Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong has just sent a report to the National Assembly on the implementation of a number of resolutions of the 14th National Assembly on thematic supervision and questioning and the National Assembly's resolutions on thematic supervision and questioning from the beginning of the 15th term to the end of the 4th session regarding the banking sector.

In this report, the State Bank said that for banks under special control, in 2022, the State Bank will implement solutions to handle banks under special control, including 3 banks subject to compulsory purchase: Construction Bank (CBBank), Ocean Bank (OceanBank), Global Petroleum Bank (GPBank) under the direction of competent authorities.

Accordingly, the State Bank has reported to competent authorities the restructuring plan for banks under special control and specific handling plans for each bank.

To date, the Government has issued a Resolution deciding on the compulsory transfer policy of the two compulsory purchasing banks.

“Currently, the State Bank is directing relevant parties to carry out procedures as prescribed in the Law on Credit Institutions (amended) to submit to the Government for approval the compulsory transfer plan for these two banks and complete the plan, submit to the Government for decision on the compulsory transfer policy for the remaining compulsory purchase bank,” the report stated.

The Government has issued a Resolution deciding on the compulsory transfer policy of 2 compulsory purchasing banks.

The State Bank also said that it has directed banks to hire consulting organizations to determine enterprise value and coordinate with consulting organizations to determine enterprise value, ensuring compliance with legal regulations.

Up to now, valuation consulting organizations have issued valuation certificates and the State Bank has sent them to the State Audit to conduct an audit of the results.

According to the State Bank, the search and negotiation for a commercial bank that is qualified to receive a compulsory transfer (weak financial capacity, management, and experience in credit organization structure) is difficult because it depends largely on the voluntary participation of commercial banks and requires time to convince shareholders, especially major shareholders and foreign strategic shareholders, to agree to participate in the compulsory transfer.

The policy mechanism and financial resources to handle weak credit institutions in general and to develop a plan for compulsory transfer of compulsory purchasing banks and Dong A Bank in particular still have many shortcomings, obstacles and lengthy procedures.

Coordination and consultation with relevant ministries and sectors are still taking a long time due to the complexity and unprecedented nature of handling weak banks. The Covid-19 pandemic has had a negative impact on the implementation and feasibility of solutions to restructure weak banks.

In addition, the capacity of officers and civil servants doing inspection and supervision work is still limited in conditions of pressure to handle large and complicated workloads, with urgent requirements on progress (conducting inspection and supervision work while restructuring weak banks).

Strictly handle cross ownership

The State Bank also said that it has continued to improve the legal basis and resolutely implemented solutions to prevent and handle share ownership exceeding the prescribed limit, cross-ownership, lending, and investment in violation of regulations, along with the process of restructuring credit institutions.

According to the State Bank, direct cross-ownership between credit institutions and between credit institutions and enterprises is gradually being handled.

Therefore, the ownership of shares exceeding the limit, cross-ownership between credit institutions, credit institutions and enterprises has decreased significantly compared to previous periods. Overcoming the situation of commercial bank ownership of shares in a credit institution exceeding the prescribed ratio of over 5% of the voting shares of another credit institution.

"Although it mainly arose before the Law on Credit Institutions 2010 took effect, share ownership exceeding the prescribed limit and direct cross-ownership between credit institutions and between credit institutions and enterprises were gradually handled," the State Bank said.

However, handling the issue of ownership exceeding the prescribed limit and cross-ownership is still difficult in cases where major shareholders and related persons of major shareholders intentionally conceal or ask other individuals/organizations to register their shares in order to circumvent legal regulations, leading to credit institutions being controlled by these shareholders, potentially leading to the risk of operating without transparency and publicity.

The State Bank said that in the coming time, it will continue to monitor the safety of credit institutions' operations and through inspections of capital, share ownership of credit institutions, lending, investment, and capital contribution activities... in case of detecting risks or violations, it will direct credit institutions to handle existing problems to prevent risks .

Source

![[Photo] Training the spirit of a Navy soldier](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/51457838358049fb8676fe7122a92bfa)

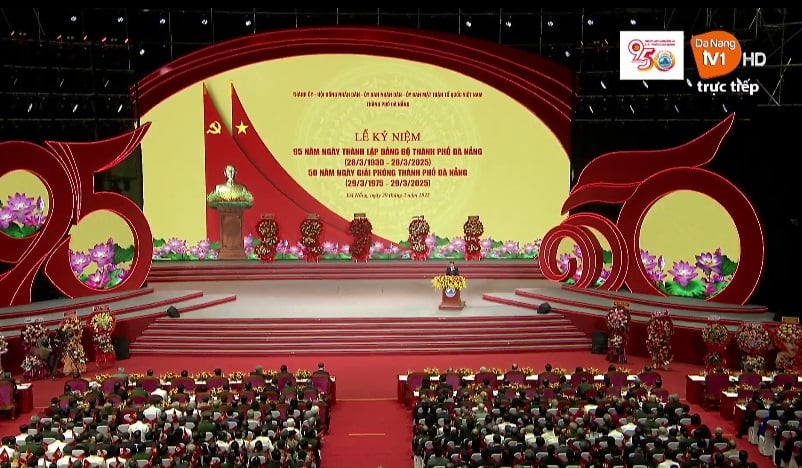

![[Photo] Flower cars and flower boats compete to show off their colors, celebrating the 50th anniversary of Da Nang Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/086d6ece3f244f019ca50bf7cd02753b)

![[Photo] President Luong Cuong hosts state reception for Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/56938fe1b6024f44ae5e4eb35a9ebbdb)

Comment (0)