The ceiling interest rate of 4.75%/year has been no longer maintained by Eximbank for deposits with terms of less than 6 months after the recent reduction in interest rates.

According to statistics on online deposit interest rates at domestic commercial banks today, the highest deposit interest rate applied for terms under 6 months is 4.6%/year, applied by Vietnam Export Import Commercial Joint Stock Bank (Eximbank) for terms of 4-5 months and Orient Commercial Joint Stock Bank (OCB) for terms of 5 months.

Following Eximbank and OCB in terms of highest bank interest rates for terms under 6 months are Bao Viet Commercial Joint Stock Bank (BaoViet Bank) and Vietnam Thuong Tin Commercial Joint Stock Bank (VietBank).

Currently, the online deposit interest rate of 4.5%/year is applied by BaoViet Bank for a 5-month term, and by VietBank for a 4-5 month term.

For 3-month term savings interest rates, the highest rate is 4.4%/year listed by VietBank. BaoViet Bank, Vikki Digital Bank (Vikki Bank) and Foreign Trade Bank Digital Technology (VCBNeo) are also leading with interest rates of 3.35%/year for 3-month term deposits.

The highest bank interest rate for the 2-month term is 4.2%/year listed by Vikki Bank and Eximbank. Next is VCBNeo with 4.15%/year and a series of banks listed interest rates of 4.1%/year including: VietBank, Nam A Bank, NCB, OCB.

With an interest rate of 4.15%/year, Vikki Bank and VCBNeo are leading the market in terms of the highest interest rate for a 1-month term . Next is VietBank at 4.1%/year, followed by Eximbank, Nam A Bank, NCB, and OCB with an interest rate of 4%/year.

In general, the group of banks Eximbank, BaoViet Bank, VietBank, Vikki Bank, VCBNeo, OCB, NCB, Nam A Bank are the banks leading the market in terms of the highest interest rates for deposits with terms of less than 6 months.

After a sharp drop in deposit interest rates since late February, the number of banks maintaining interest rates above 4%/year for deposits with terms of 1-5 months has also gradually decreased.

Currently, only 8 banks maintain interest rates of 4%/year for online deposits with a term of 1 month. Meanwhile, 11 banks offer 2-month terms; 14 banks offer 3-month terms; 12 banks offer 4-month terms and 15 banks offer 5-month terms.

On the other hand, the Big 4 banking group is still maintaining the lowest interest rates in the market. Of which, Vietcombank currently only maintains an interest rate of 1.6%/year for 1-2 month term deposits; 1.9%/year for 3-5 month term deposits.

| INTEREST RATE ONLINE DEPOSITS FOR TERM 1 - 5 MONTHS ON MARCH 29, 2025 (%/YEAR) | |||||

| BANK | 1 MONTH | 2 MONTHS | 3 MONTHS | 4 MONTHS | 5 MONTHS |

| VIETBANK | 4.1 | 4.1 | 4.4 | 4.5 | 4.5 |

| BAOVIETBANK | 3.5 | 3.6 | 4.35 | 4.4 | 4.5 |

| VCBNEO | 4.15 | 4.15 | 4.35 | 4.35 | 4.35 |

| VIKKI BANK | 4.15 | 4.2 | 4.35 | ||

| EXIMBANK | 4 | 4.2 | 4.3 | 4.6 | 4.6 |

| NCB | 4 | 4.1 | 4.2 | 4.3 | 4.4 |

| NAM A BANK | 4 | 4.1 | 4.2 | 4.2 | 4.2 |

| OCB | 4 | 4.1 | 4.2 | 4.2 | 4.6 |

| BVBANK | 3.95 | 4 | 4.15 | 4.2 | 4.25 |

| GPBANK | 3.5 | 4 | 4.02 | 4.04 | 4.05 |

| VIET A BANK | 3.7 | 3.9 | 4 | 4.1 | 4.1 |

| VPBANK | 3.8 | 4 | 4 | 4 | 4 |

| MB | 3.7 | 3.8 | 4 | 4 | 4 |

| HDBANK | 3.85 | 3.85 | 3.95 | 3.95 | 3.95 |

| MSB | 3.9 | 3.9 | 3.9 | 3.9 | 3.9 |

| LPBANK | 3.6 | 3.7 | 3.9 | 3.9 | 3.9 |

| ABBANK | 3.2 | 3.4 | 3.9 | 3.9 | 3.9 |

| BAC A BANK | 3.5 | 3.5 | 3.8 | 3.9 | 4 |

| VIB | 3.7 | 3.8 | 3.8 | 3.8 | 3.8 |

| SHB | 3.5 | 3.5 | 3.8 | 3.8 | 3.9 |

| TPBANK | 3.5 | 3.7 | 3.8 | ||

| PGBANK | 3.4 | 3.5 | 3.8 | ||

| KIENLONGBANK | 3.7 | 3.7 | 3.7 | 3.7 | 3.9 |

| PVCOMBANK | 3.3 | 3.4 | 3.6 | 3.7 | 3.8 |

| SACOMBANK | 3.3 | 3.5 | 3.6 | 3.6 | 3.6 |

| SAIGONBANK | 3.3 | 3.3 | 3.6 | 3.6 | 3.6 |

| TECHCOMBANK | 3.25 | 3.25 | 3.55 | 3.55 | 3.55 |

| ACB | 3.1 | 3.2 | 3.5 | 3.5 | 3.5 |

| SEABANK | 2.95 | 2.95 | 3.45 | 3.45 | 3.45 |

| AGRIBANK | 2.4 | 2.4 | 3 | 3 | 3 |

| BIDV | 2 | 2 | 2.3 | 2.3 | 2.3 |

| VIETINBANK | 2 | 2 | 2.3 | 2.3 | 2.3 |

| VIETCOMBANK | 1.6 | 1.6 | 1.9 | 1.9 | 1.9 |

| SCB | 1.6 | 1.6 | 1.9 | 1.9 | 1.9 |

Since the meeting on interest rates held by the State Bank with commercial banks on February 25, no domestic commercial bank has increased its deposit interest rates. On the contrary, 24 domestic commercial banks have lowered their deposit interest rates by 0.1-1.05% per year depending on the term.

In March, 20 domestic commercial banks reduced deposit interest rates from the beginning of the month, including: PGBank, Viet A Bank, Kienlongbank, Bac A Bank, Eximbank, LPBank, Nam A Bank, NCB, SHB, VCBNeo, VIB, Vikki Bank, MBV, BIDV, Techcombank, VietinBank, OCB, ABBank, BaoVietBank, BVBank.

Of which, Eximbank has reduced interest rates 4 times, Kienlongbank has reduced interest rates 3 times and PGBank has reduced interest rates twice since the beginning of the month.

Source: https://vietnamnet.vn/lai-suat-huy-dong-ky-han-duoi-6-thang-ngan-hang-nao-cao-nhat-2385580.html

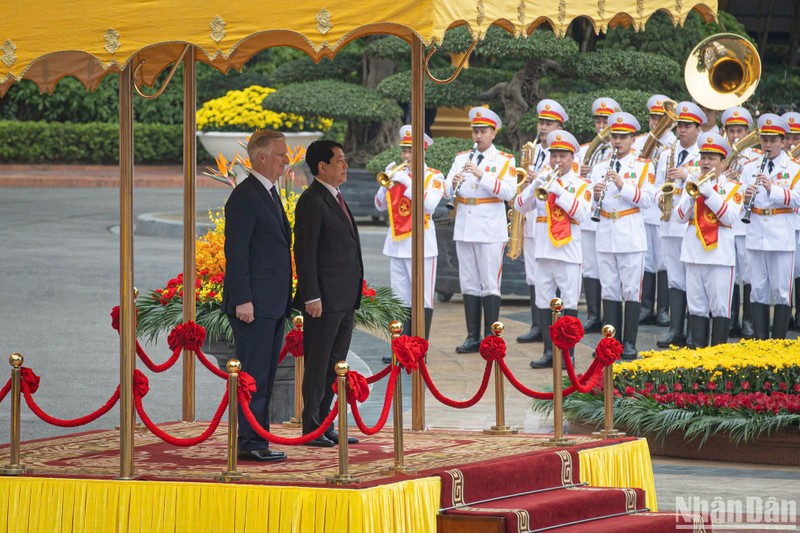

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Infographic] Vietnam's manufacturing industry recovers: Positive signals in early 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/53389fc2248e47c8a06ec8c00a632823)

Comment (0)