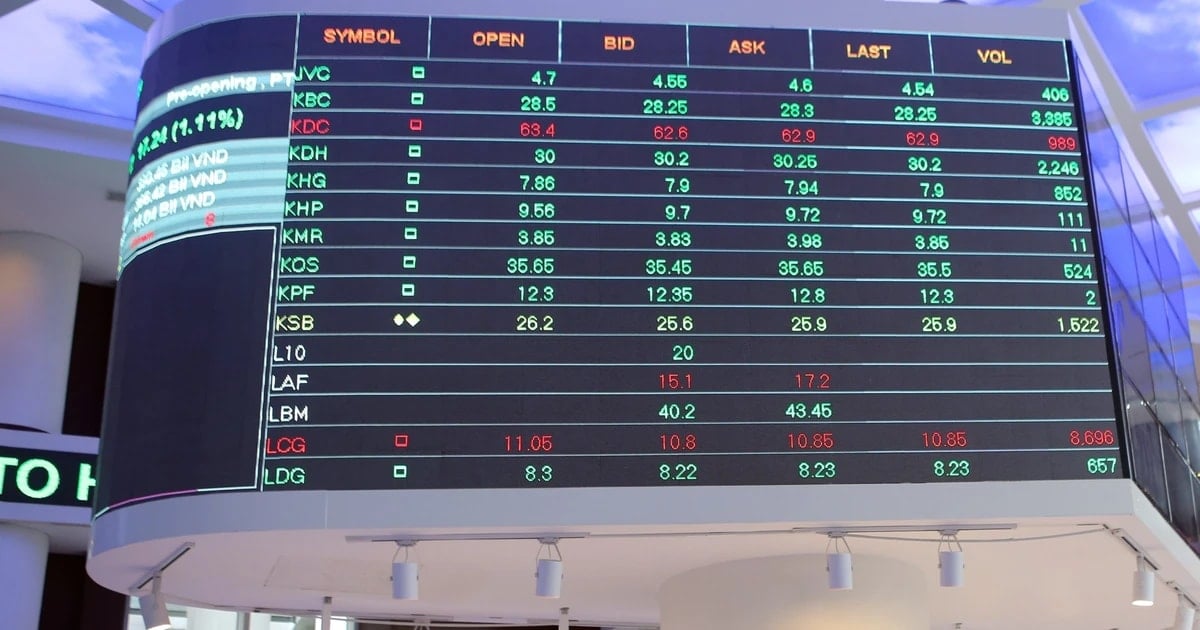

Stock markets in Asia continued to plummet this morning (April 7) as there was no sign that President Trump would withdraw plans to impose reciprocal tariffs.

Futures markets have quickly priced in nearly five 25 basis point rate cuts in the U.S. this year, sending Treasury yields sharply lower and weakening the dollar against safe-haven assets. Investors are betting that the rising risk of a recession could prompt the Federal Reserve to cut rates as early as May.

S&P 500 futures fell 3.5% in volatile trading, while Nasdaq futures fell 4.4%, adding to the market's nearly $6 trillion loss last week.

European markets were also in the red, with EUROSTOXX 50 futures down 3.6%, FTSE futures down 2.3% and DAX futures down 4.0%.

Japan's Nikkei plunged 6.6% to its lowest since late 2023, while South Korea's fell 5%. MSCI's broadest index of Asia-Pacific shares outside Japan plunged 7.5%, leaving investors reeling.

Chinese blue chips fell 6.3% as markets waited to see if Beijing would unleash more stimulus. Taiwan’s main index, which was closed for two days on Thursday and Friday, plunged nearly 10%, prompting policymakers to intervene to curb short selling.

Emerging Asia as a whole also fell into negative territory, with India's Nifty 50 index down 4%.

The turmoil came as Mr Trump told reporters that investors would have to accept reality and that he would not make a deal with China until the US trade deficit was addressed. Beijing said markets had reacted to its retaliation plan.

" The only real trigger was President Trump's iPhone and he showed no signs of a market sell-off... enough to reconsider the policy stance he has taken," said Sean Callow , senior FX analyst at ITC Markets in Sydney.

Investors think the loss of trillions of dollars in assets and the potential shock to the economy will make Mr. Trump reconsider his plans.

“ The scale and disruptive impact of US trade policies, if sustained, would be enough to push a still-healthy US and global economy into recession ,” said Bruce Kasman, chief economist at JPMorgan, who forecast a 65% chance of a recession.

“ We continue to expect the Fed to ease for the first time in June ,” he added.

“ However, we now expect the Committee to cut rates at every meeting through January, taking the funds rate target to a maximum of 3.0%.”

Source

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Reliving the heroic memories of the nation in the program "Hanoi - Will and belief in victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19ce7bfadf0a4a9d8e892f36f288e221)

Comment (0)