Wrong money transfer is difficult to get back

As a teacher, taking advantage of her free time to sell fresh food through social networks, Ms. Thu Ha (Quang Ninh) accidentally dialed a wrong number while paying a supplier, causing her to transfer 23 million VND to another account. "Frightened", Ms. Ha immediately called the bank's switchboard to ask for the account holder's number to get the money back. The bank said that the customer's phone number was confidential information, so they refused to provide it and would contact the recipient account and respond later. Feeling impatient, when someone else instructed her to "transfer an additional 1,000 VND to the recipient account with a message asking for the transferred amount back and leaving her phone number", Ms. Ha immediately did it. However, the recipient was still nowhere to be found.

Following the instructions of the bank staff, Ms. Ha reported to the police that she had mistakenly transferred money. After many days, Ms. Ha received information that the other account owner had not transacted for a long time, could not be contacted via the recipient's phone number, and the money was still in the account. Knowing that the account owner was in Ninh Thuan, Ms. Ha tiredly complained: "I came from Quang Ninh to Ninh Thuan to ask for help to get back 23 million VND. I don't know if I can get the money back, but I also have to pay for travel, accommodation, not to mention the thank you money. So I consider myself unlucky and accept losing that money."

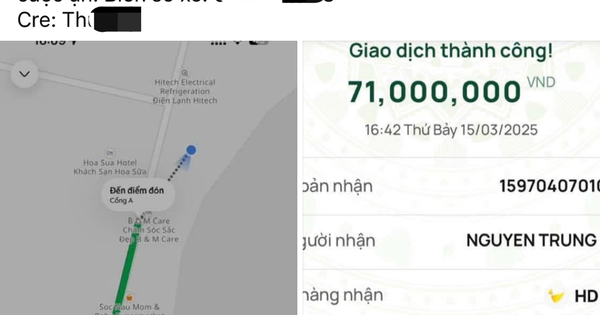

You should carefully check all information fields before clicking to transfer money via the app.

Ms. NTH (Son Tay, Hanoi) also felt upset when telling the story of transferring 5 million VND to the wrong account. The bank staff helped contact the recipient account, this person only answered the phone once and then hung up, not answering. The next times, I could not contact them. "If I wanted to get the money back, I had to report to the police to handle it, the amount was not large so I had to give up," Ms. H. said, still not over her annoyance.

Losing money by mistakenly transferring money like Ms. Ha and Ms. H. is not uncommon. Many people mistakenly transfer from a few million to a few tens of millions. If they are unlucky enough to encounter an account owner who refuses to pay, most people have the mentality of "letting it go" and not knowing whether they can get it back or not. The Head of Customer Service at a bank in Ho Chi Minh City said that every day they receive many complaints from account owners who mistakenly transferred from a few million to a few hundred million VND.

Usually, the sender asks the bank to provide information, phone number as well as freeze the recipient's money. However, current state regulations do not allow banks to arbitrarily freeze customers' accounts. Banks are only allowed to do so when requested by authorities or with the customer's consent. Furthermore, banks cannot determine whether it is a mistaken transfer or a transaction between two individuals to freeze the customer's account. Therefore, in these cases, even if the bank wants to, it cannot support but only advises the person who mistakenly transferred money to report to the police for further handling.

Failure to pay may result in criminal prosecution.

In fact, according to regulations, the recipient account holder must cooperate to return the mistakenly transferred money to his/her account. In case the recipient has used the mistakenly transferred money, he/she can negotiate with the sender about the time to return the money. If the prescribed time has passed and the recipient has not returned it, the bank will notify the customer to file a lawsuit according to the provisions of law. If the recipient does not cooperate to return and use the money, the sender has the right to complain according to regulations. The penalty for using mistakenly transferred money under 10 million VND is an administrative fine of 3-5 million VND, if the amount is greater than 10 million VND, the user can be prosecuted for the crime of "Illegal possession of property". In the past, there have been many cases where the recipient used the money of the mistakenly transferred person and had to go to jail.

However, in reality, through consulting some banks, the time to get the money back depends on whether the account owner agrees to return the money or not. Some people are lucky enough to meet a kind recipient and can get their money back in just a few hours, but others take months, or have to sue in court to get the transferred money back. A representative of Vietcombank said that in case a customer transfers money by mistake and the recipient agrees to return it, Vietcombank will refund the money to the customer.

The maximum support period is 30 days and a maximum of 3 times for a transaction requesting a refund. The fee is applied according to Vietcombank's current fee schedule for transaction verification. The representative of this bank admitted that the process of claiming mistakenly transferred money is quite complicated, so account holders need to pay attention to entering the correct account number and carefully review the information before sending the order. And in fact, many people cannot get back the mistakenly transferred money even though they know the recipient account number.

Dr. Nguyen Tri Hieu

Economist and financial expert, Dr. Nguyen Tri Hieu, said that in the US, the bank's processing procedure is very fast when a customer transfers money by mistake, sometimes taking only 2-3 days. The person who transferred the money by mistake notifies the bank that opened the account so they can process the claim. On the recipient's side, if they suddenly receive a strange amount of money, they will notify their bank to return the money.

"In the US, banks protect their clients' assets very well. Banks have departments that handle these cases under the payment department, not the responsibility of the branches or transaction offices of the recipients who opened the accounts. In case the recipient does not pay, the person who mistakenly transferred the money will file a lawsuit in court. Just provide complete and clear evidence and it will be handled quickly within a few hours. In case the recipient uses the money, they will be prosecuted," said Mr. Hieu.

The first step in handling this in Vietnam is to report to the police, and then sue in court. Because of the time and effort involved, people who mistakenly transfer small amounts of money often choose to accept the loss and have no way to quickly get it back. Each bank has a slightly different way of handling the situation and the processing time is different. Not to mention the many virtual accounts, ghost accounts, etc., so in the case of mistakenly transferring money to these accounts and not being able to find the account owner, it is also difficult to handle.

"With increasingly developed technology, payment methods are increasingly diverse and convenient, so sometimes there are risks. In addition to customers needing to be careful, authorities should have a way to handle cases of mistaken transfers to support customers to get their money back," Mr. Nguyen Tri Hieu emphasized.

Receive strange money, proactively contact the bank

In case of receiving an unknown amount of money into the bank account, then receiving a phone call or a message with the content of the money transfer, calmly check whether the contact person is a bank employee or not. In case of refunding money to the sender, the customer should proactively contact the bank to make the refund, avoid clicking on the link sent at the request of a stranger. Because the scammer takes advantage of the mistaken money transfer, sends a link and asks the recipient to log in to transfer back the mistakenly received amount. In fact, this is a trick to get the account information and money in the customer's account.

Source link

![[Photo] Capital's youth enthusiastically practice firefighting and water rescue skills](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3f8481675271488abc7b9422a9357ada)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Ho Chi Minh City speeds up sidewalk repair work before April 30 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/17f78833a36f4ba5a9bae215703da710)

![[Photo] Prime Minister Pham Minh Chinh chairs the first meeting of the Steering Committee on Regional and International Financial Centers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/47dc687989d4479d95a1dce4466edd32)

Comment (0)