According to information released by the Hanoi Stock Exchange (HNX), from now until the end of 2023, about 116.5 trillion VND of bond debt will mature.

It is estimated that the pressure to repay bonds will be concentrated in September with a maturity value of up to VND32.6 trillion, followed by December with pressure of about VND24.4 trillion.

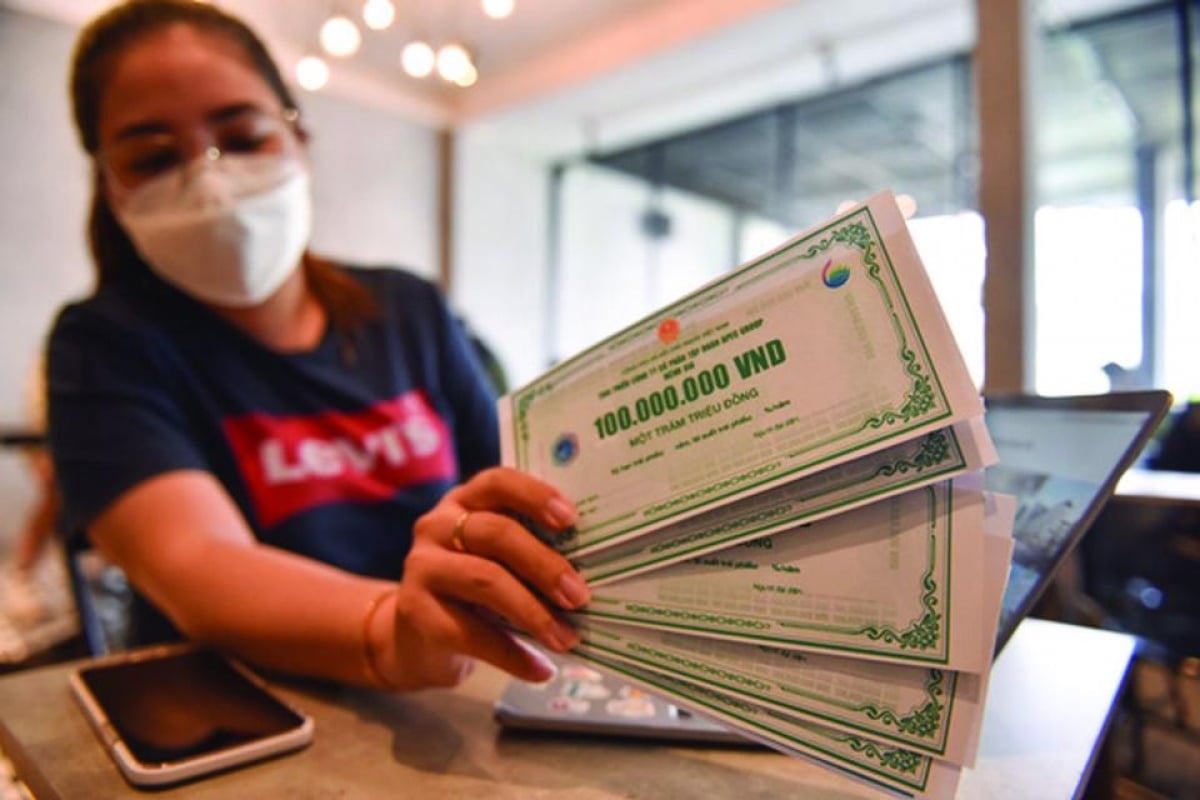

19,000 billion VND of bond debt matures in July, pressure to repay corporate bonds is strongest in September (Photo TL)

In July, the total amount of bonds due is expected to be around VND19.4 trillion. Of these, the most notable are the VND3.75 trillion bond lot of Setra; the VND3.45 trillion bond lot of Quang Thuan Investment JSC. These are two companies in the group of enterprises related to Van Thinh Phat. The bonds of these two enterprises were issued in 2020 and are expected to mature at the end of July this year.

The corporate bond market will also see many changes in July. According to Deputy Minister of Finance Nguyen Duc Tri, a corporate bond trading floor will be launched this July to increase liquidity in the bond market.

The information was released at the regular press conference of the second quarter of 2023 held by the Ministry of Finance on June 16, 2023. In addition, Deputy Minister of Finance Nguyen Duc Chi also affirmed that the difficulties of enterprises issuing bonds come from the internal nature of some enterprises, and also stem from the economic situation and production and business situation of the business community in general. Therefore, to overcome the difficulties, it is necessary to have synchronous solutions to stabilize the macro economy, stabilize production and promote economic growth.

Source

Comment (0)