Yeah1 announced the issuance of more than 54.8 million shares (equivalent to 40% of listed shares) to increase capital capacity, implement capital contribution plans, restructure debt and supplement working capital.

Yeah1 Group Joint Stock Company (stock code: YEG) has just announced a plan to offer 54.8 million shares to existing shareholders, equivalent to 40% of the outstanding shares. Accordingly, shareholders owning 100 shares can buy 40 additional shares.

The offering price is VND10,000/share, 9% higher than the market price on the stock exchange. If the offering is completed, Yeah1 is expected to collect VND548 billion. Accordingly, the company's charter capital will increase from VND1,370 billion to VND1,918 billion.

Expected issuance time is in the third or fourth quarter of 2024, after approval by the State Securities Commission.

The company said the proceeds will be used to improve capital capacity, implement capital contribution plans or cooperate to establish new business segments, M&A , debt restructuring and supplement working capital.

Specifically, Yeah1 will pay to increase capital for 1Production Company Limited (VND211 billion), repay loans to buy shares of Yeah1 Edigital Joint Stock Company (VND127 billion) and Netlink Vietnam Technology Media Joint Stock Company (VND100 billion). In addition, the company will pay off the loan from VietinBank (VND62.4 billion), the remaining amount will be used to supplement capital for content production activities.

At the 2024 annual meeting, answering shareholders' questions about whether increasing charter capital could reduce profitability, Ms. Le Phuong Thao, Chairwoman of the Board of Directors, said that 2023 - 2024 is the golden period to invest in basic resources such as people, studios, technology... to serve the high-quality content production sector.

She believes this is the right direction when most competitors in the industry have not focused on investing in the foundation but only on individual projects. In the future, when the economy recovers , the above preparations will help the company record high profits, thereby improving profitability and bringing great value to shareholders.

YEG stock price is currently at VND9,150, slightly down from the reference price. Previously, this stock had a series of 9 consecutive sessions of decline before breaking the streak at the beginning of the week. YEG has lost 22.8% compared to the price range at the beginning of the year (VND11,850). With more than 137 million shares listed on the HoSE, the market capitalization is about VND1,251 billion.

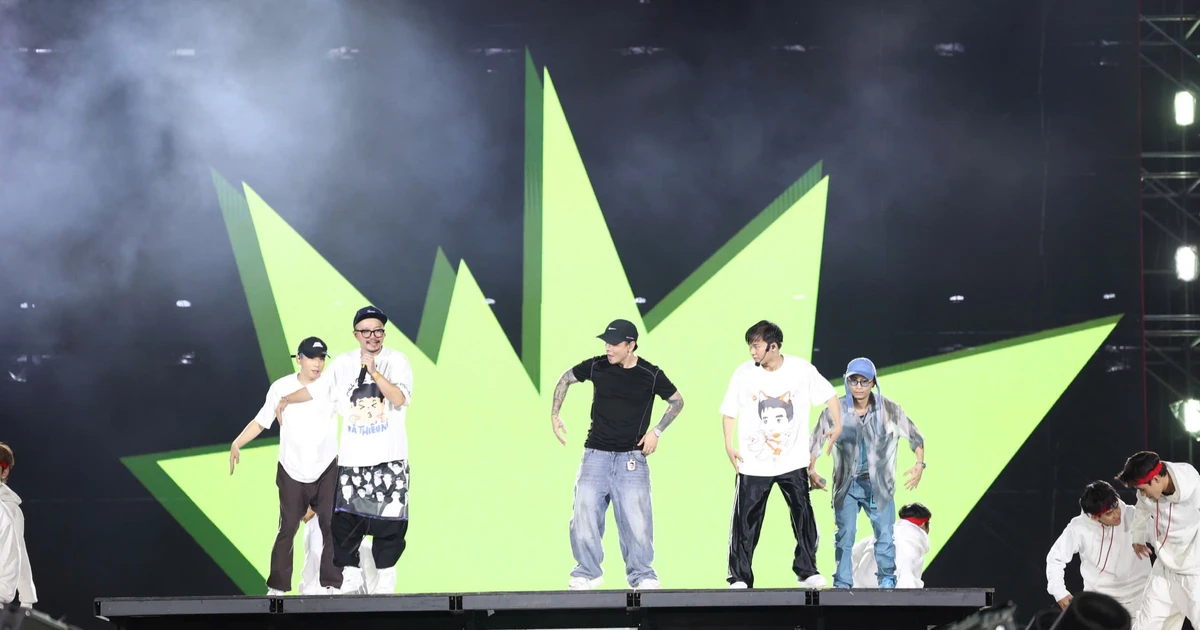

In the first half of the year, the producer of “Anh trai vu ngan cong gai” had a net revenue of nearly 281 billion VND, nearly double the 142 billion VND in the first 6 months of last year. Profit before and after tax reached 24.7 billion VND and 20.5 billion VND, respectively 4.8 times and 2.3 times higher than the same period last year.

According to Yeah1's management, the positive business results in the first half of this year were mainly due to revenue from advertising and media consulting activities growing 136% over the same period.

This year, Yeah1 targets revenue of VND800 - 1,100 billion, an increase of 94-167% compared to 2023. The company expects after-tax profit of VND65 - 105 billion, an increase of more than 145-296% compared to last year.

As of the end of June 2024, Yeah1's total assets reached VND2,005 billion, an increase of VND145 billion compared to the beginning of the year. The company has more than VND1,057 billion in short-term assets, most of which are short-term receivables.

The Group recorded total liabilities of nearly VND607 billion, an increase of VND130 billion compared to the beginning of the year. Short-term loans accounted for the largest proportion in the company's debt structure with more than VND199 billion. Owner's equity currently reached VND1,398 billion, an increase of VND15 billion compared to the beginning of the period.

Source: https://baodautu.vn/yeah1-sap-phat-hanh-548-trieu-co-phieu-rieng-le-d224618.html

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Ho Chi Minh City speeds up sidewalk repair work before April 30 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/17f78833a36f4ba5a9bae215703da710)

![[Photo] Prime Minister Pham Minh Chinh chairs the first meeting of the Steering Committee on Regional and International Financial Centers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/47dc687989d4479d95a1dce4466edd32)

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

Comment (0)