term price action.

The US Department of Labor said the producer price index (PPI) fell 0.4% in March, compared to a previous forecast of a 0.2% increase. Compared to the same period last year, the PPI increased by only 2.7%, much lower than the expected 3.3%. This is a signal that inflationary pressure from the producer side is significantly easing.

The core PPI, which excludes food and energy, also fell 0.1% in March, matching the previous month's decline. Over the 12 months, the index rose 3.3%, below the 3.6% forecast. The main reason for the slowdown was a sharp drop in energy prices.

WisdomTree expert Nitesh Shah commented: "Gold is currently the most popular safe-haven asset amid the destabilizing trade war initiated by Mr. Trump. The USD has fallen in value, US bonds have been sold off heavily due to declining confidence in the US economy."

Gold prices may correct slightly in the short term, but the uptrend will continue thanks to the downward pressure on the US dollar and room for the Fed to ease monetary policy, according to metals trader Tai Wong.

In addition, factors such as central bank buying, expectations of the US Federal Reserve (Fed) cutting interest rates, geopolitical instability and cash flows into gold ETFs also contributed to the sharp increase in gold prices this year.

The latest data showed that US producer prices unexpectedly fell 0.4% in March, but tariffs could cause inflation to rise in the coming months. The market is betting that the Fed will cut interest rates in June and could cut them by a total of 90 basis points by the end of 2025.

Along with gold, silver prices also rose 1.4% to $31.64 an ounce, while platinum edged up 0.4% to $941.90. Palladium rose 1.3% to $919.25.

Gold Price Forecast

The world's leading financial institutions have made various forecasts for gold prices in 2025 and 2026. The difference in forecasts shows the uncertainty of global financial markets, especially in the context of inflation, monetary policy and geopolitical tensions.

Two major banks, UBS and Commerzbank, have revised up their gold price forecasts, joining many other financial institutions as investors flock to the precious metal as a safe haven, largely due to economic uncertainty caused by US President Donald Trump’s trade policies.

UBS predicts that gold prices could hit $3,500 in 2025, but fall back to $3,000 by the end of the year. They did not give a forecast for 2026. Commerzbank has a gold price forecast of $3,000 an ounce for 2025, which is relatively conservative compared to some other organizations.

Another important factor driving gold prices is strong central bank buying. China, the world's largest gold consumer, reported a slight increase in its gold reserves to 73.7 million ounces at the end of March, marking the fifth consecutive month of increased central bank purchases.

Bank of America (BofA) expects gold prices to reach $3,063 in 2025 and rise to $3,350 in 2026. Goldman Sachs has set quite high expectations with a forecast of $3,300 for 2025. However, they did not give a forecast for 2026 or a specific target.

Deutsche Bank has a more positive view, saying that gold prices will reach $3,139 in 2025 and increase sharply to $3,700 in 2026. The bank also targets gold reaching $3,350 by the end of 2025.

In contrast, Morgan Stanley forecasts gold prices to be lower than average, at $2,763 in 2025 and fall sharply to $2,450 in 2026. HSBC forecasts gold prices to reach $3,015 in 2025, then fall slightly to $2,915 in 2026. In the long term, they expect gold prices to fall to $2,750 in 2027 and $2,350 in the longer term.

Citi Research forecasts $2,900 for 2025 and $2,800 for 2026. In the short term, they believe gold could reach $3,200 in 0–3 months and $3,000 in 6–12 months. Longer term, Citi expects gold to reach $3,500 by the end of 2025.

Overall, most institutions are optimistic about gold prices in 2025, with many forecasts hovering around the $3,000/ounce mark and many believing that $3,500 is entirely achievable if global risks continue to increase.

Source: https://baonghean.vn/gia-vang-hom-nay-12-4-2025-gia-vang-trong-nuoc-va-the-gioi-co-muc-gia-tang-cao-ky-luc-10294941.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

Comment (0)