Gold price today, September 11, 2024, recorded a slight decrease in the world market due to the stronger USD, and gold rings increased. Experts noted that the market seems to accept that the Fed is likely to implement a 25 basis point cut.

| 1. SJC - Updated: 09/10/2024 09:20 - Website time of supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 78,500 | 80,500 |

| SJC 5c | 78,500 | 80,520 |

| SJC 2c, 1c, 5 phan | 78,500 | 80,530 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 77,250 ▲100K | 78,500 ▲50K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 77,250 ▲100K | 78,600 ▲50K |

| Jewelry 99.99% | 77,150 ▲100K | 78,100 ▲50K |

| Jewelry 99% | 75,327 ▲50K | 77,327 ▲50K |

| Jewelry 68% | 50,763 ▲34K | 53,263 ▲34K |

| Jewelry 41.7% | 30,221 ▲21K | 32,721 ▲21K |

Update gold price today 9/11/2024

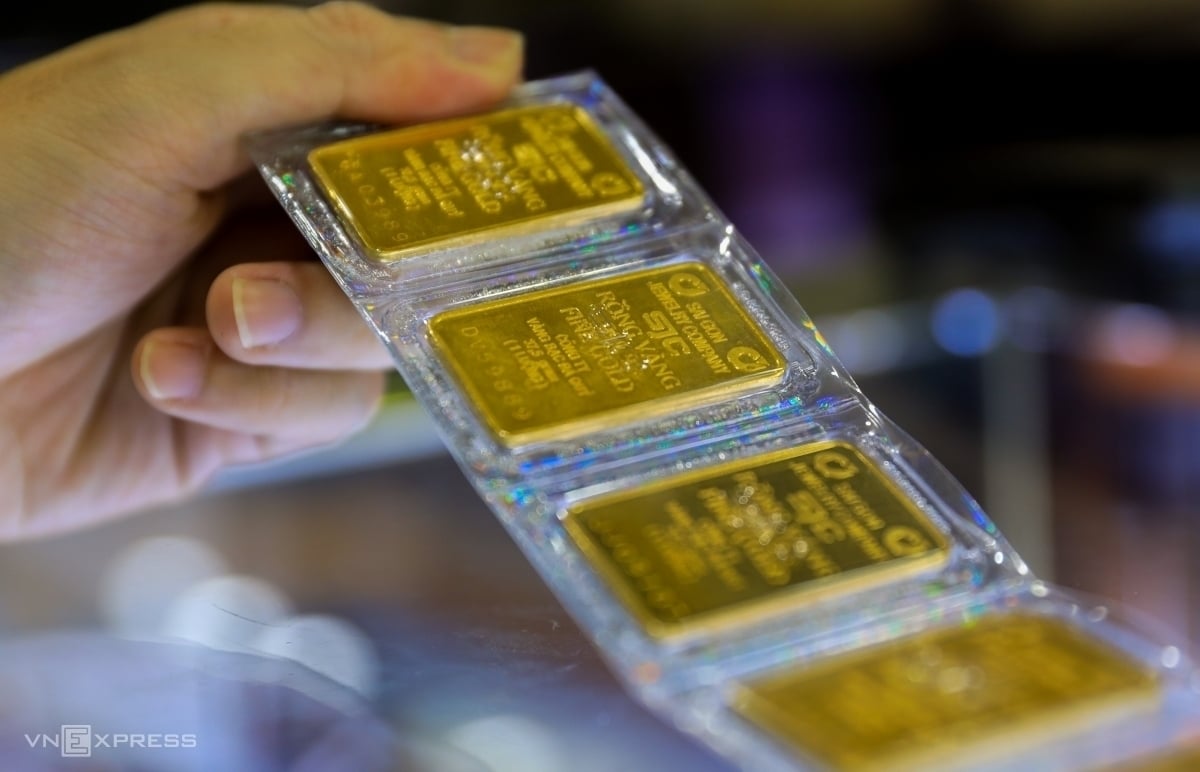

Domestic gold price at Saigon Jewelry Company (SJC) sold SJC gold bars at 78.5 - 80.5 million VND/tael (buy - sell) - recorded at the close of session on September 10.

Meanwhile, Saigon Jewelry Company - SJC increased the price of gold rings by 50,000 VND per tael, buying at 77.25 million VND/tael, selling at 78.6 million VND/tael. Phu Nhuan Jewelry Company (PNJ) also increased the price of gold rings by 50,000 VND, buying at 77.3 million VND/tael, selling at 78.45 million VND...

The difference between buying and selling price of gold rings is from 1.15 - 1.35 million VND/tael.

The selling price of gold rings is equal to the buying price of SJC gold bars. The buying price of SJC gold bars is 78.5 million VND, and the selling price is 80.5 million VND.

World gold prices fell slightly due to the stronger USD, while the market is waiting for important US inflation data to have more clues about the scale of the US Federal Reserve's interest rate cut next week.

According to the World and Vietnam Newspaper at 7:00 p.m. on September 10, the world gold price on the Kitco exchange was at 2,504.6 - 2,505.6 USD/ounce, down slightly by 2 USD compared to the previous session.

The US dollar hit a one-week high, making gold more expensive for buyers holding other currencies.

Market attention is now focused on the US Consumer Price Index (CPI) due on September 11 and the Producer Price Index (PPI) on September 12. The CPI is expected to rise 0.2% in August from the previous month, unchanged from July.

Lower interest rates reduce the opportunity cost of holding non-interest-bearing precious metals like gold. The Fed is almost certain to cut rates next week.

According to the CME FedWatch tool, traders are now pricing in a 73% chance the Fed will cut by 0.25% at next week's meeting and a 27% chance of a 0.5% cut.

Some experts predict the possibility of the Fed cutting interest rates by 0.25% and gold prices forecast the main support zone at $2,470/ounce and the main resistance level at $2,520/ounce.

|

| Gold price today September 11, 2024: Gold ring price has a new move, the market is waiting for Fed news, Vietnamese people are no longer interested in buying gold? (Source: Bloomberg) |

Summary of SJC gold bar prices at major domestic trading brands at the closing time of the trading session on the afternoon of September 9 :

Saigon Jewelry Company: SJC gold bars 78.5 - 80.5 million VND/tael.

Doji Group: SJC gold bars 78.5 - 80.5 million VND/tael.

PNJ system: SJC gold bars 78.5 - 80.5 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars: 78.5 - 80.5 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 78.5 - 80.5 million VND/tael.

Gold's main resistance level is $2,520/ounce.

Experts find that there is a close relationship between gold prices and interest rates.

The Fed's signal of lowering interest rates will lead to an increase in money supply for the economy, leading to an increase in inflation, thereby increasing the demand for gold to preserve value against inflation. This will push up the price of gold.

“If inflation figures come in much lower than expected and raise hopes for a 50 basis point cut, gold could hit an all-time high. But even if the consensus is still for a 25 basis point cut, gold will not see a big drop as the Fed is certain to cut rates,” said Carlo Alberto De Casa, a currency market analyst at Kinesis.

Peter A. Grant, vice president and senior metals strategist at Zaner Metals, expects gold prices to hit an all-time high. He said the precious metal will likely fluctuate somewhat within its established price range.

"The market seems to be accepting that the Fed is likely to deliver a 25 basis point cut. He forecasts that gold's main support zone is $2,470/ounce and the main resistance level is $2,520/ounce," he emphasized.

In the domestic market, the market has stabilized. However, according to Mr. Nguyen The Hung, Vice President of the Vietnam Gold Trading Association, a big reason why people are no longer enthusiastic about buying gold is because buying gold online has encountered many difficulties, making it impossible for many people to buy.

Meanwhile, in the market, stores are currently in shortage so they have stopped selling gold bars, even gold rings are only sold "dripping".

“Currently, many people are discouraged from buying gold online from banks. Not only is it difficult to do, but there is also a long wait and limited quantity per purchase,” he stressed.

Source: https://baoquocte.vn/gia-vang-hom-nay-1192024-gia-vang-nhan-co-buoc-di-moi-thi-truong-cho-tin-fed-nguoi-viet-het-hung-mua-vang-285703.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)