Bank leading the interest rate market

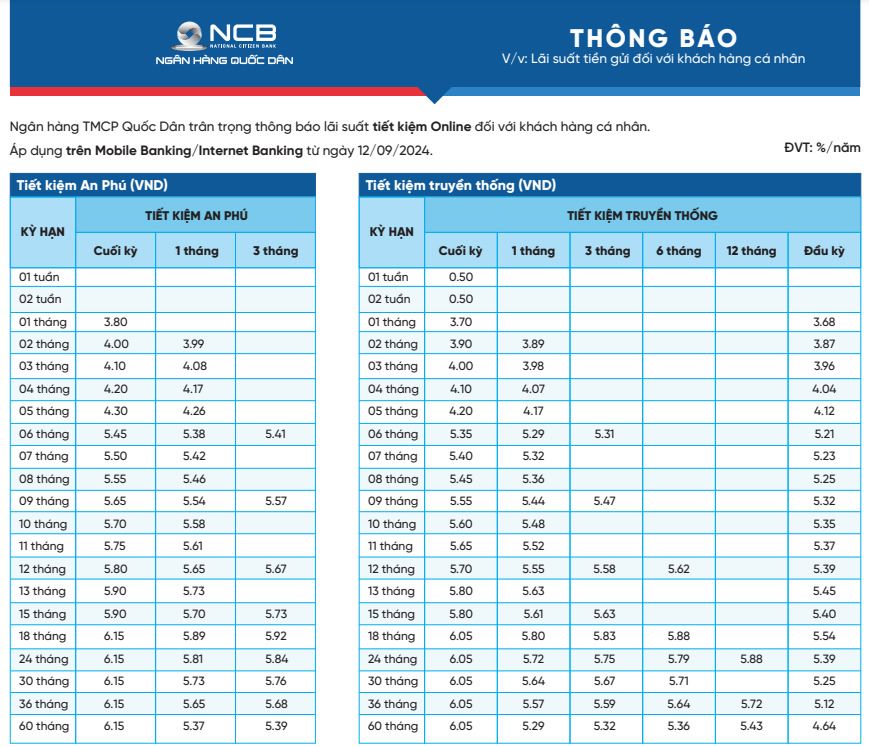

According to Lao Dong, on September 12, National Citizen Commercial Joint Stock Bank (NCB) issued a new deposit interest rate table after 2 months of no change. Accordingly, the new deposit interest rate table at NCB recorded a steady increase of 0.1% for most terms.

NCB's online deposit interest rate table records the following changes:

One-month interest rate increased by 0.1 percentage point, to 3.8%/year.

The 3-month term interest rate increased by 0.1 percentage point to 4.1%/year.

6-month term interest rate increased by 0.1 percentage point, to 5.45%/year.

The 9-month term interest rate increased by 0.1 percentage point to 5.65%/year.

12-month term interest rate increased by 0.1 percentage point, to 5.8%/year.

Interest rates for 18-36 month terms increased by 0.1 percentage points to 6.15%/year.

NCB's counter savings interest rate table also recorded similar changes.

One-month interest rate increased by 0.1 percentage point, to 3.7%/year.

3-month term interest rate increased by 0.1 percentage point, to 4.0%/year.

6-month term interest rate increased by 0.1 percentage point, to 5.35%/year.

The 9-month term interest rate increased by 0.1 percentage point to 5.55%/year.

12-month term interest rate increased by 0.1 percentage point, to 5.7%/year.

Interest rates for 18-36 month terms increased by 0.1 percentage points to 6.05%/year.

Currently, NCB is the market leader with the highest savings interest rates for terms of 6 months, 9 months and 18 months or more.

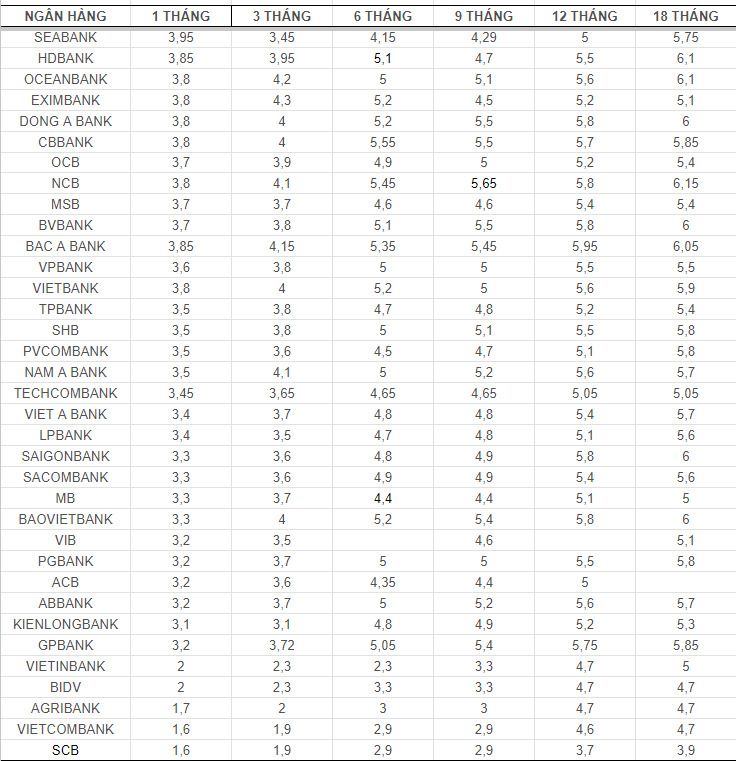

Also according to Lao Dong, since the beginning of September, the market has had 7 banks increase interest rates, including: Techcombank, Dong A Bank, OceanBank, Eximbank, GPBank, VietBank, Bac A Bank, NCB; with the increasing trend mainly in short terms.

Details of deposit interest rates at banks, updated on September 12, 2024

Source: https://laodong.vn/kinh-doanh/bien-dong-lai-suat-129-bat-ngo-lap-dinh-1393075.ldo

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)