Waterpoint: Unique villas become sought-after asset investment channel

The Long An real estate market is becoming a bright spot in the southwest of Ho Chi Minh City, in which the riverside and canalside villa products in Nam Long's integrated urban area Waterpoint are considered a sustainable investment and asset channel, according to many experts and investors.

Safe haven channel thanks to its ability to hold price and generate profit

In a recent survey by the Vietnam Association of Realtors (VARS), up to 83% of respondents identified real estate as a tool to deal with inflation. In the current economic context, real estate not only brings in direct income but also maintains its value in the long term thanks to its ability to retain its value and future potential. This is also an important reason why real estate has become a safe investment channel, less affected by negative impacts and risks, if any, from the market.

At the end of the year, with the resonance of a series of signals from a clear legal corridor, rising market confidence, and a series of key traffic projects being promoted for implementation, the real estate market is developing positively in all segments. In addition to apartments that have maintained their appeal for a long time, low-rise segments such as villas and townhouses are also on the rise again.

A survey by CBRE Vietnam shows that the “hot spot” of this segment is Hanoi with a supply explosion of more than 3,500 units in the first 9 months of this year, the highest in the past 5 years. The average primary selling price in the quarter reached VND235 million/m2, up 16% quarter-on-quarter and nearly 27% year-on-year.

Experts predict that in the coming time, villa prices will continue to increase, even in the period of market prosperity (expected from the second quarter of 2025), this segment will become the most interested type in the market with good profitability.

In a recent sharing, Mr. Nguyen Xuan Quang - Chairman of Nam Long Group commented that Hanoi real estate has shown signs of strong recovery, in many different segments, apartments and small townhouses are also "heating up" in price. The spread will affect the South, creating growth momentum for the market.

In fact, the primary supply of villas and townhouses in Ho Chi Minh City in the third quarter of 2024 increased by 15% quarter-on-quarter, of which products priced over 30 billion accounted for an overwhelming proportion, at 63%.

As an experienced investor, Mr. Tran The Minh Son (District 2, Ho Chi Minh City) said that in the context of land prices in Ho Chi Minh City constantly increasing, the housing fund is becoming increasingly scarce due to many projects stuck in legal procedures, the opportunity to own real estate in the inner city is increasingly rare. It is inevitable that investors flock to satellite projects with "golden" locations adjacent to Ho Chi Minh City, both owning valuable assets and holding a safe asset accumulation channel with room for sustainable growth over time.

|

| Satellite urban real estate attracts market attention in the context of scarce inner-city land fund |

What are the criteria for choosing safe real estate assets?

Giving advice on property investment needs, experts all have the same opinion that, besides location, investors also need to pay attention to many other factors.

According to Mr. Phan Le Thanh Long, CEO of AFA Group, co-founder of the Vietnam Financial Advisors Community (VWA), the most important criterion to consider is the time of purchase. Many investors often rely on the macroeconomic situation and interest rate fluctuations to choose to buy real estate. However, the amount of money deposited in banks is still high because many people are still hesitant about which area to buy. This concern leads to the second factor when choosing to buy real estate - location.

“Investors should consider which areas have good enough prices and have the potential to develop infrastructure and living facilities, while still having room to develop projects,” Mr. Long shared.

The value of real estate increases over time, especially in areas with great growth potential such as inner-city districts and riverside areas with master planning and prioritizing investment in infrastructure development.

Typical of the trend and vision of investment shifting to satellite cities is the Waterpoint urban area developed by Nam Long and Nishi Nippon Railroad (Japan). The prime location at the southwestern gateway of Ho Chi Minh City, just over 30 minutes from the center of District 1 and the intersection of many key inter-regional infrastructure projects such as Ring Road 3, Ring Road 4, Ben Luc - Long Thanh Expressway... creates the first attraction for Waterpoint.

|

| The Park Village canalside villas and mansions in the Waterpoint urban area are the "target" of the upper class. |

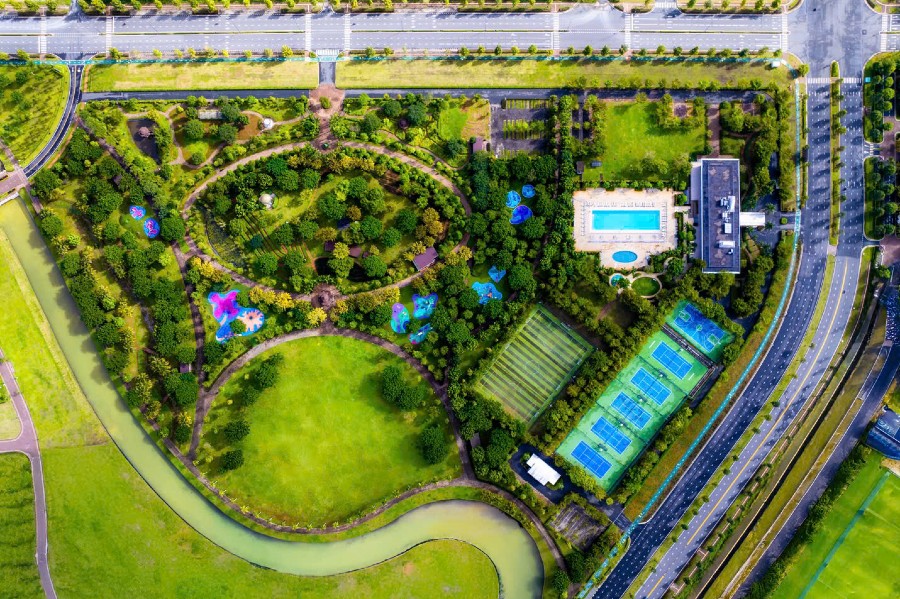

The next attraction of Waterpoint lies in the living environment in harmony with nature and the diverse, high-class utility system that is constantly being improved. From the 3-hectare sports complex; cycling path; jogging path; 8.6-hectare freshwater port bay... to riverside community clubs, restaurants, cafes or international bilingual schools, food supermarkets, polyclinics; clubhouses according to the standards of high-class resorts that have been put into operation in the subdivisions, Waterpoint fully meets the needs of living, studying, working, shopping, and entertainment.

|

| High-class utility complex in harmony with nature at Central Park subdivision, Waterpoint |

Finally, before “choosing a face to trust”, according to experts, buyers need to understand the investor clearly. Nam Long with 32 years of experience accompanying the development of Vietnamese urban areas and strategic cooperation with a partner from Japan for more than 100 years – Nishi Nippon Railroad is a guarantee for a safe and secure investment choice.

Golden location, intersection of the infrastructure area being invested, enjoying a complete utility system, harmonious living environment, villa products inside the Waterpoint urban area meet the criteria of a sustainable asset channel, with outstanding potential in the future.

Most recently, the investor officially launched the most expensive collection of villas and mansions in Waterpoint, attracting strong attention from investors. The products this time are the "rare and hard to find" riverside villas and mansions in The Aqua compound and the unique canalside villas and mansions in Park Village. Both are isolated, top-class villa areas in this metropolis with an area of up to 355 hectares. If The Aqua is adjacent to the 8.6ha freshwater port bay and adjacent to the Vam Co Dong River with contemporary Japanese architecture; then Park Village are canalside villas with elegant and luxurious European neoclassical architecture, located in the ecological heart of Waterpoint.

Customers who own The Aqua riverside villa will receive a Merry Fisher 895 yacht worth nearly 8 billion VND.

Detail:

Waterpoint Urban Area: https://waterpoint.com.vn

Compound Park Village: https://waterpoint.com.vn/parkvillage/

Comment (0)