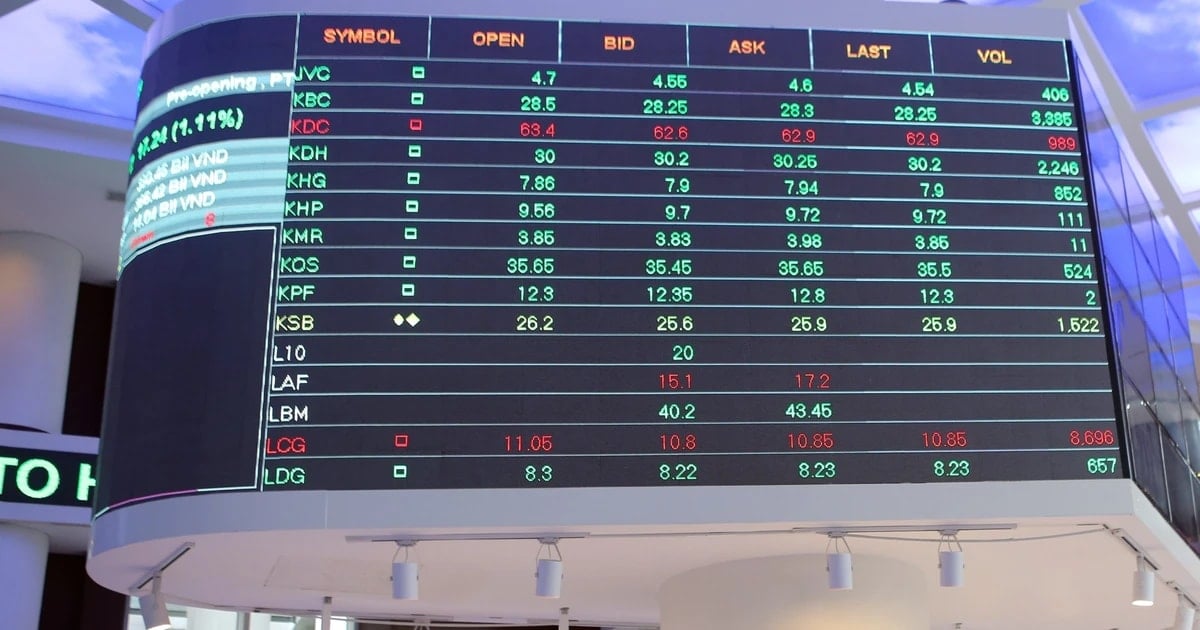

VN-Index fell 1.8% in October. This month, the market also fell about 3.8%. In particular, the correction from the end of last week spread to the first three sessions of this week, greatly affecting the general sentiment. Stocks gradually retreated to the important support level both technically and psychologically - the 1,200 point mark. VN-Index returned to the same price level as in early August. Liquidity dropped to a low level, showing that investors are still waiting for a more attractive price level before deciding to continue disbursing.

Mr. Nguyen Viet Duc, Digital Business Director of VPBank Securities (VPBankS), said that this development is not too surprising. If we follow the whole year, the market had a big wave at the beginning of the year but it quickly ended in March and had a few highlights until June. After that, from June to November, the stock market was always in a downward trend.

"Based on many bottom fishing methods, the opportunity is coming very close for investors," he stated.

This expert pointed out that the market is showing some signs of this. The first is P/E (market price per share). In any bad market, no matter how bad, P/E valuations only return to 10-11 times. This happened in 2016, before entering the strong growth wave of 2016-2017, the second time in 2020, before the Covid-19 wave, and the third time in 2022 when there is a bond story. Currently, the VN-Index is at 11 times according to P/E.

Based on P/B valuation (market price to book value), the market will have some strong support points at 1,155 points. If the market returns to this area, Mr. Duc believes there will be a recovery wave.

The final method is based on the fear index (RSI). The number of stocks trading below RSI 30 to 20-25% is the high fear threshold of the market. Before the current decline, the chart was at 10% and he believes that after the session on November 19, it could have increased to 20% and will quickly increase to 25-30%. Looking at history, in the last panic market in 2022, the number of stocks trading below RSI 30 was up to 50%. In normal circumstances, this ratio increased to 30% and there was a recovery wave.

At the 1,200-point area, the analysis team of Dragon Capital Securities (VDSC) believes that the support signal is not clear. However, if it enters the oversold zone below the above threshold, the market will be able to test the support momentum of cash flow. "The supply and demand signal in this oversold zone will have an impact on the next development of the stock market," the VDSC analysis team predicted.

The above comments were gradually verified in the trading session on November 20. In the morning, VN-Index was pushed back to the 1,200-point mark when massive selling pressure appeared. However, the market did not panic too much but improved after only one hour when bottom-fishing demand joined quite actively.

At the end of the session, the index was raised to over 1,216 points, an increase of more than 11 points. Liquidity improved well when recording more than 17,800 billion VND, 34% higher than on November 19.

Vietcombank Securities (VCBS) believes that on the daily chart, the RSI indicator is pointing up from the low zone, however, the MACD indicator (moving average convergence divergence) has not yet given a bottoming signal, indicating that the probability of fluctuations has not been completely eliminated. However, with a significant increase in liquidity and the active participation of demand, this analysis group expects the market to move sideways to consolidate momentum and gradually regain balance.

In the long term, Dragon Capital believes that the possibility of further stock declines is not high. This fund management company assessed that the stronger USD could prolong the withdrawal of capital from emerging markets to the US. However, the third quarter profits of listed companies still achieved positive results. The 80 companies in their monitoring portfolio alone recorded a net growth of 19% compared to the same period last year.

The results show the resilience of the stock market and reinforce expectations of 16-18% growth next year. The group of companies is also trading at a forward P/E of 11.6x compared to an average of 13.9x over the past five years. Combined with the positive views of domestic investors, Dragon Capital remains optimistic about the future market situation.

Considering that the opportunity is coming, VPBankS experts also noted that the important thing is how to catch the bottom. Based on William O'Neil's investment rules, Mr. Nguyen Viet Duc said that there are some points that are suitable for the Vietnamese stock market.

First, you should not buy stocks with very low market prices. In the case of Vietnamese stocks, high-quality stocks are usually priced at around VND15,000 or more. Investors should buy stocks in leading growth industries.

Second, cut losses every time they exceed 8% of the stock purchase price and there are no exceptions. On the other hand, investors also need to follow the selling rules to know when to take profits.

The next rule is to buy when the market index is rising, reduce investment and increase cash when the market is falling. The important thing is not to guess the bottom or buy when the price is falling, do not argue with the market and forget about your pride and ego.

VN (according to VnExpress)Source: https://baohaiduong.vn/chung-khoan-co-dau-hieu-do-day-398518.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)