Gold price today, September 5, 2024, in the world market is stable, domestic market is still unchanged. JP Morgan believes that the world gold price could increase to about 2,600 USD/ounce, equivalent to an increase of nearly 10% compared to the current price.

LIVE UPDATE OF GOLD PRICE TODAY 9/5 and EXCHANGE RATE TODAY 9/5

| 1. SJC - Updated: 09/04/2024 08:10 - Website time of supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 79,000 | 81,000 |

| SJC 5c | 79,000 | 81,020 |

| SJC 2c, 1c, 5 phan | 79,000 | 81,030 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 77,200 ▼100K | 78,500 ▼100K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 77,200 ▼100K | 78,600 ▼100K |

| Jewelry 99.99% | 77,100 ▼150K | 78,100 ▼100K |

| Jewelry 99% | 75,327 ▼99K | 77,327 ▼99K |

| Jewelry 68% | 50,763 ▼68K | 53,263 ▼68K |

| Jewelry 41.7% | 30,221 ▼42K | 32,721 ▼42K |

Update gold price today 9/5/2024

World gold prices are stable as investors await the US monthly employment report - data that could affect the timing and extent of interest rate cuts by the US Federal Reserve (Fed) this year.

According to the World and Vietnam Newspaper at 7:00 p.m. on September 4, the world gold price on the Kitco exchange was at 2,488 - 2,489 USD/ounce, down slightly by 4.8 USD compared to the previous trading session.

Before the nonfarm payrolls report is released on September 6, the market will focus on the job openings data on September 4, as well as the ADP hiring activity data and the jobless claims report on September 5.

According to CME Group's FedWatch Tool, the market is pricing in a 41% chance of a 0.5 percentage point rate cut on September 18 and a 59% chance of a 0.25 percentage point cut.

Earlier, data released on September 3 showed that the US manufacturing sector contracted slightly in August, amid improved hiring activity.

Gold is considered a safe-haven asset during times of political and economic uncertainty, and tends to appreciate in a low-interest-rate environment. It has gained 21% so far this year, hitting an all-time high of $2,531.60 an ounce on August 20.

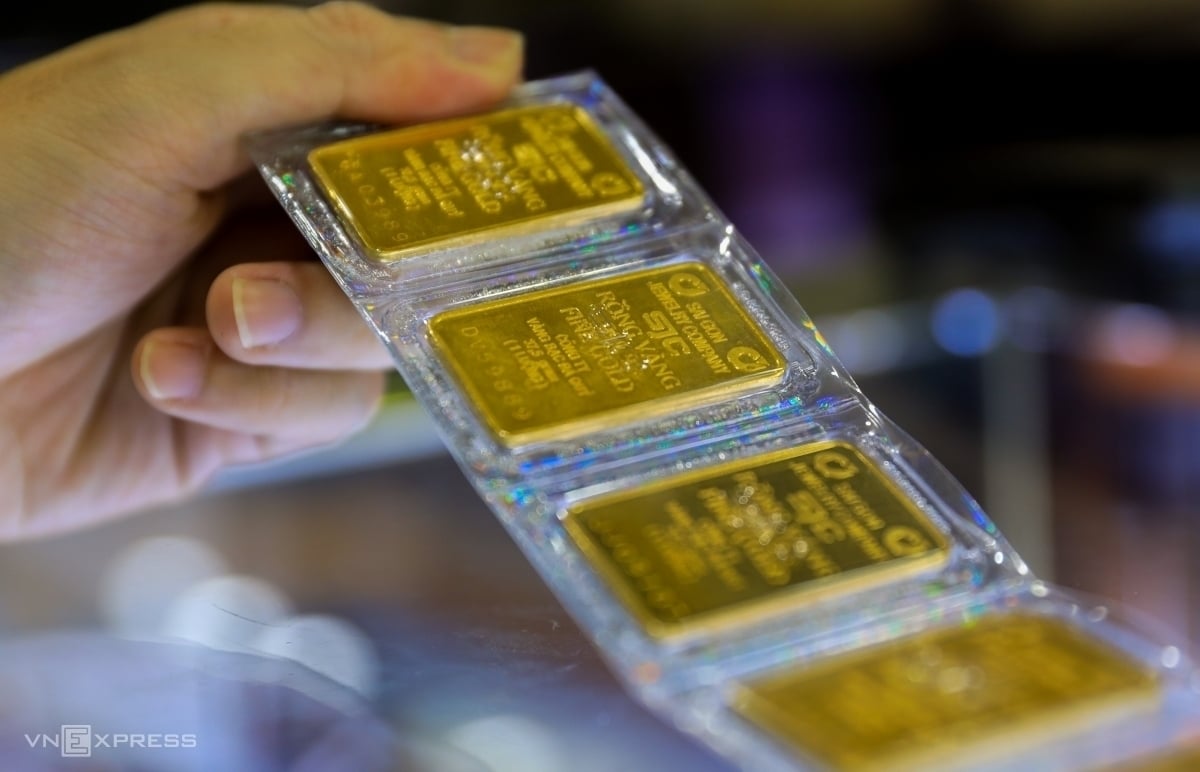

Domestic gold prices at 4 commercial banks (Vietcombank, Agribank, BIDV, Vietinbank) and SJC Company simultaneously sold SJC gold bars at 79 - 81 million VND/tael (buy - sell) - unchanged - recorded at the end of the session on September 4.

However, there is a difference in the buying direction. Specifically, while SJC, DOJI, Bao Tinh Minh Chau… all buy at 79 million VND/tael, Mi Hong Company buys up to 80 million VND/tael.

The price of gold rings produced by SJC, Phu Quy, DOJI... is 77.35 million VND/tael for buying and 78.55 million VND/tael for selling, down 50,000 VND/tael compared to the previous day.

|

| Gold price today September 5, 2024: World gold price is stable waiting for 'big wave', still increasing strongly, predicting the move of 'sharks'. (Source: Coinwweek) |

Summary of SJC gold bar and gold ring prices at major domestic trading brands at the closing time of the trading session on the afternoon of September 4 :

Saigon Jewelry Company: SJC gold bars 79.0 - 81.0 million VND/tael.

Doji Group: SJC gold bars 79.0 - 81.0 million VND/tael.

PNJ system: SJC gold bars 79.0 - 81.0 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars: 79.0 - 81.0 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 79.0 - 81.0 million VND/tael.

Gold prices will increase further

By the end of August 2024, the world gold price had increased by 104.15 USD/ounce compared to the same period in July 2024 (on August 1, the spot gold price was at 2,421 USD/ounce).

Factors contributing to the recent surge in gold prices include rising geopolitical risks and ongoing macroeconomic uncertainty that have fueled demand for gold as a safe-haven asset.

In addition, the continuous and massive demand for gold from Central Banks has added to the reserves; strong investment from the market.

Capital Economics said that the gold price increase is unlikely to stop due to the context of increasing global tensions, economic uncertainty and continued efforts to move away from the US dollar, active central bank gold buying, and strong physical gold demand in China and India.

Previously, the People's Bank of China (PBoC) had 18 consecutive months of net gold purchases at low prices. This is considered an important factor pushing the price of this metal up rapidly since the end of 2023.

According to Capital Economics, China’s demand for gold will continue to increase in the coming time as the economy slows down this decade. This will put upward pressure on gold prices and could be the source of greater volatility in the gold market in the coming years.

JP Morgan believes that the world gold price could increase to about 2,600 USD/ounce, equivalent to an increase of nearly 10% compared to the current price.

UOB experts also believe that gold prices will rise further due to geopolitical uncertainty, demand from central banks and expectations of interest rate cuts. The precious metal is forecast to reach $2,700 by mid-2025 and could rise further in the long term to $3,000/ounce.

Source: https://baoquocte.vn/gia-vang-hom-nay-592024-gia-vang-the-gioi-on-dinh-cho-song-lon-con-tang-manh-hon-nua-du-doan-dong-thai-cua-ca-map-284951.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)