Jerome Powell - Chairman of the US Federal Reserve (Fed) said that they are being very cautious and have not even thought about cutting interest rates.

Most investors believe the Fed is done raising rates and is ready to start cutting rates next year, possibly in the first half of next year. However, Fed Chairman Jerome Powell does not think it can come so quickly.

"The Fed is acting very cautiously. The risks of tightening too much or not tightening enough are now equal. It is too early to confidently conclude that we have tightened enough, and it is also too early to talk about when to loosen," Powell said in a discussion at Spelman College (Atlanta, USA) on December 1.

Powell's comments come less than two weeks before the Fed's final policy meeting of the year. The Fed is expected to keep interest rates unchanged at a 22-year high for the third straight time.

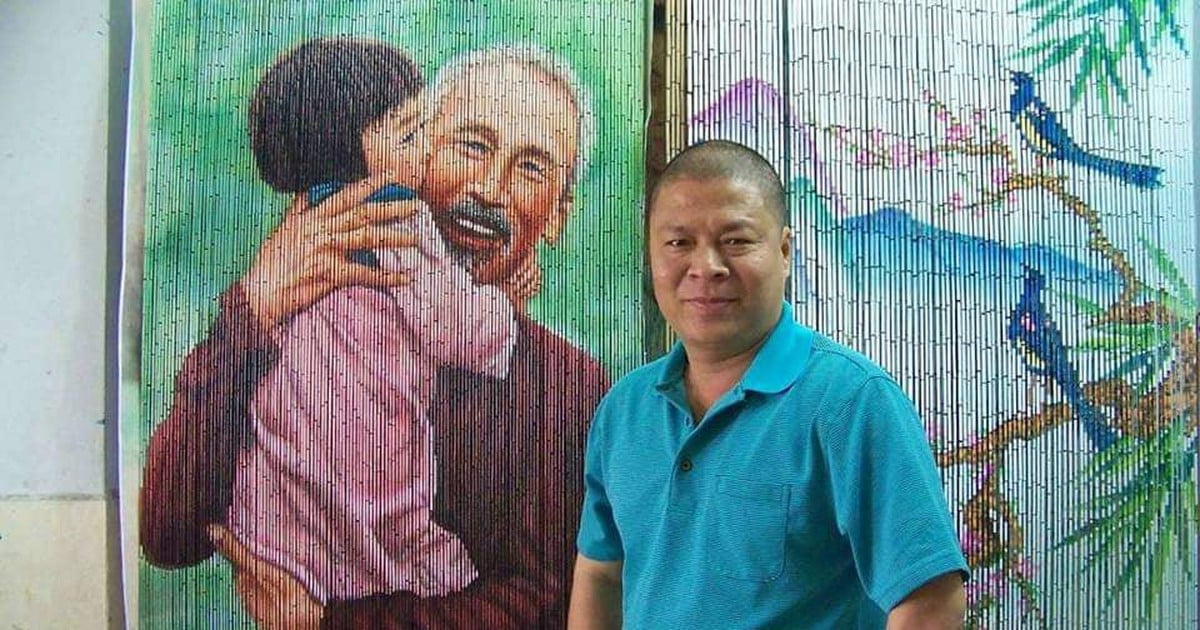

Mr. Jerome Powell at Spelman College on December 1. Photo: Atlanta Journal Constitution

Although Powell and other officials have said they are not yet thinking about cutting rates, many investors expect rates to start falling by the middle of next year. With the U.S. housing market still struggling with falling sales and high prices, easing could pave the way for lower mortgage rates. The Fed does not directly set mortgage rates, but its policies will influence them.

Fed officials breathed a sigh of relief when the latest data showed U.S. inflation cooled in October, helped by a recent sharp drop in energy prices. The Fed has raised interest rates four times in seven meetings this year.

Still, American holiday spending remains strong, with Black Friday and Cyber Monday sales both hitting records. The Fed wants to cool the economy, and raising interest rates has been a tool it has used since early last year. Economists expect the economy to cool in the final quarter of this year, after a strong third quarter.

During yesterday's discussion, Powell emphasized that the Fed's current strategy is to balance the risk of accelerating inflation with unintentionally causing unnecessary damage to the economy. He said the current situation is too uncertain.

"The current environment is unprecedented. We are now in the third year of the pandemic. Policy is already tight, which means it is holding the economy back. Inflation is still above target, but it is moving in the right direction. So the right thing to do is to be cautious," he said.

Recently, many Fed officials have acknowledged that economic conditions are paving the way for inflation to cool. "Growth has cooled. I expect inflation to continue to slow," Christopher Waller, a member of the Fed's Board of Governors, said at an event this week in Washington.

On November 30, New York Fed President John Williams also predicted inflation would only be slightly above 2% next year. However, he warned that “rate hikes may still be necessary” if the pace of inflation cooling slows, or even if inflation accelerates.

Ha Thu (according to CNN)

Source link

Comment (0)