Interest from savings deposits is an important source of income for people. The proposal to tax savings deposits is not 'worth it' and not worthwhile.

Associate Professor Dr. Dinh Trong Thinh - economic expert had an interview with a reporter from the Industry and Trade Newspaper about this issue.

- Sir, the story about taxing savings deposits of individuals at banks has been stirred up again after more than ten years of proposal. What is your comment on this proposal?

Associate Professor, Dr. Dinh Trong Thinh: I think this proposal is unreasonable. Because currently, savings interest rates are very low. If you deposit 100 million VND in the bank, each year the depositor will receive about 6 million VND in interest. With such an interest rate, the tax revenue from deposit interest is not too large.

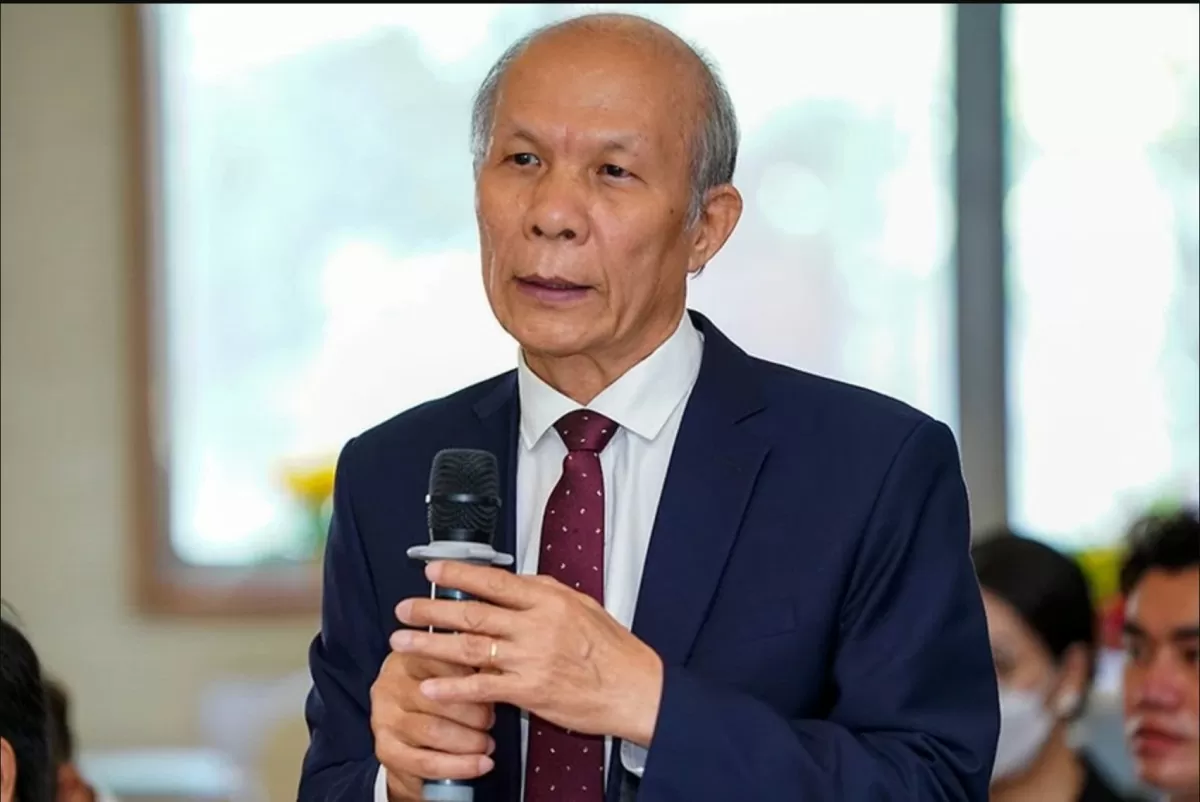

|

| Interest from savings deposits is one of the important sources of income for people. Illustrative photo |

In theory, if we consider bank savings as an investment, in principle, if it is an investment and brings profit, we must pay personal income tax. But in reality, savings deposits in Vietnam are said to have positive real interest rates, but in the end they are affected by inflation.

In fact, people choose to deposit savings in banks because it is the safest investment channel, not the most attractive investment channel.

Besides, to have 100 million VND deposited in the bank, people have to fully fulfill their tax obligations to the State, from corporate income tax to personal income tax. Only then will they have the balance to accumulate. People depositing money is an important factor that helps banks mobilize resources to lend to the economy, rather than them buying gold to store it. Then, the money will not go into the economy. If people do not deposit money, where will the banks get the money to lend? Obviously, taxing people's deposits is not "worth it" and not worth it.

This is also the reason why this issue was proposed more than ten years ago. Experts also analyzed and reanalyzed and the Ministry of Finance also realized that if tax collection on savings deposits was implemented, the cost of collection would be too large compared to the amount of money received from taxation. Therefore, they did not collect tax.

- Cash flow needs to be injected into the economy to promote production and business growth. Some opinions are concerned that taxing savings interest will lead to a situation where banks cannot mobilize capital, forcing banks to increase deposit interest rates, which will also affect lending interest rates. What is your comment on this?

Associate Professor Dr. Dinh Trong Thinh: That's right, people deposit savings so that banks have resources to lend for investment, production and business. Imposing a tax on savings deposits makes people no longer interested in depositing money in banks. This forces banks to increase deposit interest rates, which means banks are forced to increase capital mobilization costs.

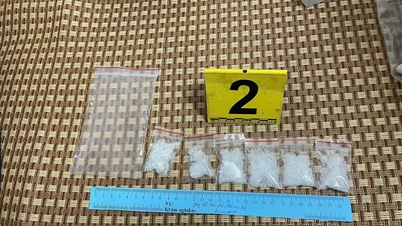

|

| Economist, Associate Professor, Dr. Dinh Trong Thinh. Photo: NH |

Increasing deposit interest rates will have a negative impact on lending interest rates, affecting capital resources for production and business, and people are still the ones most affected. This will have a negative impact on inflation and other issues. On the other hand, when using customers' savings for investment and business, banks themselves have paid corporate income tax.

Expanding the tax base is considered a trend to increase revenue, however, if the policy is not thorough, it will directly affect people's savings habits and capital flows in the banking system. Therefore, the development of tax policies always requires careful assessment of social and economic impacts. Obviously, finding a common voice between fiscal goals and financial market stability remains a challenging problem.

-Taxing income from interest on deposits is not uncommon in the world . Thailand taxes interest on bank deposits, China also taxes income from interest, while South Korea considers interest as taxable income. In Vietnam, in your opinion, what conditions are needed to implement this policy?

Associate Professor Dr. Dinh Trong Thinh: For Vietnam to be able to tax savings deposits, the first thing is that the economy must be stable, inflation must be low, and the average income per capita of the people must be high. In addition, the mobilized deposits of banks must be large, then the tax will be appropriate.

People's income is still low. Our inflation is still relatively high, and capital mobilization is still difficult. Combined with the tax on savings deposits, I'm afraid no one will save anymore.

Thank you!

| The issue of taxing income from interest on savings deposits arose once again when the People's Committee of Can Tho City commented on the draft proposal to build a Law on Personal Income Tax (replacement) chaired by the Ministry of Finance. Accordingly, this locality proposed that only small-scale deposit interest should be exempted from personal income tax, while large deposit interest should be subject to tax. It is worth noting that the idea of taxing interest on savings deposits is not the first time it has appeared. Previously, in 2013 and 2017, there were a number of similar proposals. |

Source: https://congthuong.vn/danh-thue-lai-tu-tien-gui-tiet-kiem-la-khong-phu-hop-374551.html

Comment (0)