Price list of some popular electric vehicle (EV) models, October 2023. Source MakeUseOf

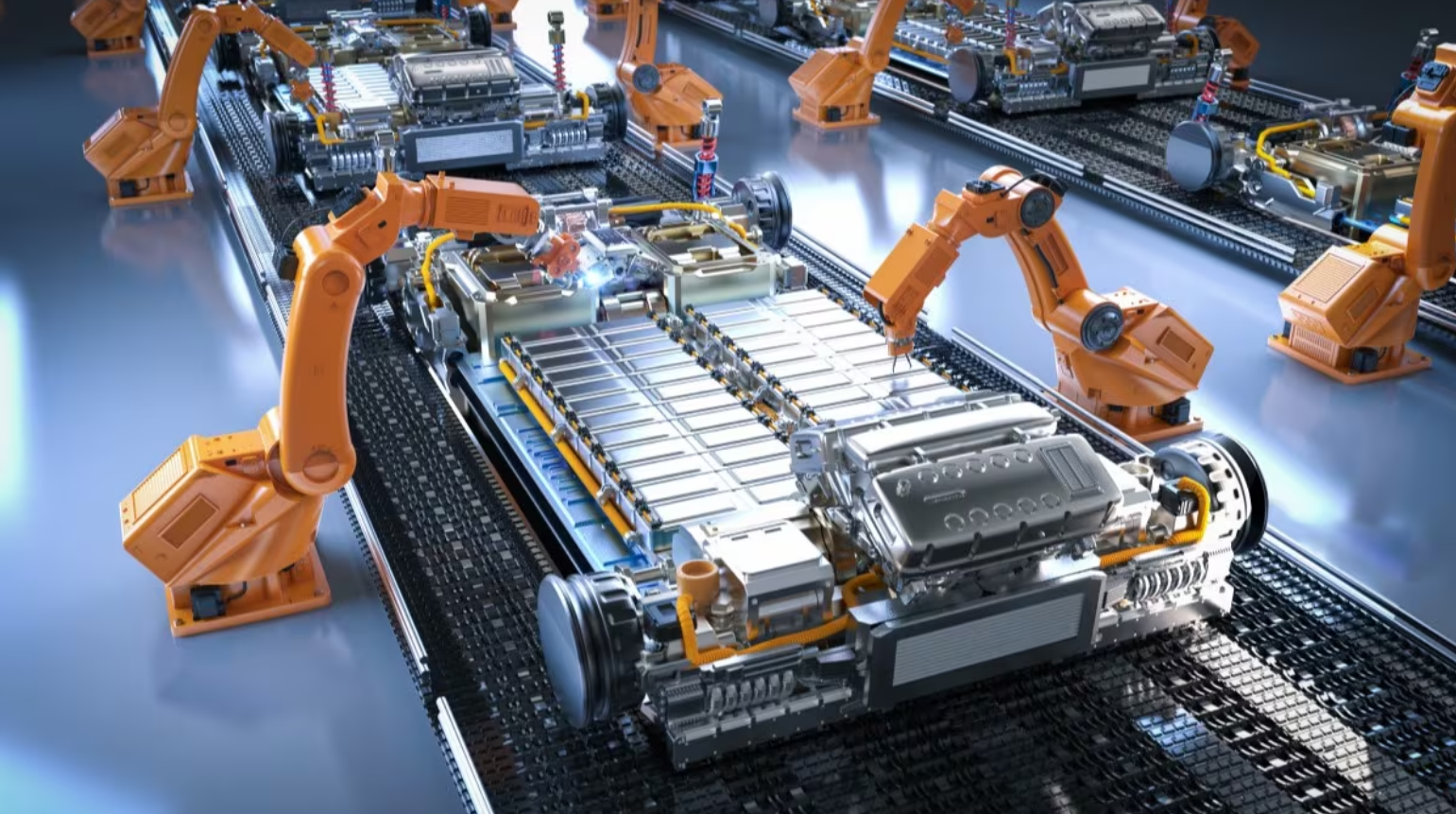

Accordingly, the global battery industry needs to invest at least $514 billion in the supply chain to meet projected demand in 2030, and $920 billion in 2035. Of the total investment in 2030, $220 billion (43%) will be for critical raw materials, $201 billion (39%) for battery manufacturing – in both new and expanded factories, and $93 billion for battery materials, including anodes, cathodes, electrolytes, etc.

Benchmark Minerals warns that without investment in midstream processes, the upcoming electric vehicle battery gigafactories “will not be able to operate at full capacity.” And when they do, lithium production will need to increase to 2.8 million tonnes, up from 1 million tonnes in 2023, requiring $51 billion in investment.

In the not-too-distant future of 2030, “the question is whether all these plants can be built on time given the huge demand,” said Dean, an analyst at Bloomberg Intelligence.

Additionally, Dean said, lithium prices remain volatile, “and we don’t know if there will be enough lithium supply to meet the demand that we see coming in 2024 or 2025, when all the automakers have a major goal of selling more electric vehicles globally.”

To address this, Dean believes there needs to be more vertical integration in the industry. “Some automakers are moving toward becoming more vertically integrated, so we could see more and more EV components being produced in-house,” the Bloomberg Intelligence analyst said.

With supply chains of key metals in turmoil, some automakers — which aim to sell more electric vehicles — are looking to expand their businesses into mining in hopes of securing long-term supplies of raw materials.

Electric vehicles are assembled on the production line at Leapmotor's factory in Jinhua, Zhejiang, China, April 26, 2023. Photo: China Daily

Early last year, General Motors (GM) announced that it had formed a joint venture with mining company Lithium Americas. With a $650 million investment, GM became the mining company’s largest customer and shareholder, giving it exclusive access to lithium from a mining site in Nevada, USA, called Thacker Pass.

American Battery Technology has been awarded a grant from the US Department of Energy (DoE) to help it build a lithium refinery and battery recycling facility, also in Nevada. The grant is part of the DoE’s program to create a domestic battery supply chain.

Charging station for BMW iX electric vehicle. Photo Getty Images

Ford – through a joint venture with South Korean battery company SK Innovation – will receive a $9.2 billion loan from the DoE, the largest in the history of the DoE’s Office of Loan Programs, to develop battery plants in Tennessee and Kentucky.

Stellantis has separate joint ventures with Samsung SDI and LG Energy Solution to build battery factories in the US and Canada, respectively. Others such as Tesla, BMW, Volkswagen (VW), Hyundai and Honda are also making similar investments in building battery manufacturing capacity.

Over the next few years, more partnerships will form – not just commercial partnerships but strategic partnerships, and across the electric vehicle battery supply chain.

An electric pickup truck equipped with Samsung SDI batteries. Photo: Korea Economic Daily

The future of the electric vehicle industry is vertical collaboration, “from the mine to the wheel.” This means that early efforts at long-term planning and relationship building will become increasingly important.

But the story of electric car batteries is no longer just about lithium. The world is also moving towards cheaper and more abundant sources of raw materials, such as sodium (an ingredient in table salt) and sulfur (sulfur or brimstone).

Startups in the US and Europe are racing to develop new batteries using these two materials by overcoming problems such as sodium batteries being unable to store enough energy to power a car, while sulfur battery cells tend to corrode quickly and do not last long.

Accordingly, future electric cars – appearing after 2025 – could switch to using Sodium-ion battery cells (SIBs) or Lithium-Sulfur (Li-S) which are up to two-thirds cheaper than current Lithium-ion (Li-Ion) batteries if their technical limitations are overcome.

The average price of an electric car fell nearly 20% in one year in 2023. Photo: Kelley Blue Book

Asian battery giants are also working on new chemistries. China’s CATL began mass production of its first generation of sodium-ion batteries last October. The first plant has a capacity of about 40 GWh per year.

China currently has 16 of the 20 sodium battery plants planned or under construction globally, according to Benchmark Minerals. CATL’s sodium-ion batteries, after being upgraded to increase energy density, will be used by Chery – China’s ninth-largest automaker and top auto exporter.

With Lithium-Sulfur batteries, South Korea's LG Energy Solution aims to start producing new batteries for electric vehicles from sulfur in 2025.

Source

![[Photo] Paris "enchanted" by the blooming flower season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/e967dc548ff74f9ca8e89d72c3608825)

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

Comment (0)