According to Kitco, the world gold price recorded at 1:30 p.m. today, Vietnam time, was at 2,356.33 USD/ounce. The gold price this afternoon is 13.04 USD/ounce higher than the closing price of gold yesterday. Converted according to the current exchange rate at Vietcombank, the world gold price is about 70.378 million VND/tael (excluding taxes and fees).

Domestically, if the price of gold plummeted at the end of the week, this afternoon it reversed and increased sharply. Accordingly, the price of SJC gold bars was listed at 83.20 - 83.30 million VND/tael for buying and 85.20 - 85.40 million VND/tael for selling. The price of gold increased by 2.5 - 2.7 million VND/tael for buying and increased by 2.2 - 2.4 million VND/tael for selling, bringing the price of gold to over 85 million VND/tael. Gold bars recorded a new historical peak.

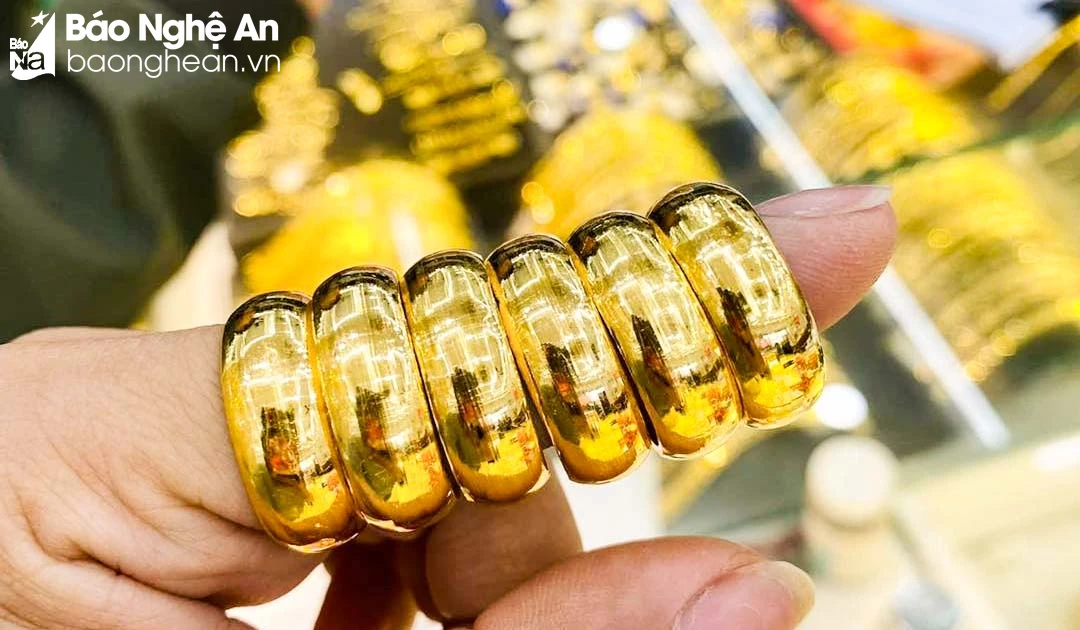

The price of 9999 gold rings in the first session of this week was adjusted by gold brands to increase rapidly by 1 million VND per tael, raising the selling price to over 77 million VND/tael.

In Nghe An, as of 2:00 p.m. on April 15, gold prices listed by gold and silver businesses were as follows: SJC gold bars were bought at VND83.20 million/tael, sold at VND85.50 million/tael; Gold rings were VND73.50 million/tael (bought) and VND78.30 million/tael (sold).

The sharp increase in gold prices has caused gold trading in Nghe An to become active again. According to records, although it was the beginning of the week, in the early afternoon, gold shops were quite crowded. Despite the high gold prices, many people still decided to spend money to buy gold for storage.

Mr. Ho Huy S., a customer, said: “When gold peaked last week, I sold 7 taels of gold to make a profit. After 1 year of investing, I made a profit of nearly 100 million VND. At this time, the money from selling gold is idle. At this rate, the price of gold will increase in the future, so I decided to buy gold to store, wait for the price to increase, and then sell it for a profit. This time, I bought 5 taels of round, smooth gold rings and 3 taels of SJC gold bars.”

Although there are no specific statistics, it is estimated that this afternoon, when the gold price rebounded, gold transactions at many businesses increased. Ms. Manh My Duyen, director of a gold and silver business on Tran Phu Street (Vinh City) said: "Compared to the last 2 days of the weekend, today, from the first trading session of the week, the number of customers increased sharply, about 30%. The gold price increased, but the number of people buying gold for investment and storage was quite large."

According to Ms. Duyen, in recent weeks, many people have continuously suffered losses if they invest in gold in the short term because the difference between buying and selling prices has been pushed to a high level. However, if they invest in the long term, domestic investors will still earn large profits.

Specifically, if buying gold from the beginning of the year until now, the buyer has made a profit of nearly 7 million VND/tael; compared to 1 year ago, the price of SJC gold was only at 66.65 - 67.25 million VND/tael (buy - sell). Up to now, SJC gold has increased to 80.6 - 85.4 million VND/tael (buy - sell). After 1 year, investors have made a profit of nearly 15 million VND/tael.

This is also the reason why even though the gold price is high and gold is increasing, the number of people investing in gold has not decreased. Besides, for many people, buying gold or saving at the bank are safe investment channels. When they have idle money, people often put it in these channels.

Some other investment channels such as stocks or real estate require large capital or experience, and have a high level of risk, so investors are more selective. However, in recent months, savings interest rates have been continuously adjusted down, the highest savings interest rate is only at 5.8%/year. Meanwhile, the price of gold has been continuously increasing recently, making gold an optimal investment channel for many people.

World gold prices continue to reach new peaks. Domestic gold prices have long tended to adjust according to world market developments, so many people believe that the precious metal will hardly decrease while the world market is still "hot".

Some experts believe that gold will have the momentum to jump back to $2,400/ounce as central banks continue to buy gold, geopolitical instability has not cooled down and China is still leading the market by increasing gold reserves for the 17th consecutive month.

Source

Comment (0)