VN-Index recovers more than 20 points after 5 sessions, 2 bank stocks expected to increase more than 20%, Senior leaders aggressively sell MWG shares, dividend payment schedule.

VN-Index increased for 5 consecutive sessions, reaching 1,270 points

At the end of the last trading week, VN-Index returned to the 1,270 point threshold, reaching 1,272 points, up more than 20 points after 1 trading week.

Green dominated with 415 stocks increasing and 349 stocks decreasing, cash flow improved significantly when it skyrocketed to nearly 21,821 billion VND, up 33% compared to the average of the past month.

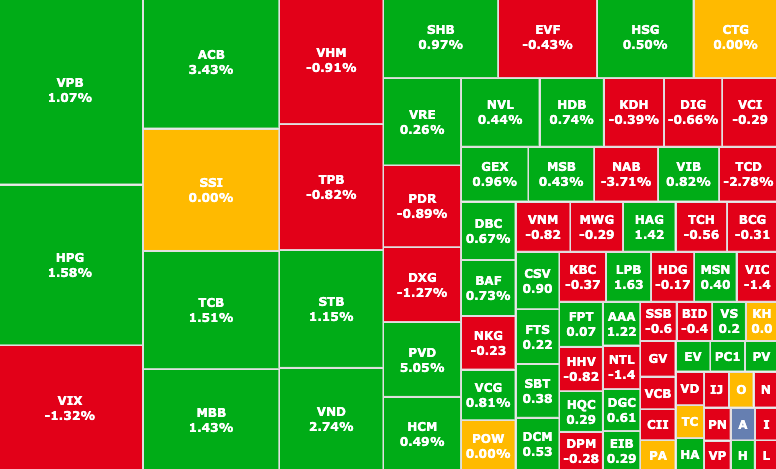

The VN30 group had 16 stocks increasing, helping to maintain the green color for the group, notably ACB (ACB Bank, HOSE) increasing strongly by 3.43%, establishing a new historical peak at 25,650 VND/share.

Following that, HPG (Hoa Phat Steel, HOSE), TCB (Techcombank, HOSE) and MBB (MBBank, HOSE) increased by over 1%. On the contrary, VCB (Vietcombank, HOSE), VIC (Vingroup, HOSE) and VHM (Vinhomes, HOSE) were the reasons creating resistance to the market's growth.

Banking stocks led the increase last week (Photo: SSI iBoard)

In terms of industry groups, real estate, consumption, securities and steel have strong differentiation. Meanwhile, the oil and gas group attracted cash flow with many codes increasing strongly: PVD (Oil and Gas Drilling and Drilling Services, HOSE) increased by 5%, PVC (Oil and Gas Chemicals and Services, HOSE) increased by 3.1%, PVS (Oil and Gas Technical Services, HOSE) increased by 3%,...

Foreign investors reversed to net sell more than 280 billion VND at VHM (Vinhomes, HOSE), VIX (VIX Securities, HOSE), VNM (Vinamilk, HOSE). On the contrary, SSI (SSI Securities, HOSE) led the buying direction.

VPBank and MBBank bank stocks expected to increase by over 20%

The State Bank's move to reduce mortgage interest rates from valuable paper to 4% has helped bank stocks "catch the wave" positively.

In which, Vietcap Securities (VCI, HOSE) gives a buy recommendation for VPB (VPBank, HOSE) and MBB (MBBank Securities, HOSE).

Accordingly, VPB is expected to have the highest improvement in NIM (net interest margin) among banks monitored by VCI, thanks to: reduced mobilization costs; stronger credit growth compared to deposit growth.

Despite the high bad debt ratio and pressure on credit costs, VCI still believes that revenue growth, improvement in NIM and year-end credit demand will support profits at VPB.

VPB is expected to achieve a 30% price increase potential, with a target price of VND 24,500/share.

Regarding MBB , VCI believes that MBB can maintain the bank's NIM around the current level after a strong improvement in the second quarter, thanks to deposit interest rates starting to increase in mid-2024 and fiercer competition with lending interest rates.

Bad debt indicators are stable in the second half of 2024. It is forecasted that by the end of 2024, the bad debt ratio at MBB will be at 1.7%.

VCI's target price at MBB is 30,000 VND/share, with a potential price increase of 21%.

Comments and recommendations

Mr. Pham Duy Hieu, investment consultant, Mirae Asset Securities , commented that VN-Index experienced a trading week with a surprise increase of more than 20 points after two important news: Circular 68 helps create conditions for market upgrading and the US Federal Reserve (FED) lowers interest rates by 50 basis points.

Improved liquidity is considered a reliable signal, confirming that the market has bottomed out after a correction.

VN-Index is forecast to maintain an upward trend, but the risk of "shake-up" still appears (Photo: SSI iBoard)

Next week , VN-Index is forecasted to have a positive trend, with the opportunity to increase to close to 1,300 points. Foreign investors are expected to buy more strongly, along with smart money starting to look for stocks with positive forecasted business results for the third quarter of 2024.

Some stocks that investors can note: Banking: MBB (MBBank, HOSE), ACB (ACB, HOSE); Retail: MWG (Mobile World, HOSE), MSN (Masan, HOSE); Utilities: REE (REE Refrigeration and Electrical Engineering, HOSE).

In the long term, the Vietnamese stock market is receiving many positive prospects: foreign capital has the opportunity to flow into the market when the FED reduces interest rates, reducing pressure on large stock groups (banks, real estate) and increasing liquidity; support from the Government: flexible monetary policy and expansionary fiscal policy, creating momentum for groups: industry, infrastructure and domestic consumption;...

KB Securities said that despite the increase, the selling pressure suddenly increased at the end of the week, causing the VN-Index to lose most of its gains on September 20. However, the trading session coincided with the fund portfolio restructuring period, so the cash flow did not fully reflect the supply-demand situation. The VN-Index is still expected to maintain its upward trend. Investors can flexibly sell off a portion of their holdings and rebalance their positions when the index or target stocks approach the 1,270-point resistance zone.

SSI Securities assessed that, based on the results of last weekend's session, along with technical indicators, the market is likely to face the risk of "shakes" in the short term at the support zone of 1,255 - 1,257 points.

Dividend schedule this week

According to statistics, there are 24 enterprises that have dividend rights from September 23-27, of which 22 enterprises pay in cash, 2 enterprises pay in shares and 1 enterprise pays in combination.

The highest rate is 200%, the lowest is 1%.

2 companies pay by stock:

Transimex Corporation (TMS, HOSE), ex-right trading date is September 23, rate 7%.

Tien Phong Commercial Joint Stock Bank - TPBank (TPB, HOSE) , ex-right trading date is September 23, rate 20%.

1 business pays combination:

SSI Securities Corporation (SSI, HOSE) pays dividends in cash, issues additional shares and exercises purchase rights.

In the form of additional issuance and exercise of purchase rights, the ex-rights trading date is September 23, the rates are 20% and 10% respectively.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| HCC | HNX | 9/23 | 10/24 | 12% |

| SSI | HOSE | 9/23 | 10/18 | 10% |

| PPS | HNX | 9/23 | 10/10 | 9.4% |

| UPC | UPCOM | 24/9 | 10/10 | 16% |

| VNM | HOSE | 24/9 | 10/24 | 9.5% (2023) |

| VNM | HOSE | 24/9 | 10/24 | 15% (phase 1/2024) |

| VGV | UPCOM | 24/9 | 10/4 | 6% |

| VPD | HOSE | 24/9 | 10/25 | 5% |

| UDJ | UPCOM | 24/9 | 10/14 | 6% |

| CMV | HOSE | 9/25 | 10/16 | 4% |

| SBV | HOSE | 9/25 | 10/16 | 2.5% |

| NSS | UPCOM | 9/25 | October 30 | 1% |

| VTP | HOSE | 9/25 | 10/24 | 15% |

| WTC | UPCOM | 9/26 | 8/10 | 12% |

| FBC | UPCOM | 9/26 | 7/11 | 200% |

| TA9 | HNX | 9/26 | 10/16 | 12.1% |

| IJC | HOSE | 9/26 | 12/26 | 7% |

| DWS | UPCOM | 9/26 | 10/10 | 6% |

| TRC | HOSE | 9/27 | 6/11 | 9% |

| TDW | HOSE | 9/27 | 10/14 | 10% |

| SNZ | UPCOM | 9/27 | 10/14 | 12% |

| SAC | UPCOM | 9/27 | 10/15 | 70.7% |

| SSC | HOSE | 9/27 | October 31 | 10% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-23-27-9-vn-index-xuat-hien-nhieu-co-hoi-tang-ap-sat-1300-diem-2024092307463855.htm

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)