Domestic gold price today March 29, 2025

At the time of survey at 04:30 on March 29, 2025, domestic gold prices continued to increase, surpassing the 100 million VND/tael mark. Specifically:

The price of SJC gold bars was listed by Saigon Jewelry Company at 98.2-100.2 million VND/tael (buy - sell), an increase of 800 thousand VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC pieces listed by DOJI Group is at 98.2-100.2 million VND/tael (buy - sell), an increase of 800 thousand VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98.3-100.2 million VND/tael (buy - sell), an increase of 800 thousand VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 1.9 million VND/tael.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 98.4-100.2 million VND/tael (buy - sell); an increase of 1.2 million VND/tael for buying and an increase of 700 thousand VND/tael for selling. The difference between buying and selling is listed at 1.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.6-100.6 million VND/tael (buy - sell); increased by 1 million VND/tael for buying and increased by 900 thousand VND/tael for selling. The difference between buying and selling is 2 million VND/tael.

The latest gold price list today, March 28, 2025 is as follows:

| Today (March 28, 2025) | Yesterday (March 27, 2025) | |||

| Purchase price | Selling price | Purchase price | Selling price | |

| SJC | 98,200 ▲800 | 100,200 ▲1300 | 97,400 | 98,900 |

| DOJI HN | 98,200 ▲800 | 100,200 ▲1300 | 97,400 | 98,900 |

| DOJI SG | 98,200 ▲800 | 100,200 ▲1300 | 97,400 | 98,900 |

| BTMC SJC | 98,300 ▲800 | 100,200 ▲1300 | 97,500 | 98,900 |

| Phu Quy SJC | 98,300 ▲800 | 100,200 ▲1300 | 97,400 | 98,900 |

| PNJ HCMC | 98,200 ▲800 | 100,200 ▲800 | 97,400 | 99,400 |

| PNJ Hanoi | 98,200 ▲800 | 100,200 ▲800 | 97,400 | 99,400 |

| 1. DOJI - Updated: March 28, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 98,200 ▲800K | 100,200 ▲1300K |

| AVPL/SJC HCM | 98,200 ▲800K | 100,200 ▲1300K |

| AVPL/SJC DN | 98,200 ▲800K | 100,200 ▲1300K |

| Raw material 9999 - HN | 98,400 ▲1200K | 99,300 ▲700K |

| Raw material 999 - HN | 98,300 ▲1200K | 99,200 ▲700K |

| 2. PNJ - Updated: March 28, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| HCMC - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Hanoi - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| Hanoi - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Da Nang - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| Da Nang - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Western Region - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| Western Region - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Jewelry gold price - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| Jewelry gold price - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Jewelry gold price - Southeast | PNJ | 98,200 ▲800K |

| Jewelry gold price - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 98,200 ▲800K |

| Jewelry gold price - Jewelry gold 999.9 | 97,600 ▲800K | 100.100 ▲800K |

| Jewelry gold price - Jewelry gold 999 | 97,500 ▲800K | 100,000 ▲800K |

| Jewelry gold price - Jewelry gold 99 | 96,700 ▲790K | 99,200 ▲790K |

| Jewelry gold price - 916 gold (22K) | 89,290 ▲730K | 91,790 ▲730K |

| Jewelry gold price - 750 gold (18K) | 72,730 ▲600K | 75,230 ▲600K |

| Jewelry gold price - 680 gold (16.3K) | 65,720 ▲550K | 68,220 ▲550K |

| Jewelry gold price - 650 gold (15.6K) | 62,720 ▲520K | 65,220 ▲520K |

| Jewelry gold price - 610 gold (14.6K) | 58,710 ▲490K | 61,210 ▲490K |

| Jewelry gold price - 585 gold (14K) | 56,210 ▲470K | 58,710 ▲470K |

| Jewelry gold price - 416 gold (10K) | 39,290 ▲330K | 41,790 ▲330K |

| Jewelry gold price - 375 gold (9K) | 35,190 ▲300K | 37,690 ▲300K |

| Jewelry gold price - 333 gold (8K) | 30,680 ▲260K | 33,180 ▲260K |

| 3. SJC - Updated: 03/29/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 98,200 ▲800K | 100,200 ▲1300K |

| SJC gold 5 chi | 98,200 ▲800K | 100,220 ▲1300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 98,200 ▲800K | 100,230 ▲1300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,100 ▲900K | 100,100 ▲1400K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,100 ▲900K | 100,200 ▲1400K |

| Jewelry 99.99% | 98,100 ▲900K | 99,800 ▲1400K |

| Jewelry 99% | 95,812 ▲1387K | 98,812 ▲1387K |

| Jewelry 68% | 65,021 ▲953K | 68,021 ▲953K |

| Jewelry 41.7% | 38,771 ▲585K | 41,771 ▲585K |

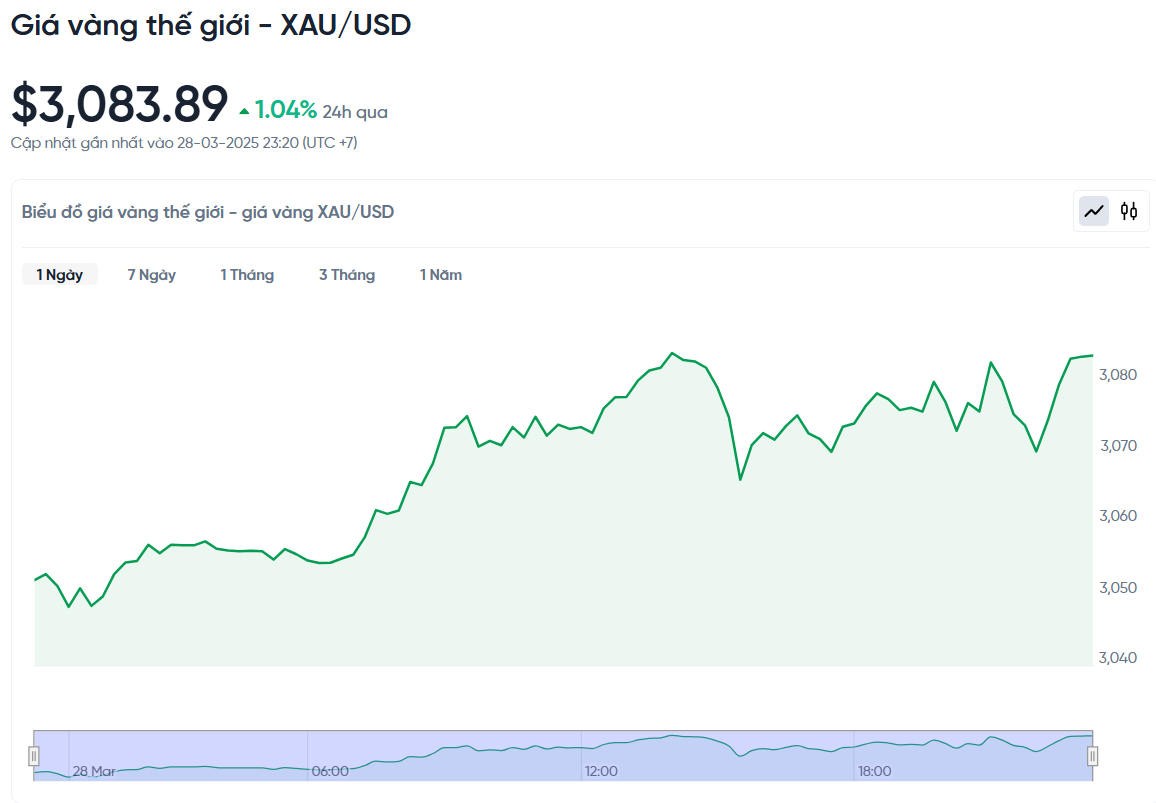

World gold price today March 28, 2025 and world gold price fluctuation chart in the past 24 hours

In the international market, the spot gold price was recorded at 3,083.89 USD/ounce, up 31.85 USD/ounce compared to the previous session. Converted at the current exchange rate, the world gold price is equivalent to about 97.57 million VND/tael (excluding taxes and fees), nearly 2.63 million VND/tael lower than domestic gold bars.

The price of gold has suddenly skyrocketed to an all-time high as investors flocked to gold as a safe haven asset. The main reason was the fear of a global trade war after the new tax move by US President Donald Trump.

For the week as a whole, world gold prices increased by 1.8% and are on track to increase for the fourth consecutive week. Meanwhile, US gold futures also increased by 0.7%, to 3,083.20 USD.

Gold has been supported by safe-haven demand amid concerns about tariffs, trade and geopolitical uncertainty, said Peter Grant, vice president and senior metals strategist at Zaner Metals. Gold is considered a hedge against economic or political uncertainty and tends to rise in low-interest-rate environments.

The US personal consumption expenditures (PCE) price index rose 0.4% in February, higher than analysts' forecast of 0.3% and the same as January's increase. However, Mr. Grant said that this data was not enough to significantly change expectations for the Federal Reserve to cut interest rates, as the increase was only slightly higher than expected.

The Fed left interest rates unchanged this year after three cuts through 2024, but has hinted at the possibility of another 0.5 percentage point cut in the near future. Markets now expect the Fed to start cutting rates in July, with a total reduction of about 63 basis points by the end of the year.

Investors are awaiting Mr Trump’s retaliatory tariffs plan, expected to be announced on April 2. Experts say the former US president’s policies could increase inflation, threaten economic growth and escalate trade tensions.

Besides gold, other precious metals also gained. Silver rose 0.3% to $34.52 an ounce, platinum fell 0.2% to $983.95, while palladium rose 0.6% to $981.51. All three posted gains this week.

Gold Price Forecast

Technically, gold has overheated, with the monthly RSI above 83, suggesting a short-term correction. However, key support levels at $3,000 and $2,950 should help sustain the upside momentum. If this trend holds, gold could head towards $3,336, or even $4,000 in the long term.

Meanwhile, tech stocks (Nasdaq) are weakening, causing many investors to turn to gold and precious metals mining stocks. This is seen as a good opportunity to invest in quality gold and silver mining companies, especially when many codes are still at attractive prices.

With gold prices continuing to rise sharply, many major banks on Wall Street have raised their forecasts for gold prices in the coming time. Bank of America (BofA) predicts that gold prices will increase from $3,000 to $3,500 per ounce in the next 18 months, thanks to increasing demand for gold. This demand mainly comes from China, central banks and ETFs that hold physical gold.

Similar to BofA, Macquarie Bank also believes that gold prices could reach $3,500 in the third quarter of this year. Notably, JPMorgan has made a bolder prediction, asking whether gold prices could quickly reach $4,000.

According to JPMorgan’s analysis, the recent increase in gold prices is unusually fast. The time it took for gold prices to increase from $2,500 to $3,000 per ounce was only 210 days, much faster than previous price increases (which usually took about 1,700 days). At this rate, the bank believes that a price of $4,000 is completely feasible in the near future.

Goldman Sachs also agreed when it recently continued to raise its gold price forecast to $3,300 by the end of this year, up from $3,100 given at the end of February.

The main reason, according to Goldman Sachs experts, is that central banks around the world have been actively buying gold reserves in large quantities and continuously for many years. This trend is expected to continue until at least 2025.

Goldman Sachs also noted that investors are increasingly interested in gold-backed ETFs to protect their assets during times of economic uncertainty. If this trend continues, as it did during the Covid-19 pandemic in 2020, gold prices could reach $3,680 per ounce by the end of the year.

Source: https://baoquangnam.vn/gia-vang-hom-nay-29-3-2025-gia-vang-trong-nuoc-va-the-gioi-tang-4-tuan-lien-tiep-3151684.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)