5 banks with high interest rates for 12-month term

According to Lao Dong reporter (9:00 a.m. on December 5, 2023), the 12-month term interest rate table ranges from 4.2 - 10.5%, depending on the applicable conditions of the banks.

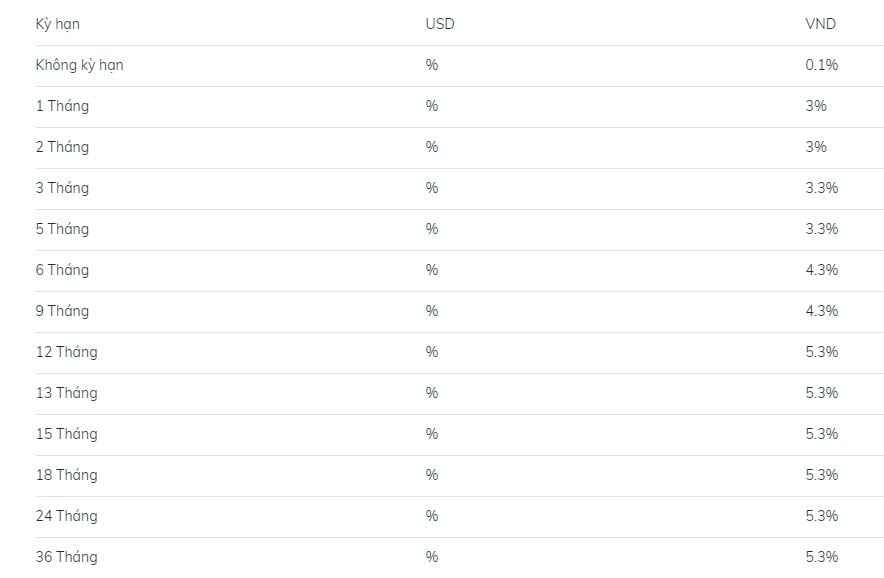

In particular, PVcomBank listed the highest savings interest rate for this term, up to 10.5% when customers open a book at the counter with a new deposit balance of 2,000 billion or more.

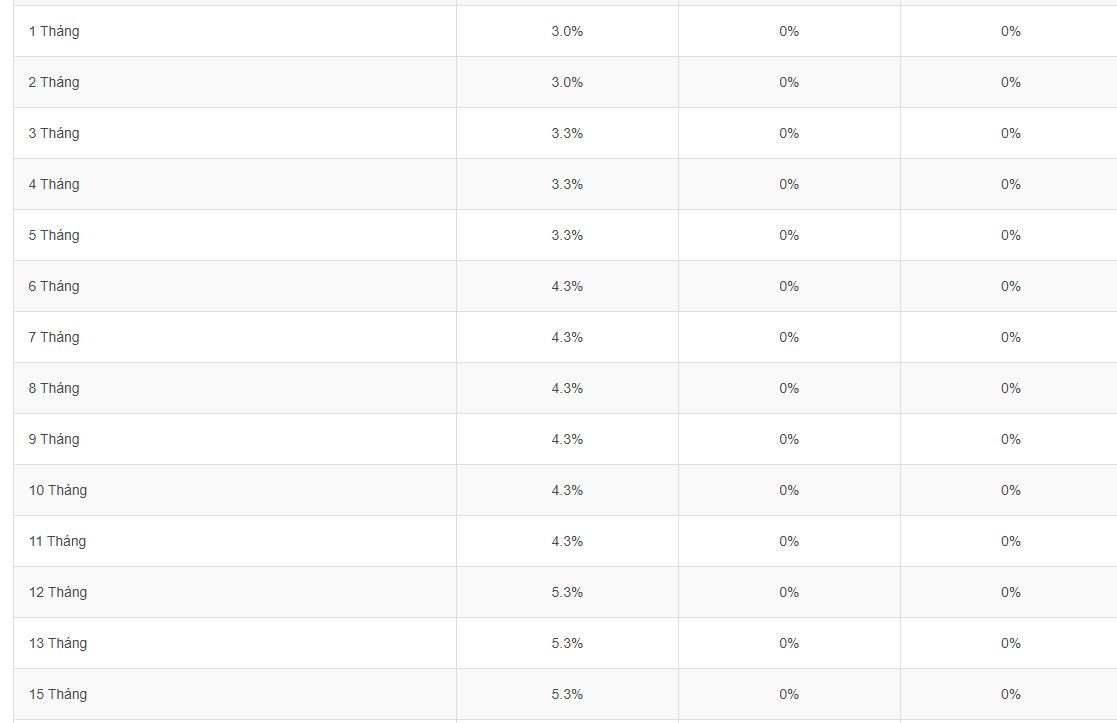

In case of depositing a lower savings amount, customers will enjoy an interest rate of 5.3% for this term.

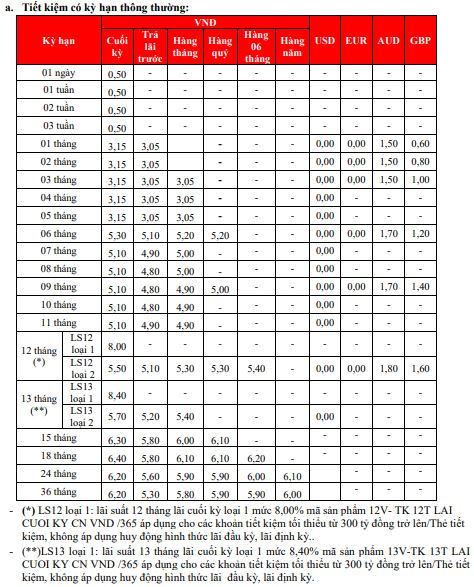

Next is HDBank, with the highest 1-year term interest rate of 8.0%. The applicable condition is a minimum savings amount of 300 billion VND or more. With a lower savings amount, customers enjoy an interest rate of 5.7%.

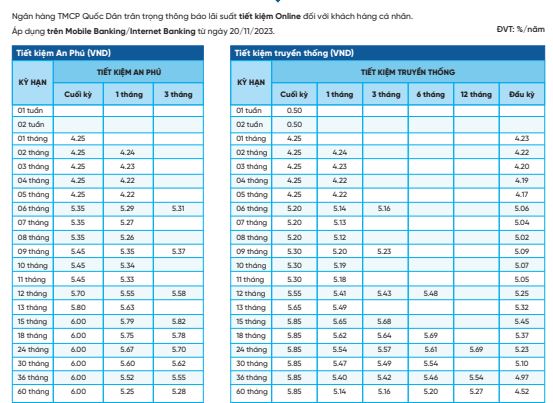

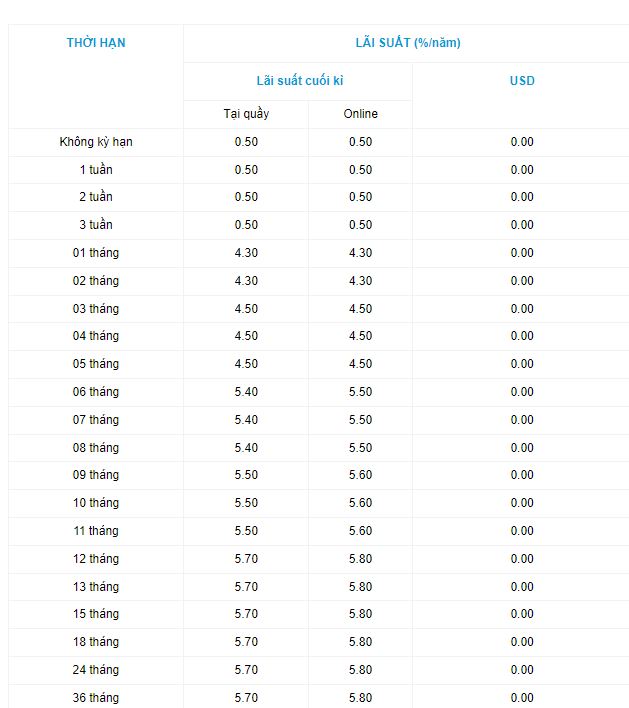

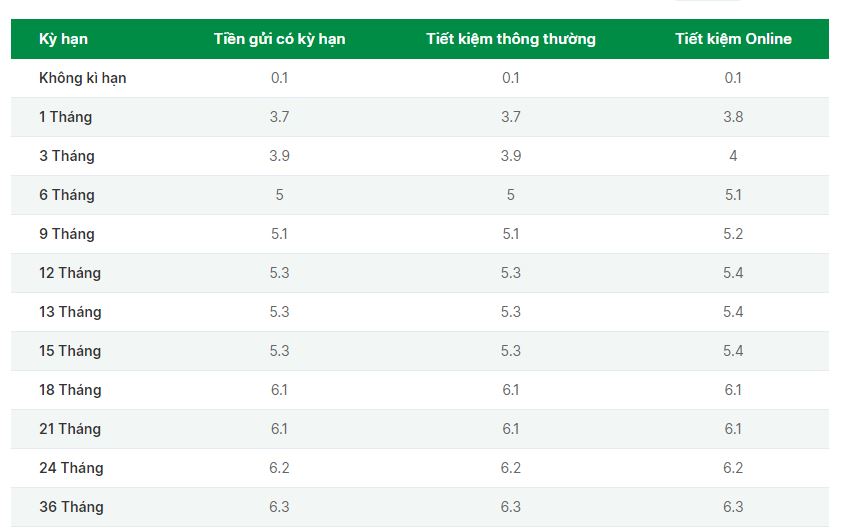

Meanwhile, OceanBank, NCB and NamABank all listed interest rates for this term at 5.7%.

Low interest rate bank group with 12-month term

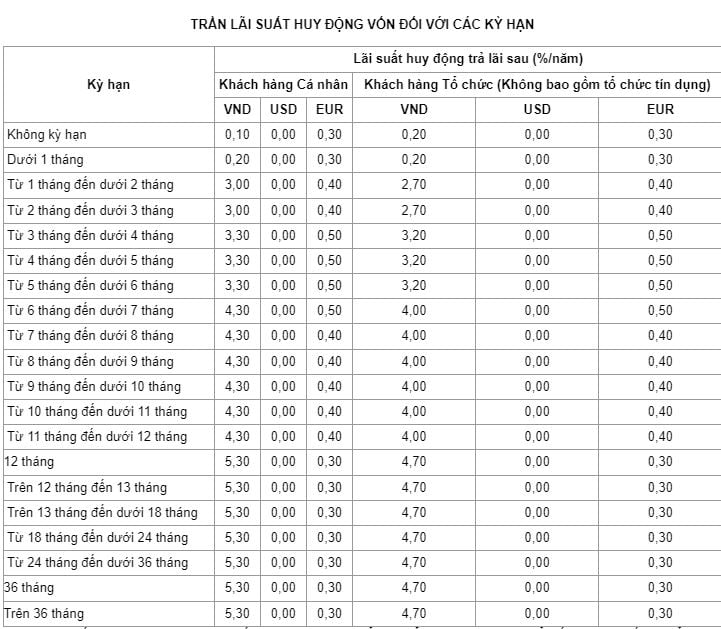

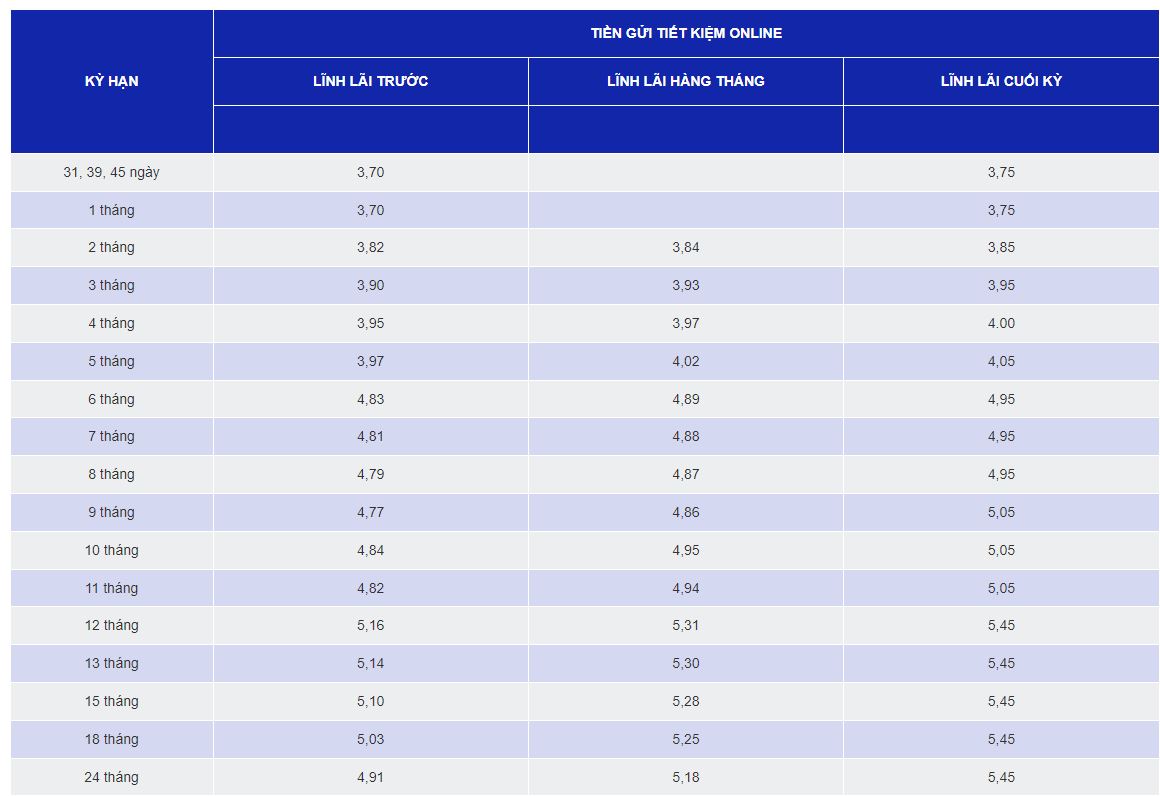

Meanwhile, the group of banks with low interest rates for this term includes: ABBank (4.2%), Agribank (5.3%), Vietinbank (5.3%), BIDV (5.3%), OCB (5.4%), SCB (5.45%).

Deposit 1 billion, after 1 year how much interest can I receive at most?

Depending on the interest rate schedule of each bank, depositors can calculate the interest received according to the formula: Interest = Deposit x interest rate (%)/12 months x number of months of savings.

For example, you have 1 billion in savings for 12 months at OceanBank, with an interest rate of 5.7%, the interest you receive is:

Interest = 1 billion VND x 5.7%/12 x 12 months = 57 million VND.

With the same amount of money, you deposit it at Agribank with an interest rate of 5.3%, after 12 months, the interest you receive is:

Interest = 1 billion VND x 5.3%/12 x 12 months = 53 million VND.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Source

Comment (0)