Investment Comments

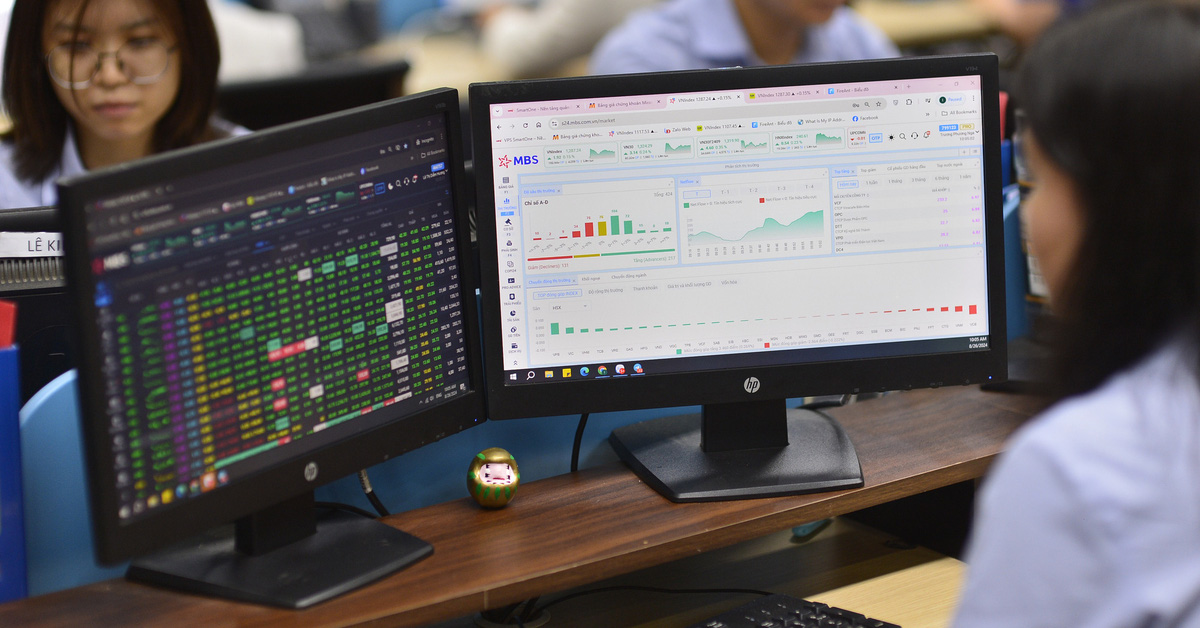

KB Vietnam Securities (KBSV) : Although the correction fluctuations may continue in the next few sessions, the uptrend of VN-Index is expected to be maintained with a notable support zone around 1,215 (+/-10) points.

Investors are recommended to spread orders in parts, increasing the trading weight of the current position when the index or target codes fall to support zones.

Beta Securities : In the next trading sessions, the short-term correction trend is gradually increasing, along with technical indicators showing not very positive signals. Moreover, this is the derivatives expiry trading week, so it is very likely that the market will experience strong fluctuations, leading to risks in the near future.

Investors need to carefully observe and monitor market developments, avoid using leverage and chasing stocks despite signs of overheating to limit risks in short-term trading.

Asean Securities (Aseansc) : In the short term, the market will remain gloomy, anchored above the 1,240-point neckline. Big fluctuations may appear after the derivative maturity period ends.

Momentum indicators such as RSI and MFI show a 3-segment divergence signal along with the pressure from previous dense distribution sessions, creating an unbalanced market structure for a sustainable uptrend. Therefore, Aseansc maintains the recommendation to continue observing and narrowing the portfolio at this time.

Stock news

- Japan ends negative interest rates. After 8 years of controversial application, the Bank of Japan (BOJ) today made a historic turn when it stopped its negative interest rate policy. On March 19, BOJ announced that it would raise short-term interest rates to 0-0.1%, instead of -0.1% as before. This is the first time in 17 years that the agency has raised interest rates, and also the first time since 2016 that they have ended their negative interest rate policy. However, the interest rate is still maintained around 0%, due to the fragile economic recovery. Japan is the last country in the world to abandon negative interest rates, ending the period of monetary easing to promote growth.

- ETF funds have been withdrawn by nearly 5,000 billion since the beginning of 2024. During the week from March 11 to March 15, 2024, the cash flow of ETF funds maintained a net withdrawal trend of more than 386 billion VND and this was the 5th consecutive week of net withdrawal, but the scale of net withdrawal decreased. This trend occurred in 9/20 ETF funds in both domestic and foreign ETFs.

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)