The market ended the last trading session of the Year of the Cat with a strong increase. VN-Index is expected to surpass the 1,200 point mark in the first trading sessions of the Year of the Dragon with many bright spots.

Where does the growth momentum for stocks come from?

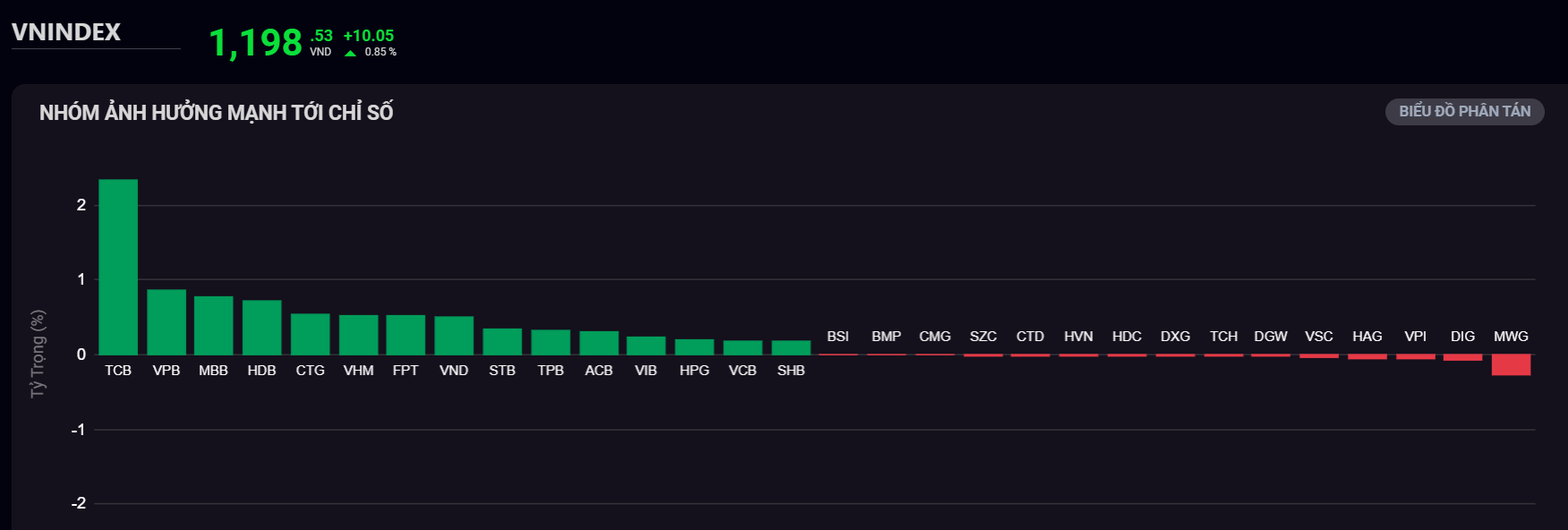

The stock market closed the trading session of the year of the Cat at 1,198.53 points. This was followed by a positive growth momentum.

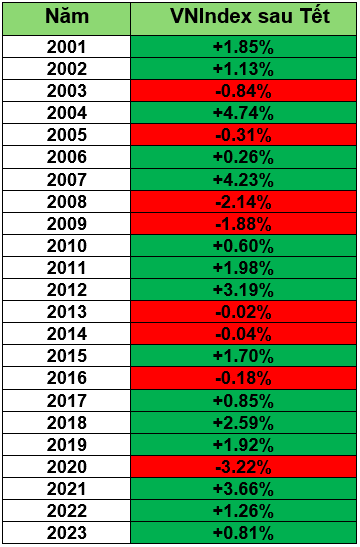

VN-Index is expected to increase by about 12.2% in 2023 compared to 2022, in the context of a volatile world economy, a domestic economy under pressure and not yet fully returning to growth. Looking back at the results of 2023, it shows that the stock market has had a positive year of growth, better than concerns in the middle of the year.

According to Mr. Ho Huu Tuan Hieu, investment strategy expert, Investment Analysis and Consulting Center of SSI Securities Company, the factors that helped the market achieve such growth results came from the low point in early 2023 and the recovery from business results in a number of important industry groups. This brings many expectations for an improvement in the recovery rate and a return to growth this year.

Observations show that liquidity is tending to return to the market, reaching up to VND17,000 billion in one session. In the context of record low interest rates and not many alternative investment channels, many experts believe that in 2024, securities will still be an attractive investment channel, actively attracting domestic cash flow.

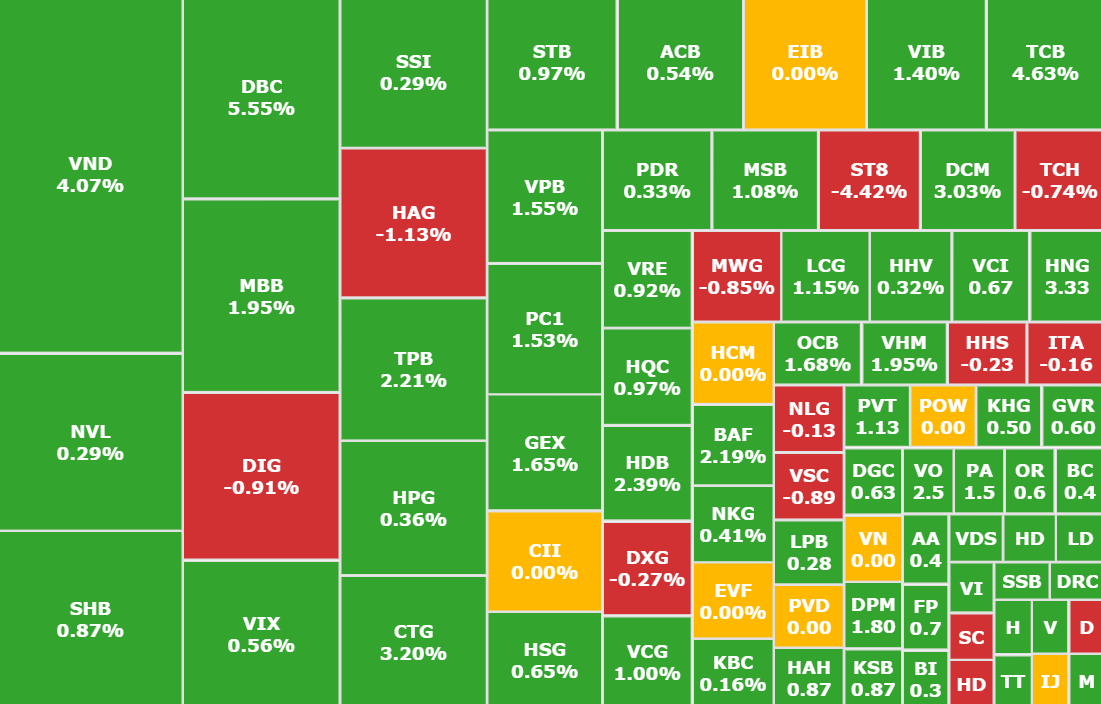

Green color spreads across the market at the end of the year of the Cat

Expert Tuan Hieu pointed out 3 main " bright spots" that create momentum for the market, which are:

(1) recovery from industry performance;

(2) Macro information and policies help boost market recovery and growth;

(3) Developing the stock market is an important goal of the Ministry of Finance, the State Securities Commission and its members.

Accordingly, in 2024, the Ministry of Finance will closely coordinate with ministries and branches to direct the State Securities Commission, the Vietnam Stock Exchange, its subsidiaries and the Vietnam Securities Depository and Clearing Corporation to make every effort to develop the Vietnamese stock market to develop sustainably and healthily.

Including: perfecting institutions, ensuring strict legal regulations, removing difficulties and obstacles, aiming for the goal of sustainable stock market development by 2030 after being approved by the Prime Minister.

Regarding the "bright spot" from macroeconomic information, Mr. Bui Thang Long, a consultant at VPS Securities, shared the same view: The process of tightening monetary policy from major central banks in the world has reached its final stage. If the FED (US Federal Reserve) lowers interest rates in the second quarter of 2024 and returns to 4.5% by the end of 2024, this will stimulate investors to seek growth from other markets.

23-year trading history of the session after Lunar New Year.

List of potential sectors for stocks at the beginning of the year

From the beginning of 2024 until the end of the Lunar Year of the Cat, the market witnessed strong growth from the banking industry. Banking stocks continuously played a pivotal role in the market with a series of big names: TCB (Techcombank), VPB (VPBank), MBB (MBBank)...

Forecasts suggest that short-term cash flow will continue to flow into this sector in the first sessions of the new year. At the same time, positive sentiment from the Banking sector will spread and be distributed to a number of mid-capitalization sectors.

According to Mr. Thang Long, the potential of the banking industry is being supported by factors: low interest rate environment and economic recovery prospects help increase credit, strengthen bad debt handling in 2023, contributing to profit growth in 2024.

Furthermore, solutions to remove difficulties for real estate from the Government will help unblock capital flows for the economy, bring positive results and reduce pressure on the banking system.

The banking industry has actively supported the market in recent times (Photo: SSI iBoard)

In addition, the Industrial Park Real Estate industry may be the next industry group to catch the wave in the near future.

In the challenging year of 2023, the industrial real estate industry still achieved positive results. According to data from the General Statistics Office, the total registered foreign investment (FDI) in Vietnam as of January 20, 2024 reached 2.36 billion USD, an increase of 40.2% over the same period. Of which, real estate business took the lead with total investment capital accounting for 53.9% of the total registered investment capital, twice as much as the same period.

Therefore, Mr. Thang Long recommends that the investment prospect of industrial real estate stocks will focus on enterprises with: Clean land fund ensuring long-term lease, favorable location, investment in traffic infrastructure; healthy financial situation, low debt; attractive valuation with high dividend rate.

Although forecasted with many positive growth signals, stock investment is an activity that requires knowledge, skills and has potential risks. The probability of adjustment can still appear in the short term, investors need to be cautious when trading.

Source

![[Photo] Unique Ao Dai Parade forming a map of Vietnam with more than 1,000 women participating](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/fbd695fa9d5f43b89800439215ad7c69)

![[Photo] Schools and students approach digital transformation, building smart schools](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/9ede9f0df2d342bdbf555d36e753854f)

![[Photo] Training the spirit of a Navy soldier](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/51457838358049fb8676fe7122a92bfa)

![[Photo] Flower cars and flower boats compete to show off their colors, celebrating the 50th anniversary of Da Nang Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/086d6ece3f244f019ca50bf7cd02753b)

Comment (0)