Gold price today July 14, 2024, gold price increased sharply, marking an impressively strong week, investors are optimistic about the all-time high in the very near future. Gold ring price suddenly increased, surpassing SJC gold ring price for the first time.

LIVE UPDATE TABLE OF GOLD PRICE TODAY 7/14 and EXCHANGE RATE TODAY 7/14

| 1. SJC - Updated: 07/12/2024 08:52 - Website time of supply source - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 75,480 | 76,980 |

| SJC 5c | 75,480 | 77,000 |

| SJC 2c, 1c, 5 phan | 75,480 | 77,010 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 75,150 | 76,650 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 75,150 | 76,750 |

| Jewelry 99.99% | 75,050 | 76,050 |

| Jewelry 99% | 73,297 | 75,297 |

| Jewelry 68% | 49,369 | 51,869 |

| Jewelry 41.7% | 29,366 | 31,866 |

Update gold price today 7/14/2024

Domestic gold prices fluctuated last week.

On the morning of July 8, the price of SJC gold bars continued to maintain the level of 76.98 million VND/tael in the selling direction, remaining stable compared to the previous session's closing price. Specifically, Saigon Jewelry Company (SJC) also listed the price of SJC gold at 74.98 - 76.98 million VND/tael (buy - sell), unchanged compared to the closing price on the afternoon of July 7.

Throughout this week, the selling price of SJC gold bars maintained a sideways trend, at 76.98 million VND/tael, however, there were significant fluctuations in the buying direction.

Accordingly, as of the afternoon session of July 13, the price of SJC gold bars of SJC Gold and Gemstone Group was listed at 75.48 - 76.98 million VND/tael (buy - sell), an increase of nearly 1 million VND/tael in the buying direction.

While the selling price of gold bars remained unchanged all week and continued to remain below the 77 million VND/tael mark, the price of gold rings increased sharply, surpassing 77 million VND/tael, surpassing the price of SJC gold bars for the first time.

Specifically, in the morning session of July 12, DOJI Gold and Gemstone Group listed the price of gold rings at 76.15 - 77.4 million VND/tael (buy - sell), an increase of 550 thousand VND/tael for buying and an increase of 600 thousand VND/tael for selling compared to the previous session. However, by the session of July 13, the price of gold rings fell below the 77 million VND/tael mark for selling.

According to The Gioi & Viet Nam Newspaper , at 5:03 p.m. on July 13 (Vietnam time), the world gold price at goldprice.org was at 2,411.67 USD/ounce, down 3.89 USD/ounce compared to the previous trading session.

|

| Gold price today July 14, 2024: Gold price skyrockets, all-time high is very close; gold rings accelerate, leaving SJC behind for the first time. (Source: Kitco News) |

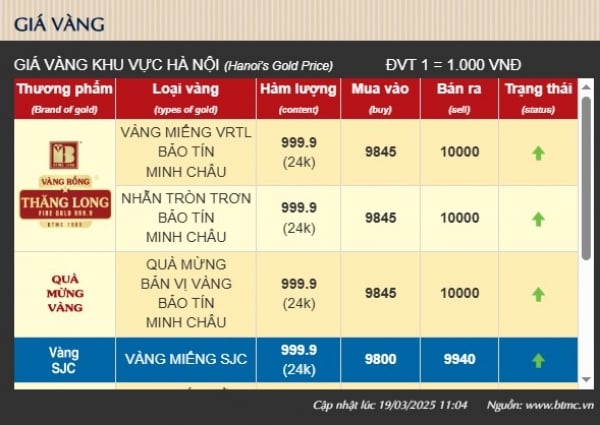

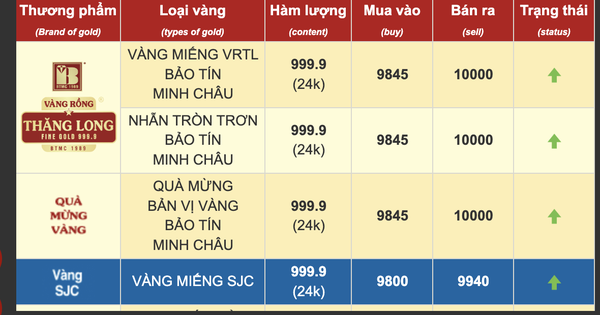

Summary of SJC gold prices at major domestic trading brands at the closing time of July 13:

Saigon Jewelry Company listed at 75.48 - 76.98 million VND/tael.

Doji Group is currently listed at: 74.98 - 76.98 million VND/tael.

PNJ system listed at: 75.48 - 76.98 million VND/tael.

Phu Quy Gold and Silver Group listed at 75.80 - 76.98 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 75.88 - 76.98 million VND/tael; Rong Thang Long gold brand is traded at 75.68 - 76.98 million VND/tael; jewelry gold price is traded at 74.80 - 76.70 million VND/tael.

Converted according to the USD price at Vietcombank on July 13, 1 USD = 25,460 VND, the world gold price is equivalent to 73.98 million VND/tael, 3.0 million VND/tael lower than the selling price of SJC gold.

World gold prices "anchored" above the important mark of 2,400 USD/ounce in the session of July 12 and recorded the third consecutive week of price increase, as investors believed that the US Federal Reserve (Fed) would soon lower interest rates.

Spot gold has gained nearly 1% so far this week, while U.S. gold futures fell 0.2% to $2,416.7 an ounce.

The uptrend largely dominated the gold market last week as positive US economic data reinforced speculation about a Fed rate cut.

Precious metals investors had another wild ride this week, as gold was hit by both positive and negative news, but on balance had a very strong week.

The latest Kitco News weekly gold survey shows that industry experts are nearly unanimous in their bullish outlook for gold next week, while retail sentiment is also firmly bullish.

Marc Chandler , CEO at Bannockburn Global Forex, said the bullish trend in gold continues.

“Gold rose for a third straight week, supported by lower US interest rates and a weaker US dollar. The precious metal rose to near $2,425 after a slight decline in CPI and increased speculation that the Fed could cut rates more than twice this year (~40% chance of a third cut),” he wrote.

“Up,” said James Stanley , senior market strategist at Forex.com . “In my opinion, this is still in the bulls’ hands and the fact that they have held support throughout Q2, even with a lot of bearish patterns going on, I think $2,500 an ounce is still very doable.”

Darin Newsom , senior market analyst at Barchart.com , the only doubter this week, said gold is headed lower. “From a technical standpoint, August could turn into a short-term downtrend on the weekly chart after reaching the target range of $2,411.10 to $2,440.10 this week,” he said.

Sean Lusk , co-director of commercial hedging at Walsh Trading, is looking at the week’s conflicting US data to determine the likely direction for gold and the economy.

“The dollar went a little higher and then everything came back down on weak consumer sentiment. So does one really offset the other here? I guess it could. I just feel like with everything going on in Washington and everywhere else, why would you want to short gold?” he noted.

He predicts gold could hit $2,485.

Thirteen Wall Street analysts participated in the Kitco News Gold Survey this week, and all but one of them are in agreement that the precious metal will move higher. Twelve, or 92%, expect gold prices to rise next week, while just one analyst, or 8%, predicts a decline. None see gold moving sideways next week.

Meanwhile, 178 votes were cast in Kitco’s online poll, with Main Street investors maintaining their bullish stance from last week. 119 retail traders, or 67%, predict gold prices will rise next week. Another 32%, or 18%, predict the precious metal will trade lower, while 27 respondents, or the remaining 15%, see prices trading sideways next week.

Next week, the market's focus will shift from the Fed to the European Central Bank, which will announce its interest rate decision on Thursday morning.

Alex Kuptsikevich , senior market analyst at FxPro, noted that gold's rise above $2,400 is a good sign for prices and he sees the potential for a new all-time high hundreds of dollars higher than the previous level.

“Gold is approaching a three-month high, which could be the end of a consolidation period after recovering from the October lows,” Kuptsikevich said. “From a technical perspective, a potential upside target for gold in the event of a breakout above resistance is $2,850,” he said.

Meanwhile, Adam Button , head of currency strategy at Forexlive.com, acknowledged that the two-day testimony from Fed Chairman Jerome Powell is crucial, but he expects gold to fall on news from China this week.

“China said it did not buy gold reserves for the second month in a row,” he said.

With China's central bank having been a major driver of gold price action over the past few years, Button was surprised to see the precious metal's decline so shallow and short-lived.

Analysts at CPM Group continue to see gold as a buy in the near term. “Gold is struggling to hold, supported by growing concerns and uncertainty about political conditions around the world. As the US election draws closer to home, gold prices are expected to rise,” they wrote.

If prices can hold above $2,400, this could set the stage for gold to set a new record high later this year, CPM said.

Gold prices could return to all-time highs

Hotter-than-expected producer prices are failing to cool the gold market, with gold ending the week above $2,400 an ounce for the second time, as analysts look for a new all-time high, says Neils Christensen in an analysis for Kitco News.

Gold is seeing fresh upside momentum following relatively dovish comments from Fed Chairman Jerome Powell, along with weaker-than-expected inflation. The core CPI, which excludes volatile food and energy prices, has risen 3.0% over the past 12 months. Annual inflation rose at its slowest pace since April 2021.

According to the CME FedWatch Tool, the market sees a more than 90% chance that the Fed will cut interest rates in September.

Naeem Aslam, chief investment strategist at Zaye Capital Markets, said that at this point, a September rate cut is a done deal. While next week will see some important economic reports, some market analysts do not expect any data to significantly change market expectations, which will continue to support gold’s renewed momentum.

Carsten Fritsch , Commodity Analyst at Commerzbank, is also expecting gold to hit an all-time high next week.

“The September rate cut is now almost fully priced in, and another cut later this year. As a result, gold prices could return to their all-time highs from May in the coming days,” he said in a note on Friday.

Source: https://baoquocte.vn/gia-vang-hom-nay-1472024-gia-vang-tang-vot-nguong-cao-nhat-moi-thoi-dai-dang-rat-gan-vang-nhan-but-toc-lan-dau-bo-sjc-lai-phia-sau-278585.html

Comment (0)