VN-Index will increase to 1,555 - 1,663 points in 2025; 5 stocks with the strongest increase in 2024; Banking business results expected to grow strongly; Dividend payment schedule.

VN-Index returns to 1,270 points

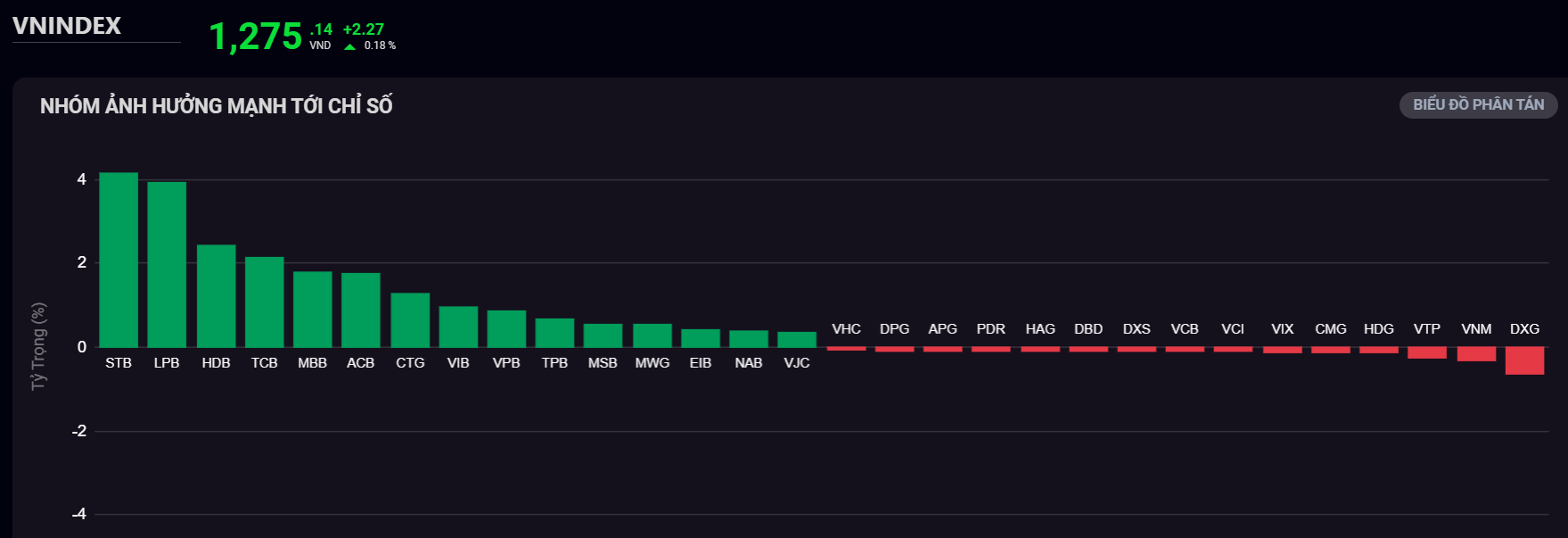

VN-Index officially surpassed the 1,275 point mark thanks to the recovery of the VN30 group last week.

Liquidity on the HOSE floor reached nearly 16,900 billion VND. Meanwhile, both the HNX-Index and UPCoM-Index closed in slight red.

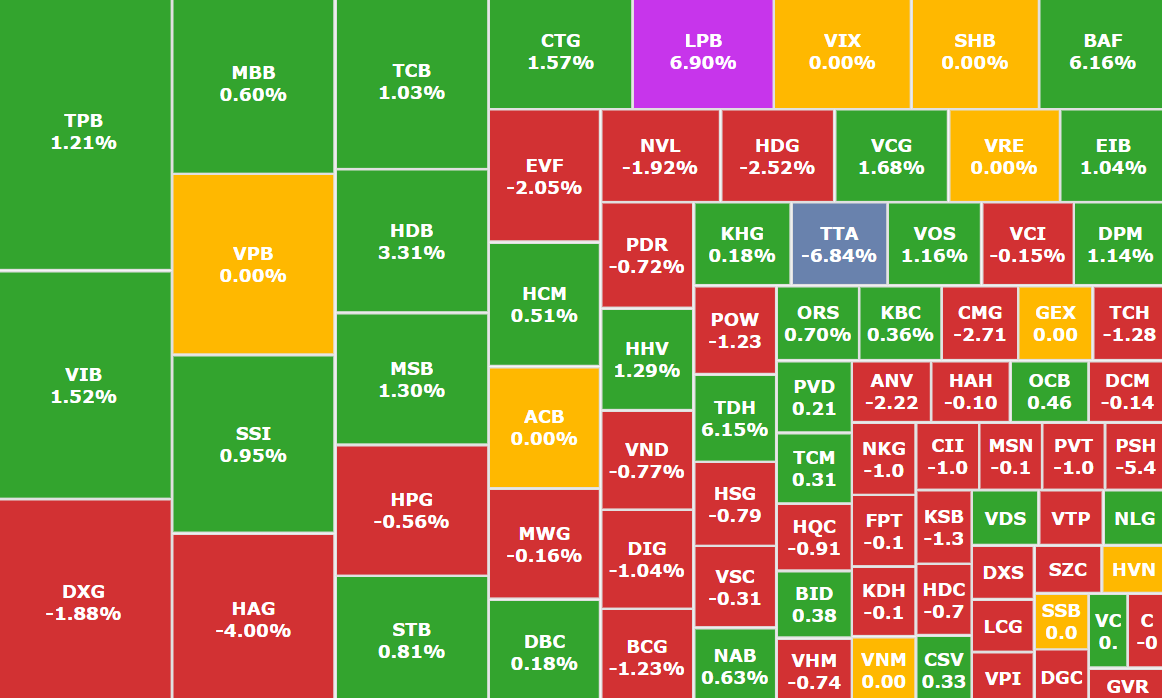

The trading market showed a clear differentiation between stock groups, in which the banking group became the focus with the role of leading the market despite the profit-taking pressure from some other codes. Many codes received strong demand, many stocks increased by more than 1% such as TCB (Techcombank, HOSE), VIB (VIB, HOSE), TPB (TPBank, HOSE),... Most notably, HDB (HDBank, HOSE) led the increase with 3.3%, while LPB (LPBank, HOSE) increased to the ceiling with 6.9%.

Banking group leads positive market developments (Photo: SSI iBoard)

On the other hand, YEG (Yeah1, HOSE) suddenly reversed and hit the floor after a series of consecutive ceiling increases. Next, HBC (Hoa Binh Construction, UPCoM), HAG (Hoang Anh Gia Lai, HOSE), VGI (Viettel Global, UPCoM),... also faced profit-taking pressure, with a sharp decrease of 4-8% in market price on the floor.

Foreign investors sent a positive signal when they reversed and net bought 405 billion VND, focusing on CTG (VietinBank, HOSE), ACV and STB (Sacombank, HOSE).

The Vietnamese stock market is gradually closing a year full of fluctuations. The VN-Index recorded a growth of nearly 12%, but most of the growth was concentrated in the first quarter, while the market fluctuated in a narrow range in the remaining three quarters, failing many times before the 1,300 point threshold.

5 stocks with the strongest growth in 2024

As 2024 draws to a close, in addition to the somewhat gloomy developments, the Vietnamese stock market still witnessed a number of stocks with "huge" increases, bringing many profits to investors, all of which are listed on the HNX.

PTX shares (Petrolimex Nghe Tinh Transport and Services JSC, HNX) reached VND17,800/share, a sharp increase of 3,608% compared to the beginning of the year. This development occurred after the company closed the right to pay the highest cash dividend in history at 15%.

HGM shares (Ha Giang Mechanical and Mineral Joint Stock Company, HNX ) have increased 7 times in the past year. This move came after the company announced its business results in the third quarter with a record profit of nearly 59 billion VND, 3 times higher than the same period last year.

CTP shares (Hoa Binh Takara JSC, HNX) have increased by 555% since the beginning of the year. However, unlike other stocks, CTP has increased thanks to market cash flow when business results were not very positive. In the second quarter, the company did not earn any revenue and had a pre-tax loss of VND151.2 million.

TFC shares (Trang JSC, HNX) increased by 550%, thanks to the business results in the third quarter of 2024 with record revenue and profit, respectively VND 399 billion and VND 82 billion, up 20% over the same period. In addition, the information about paying the highest dividend in history with 12% for 2023 in cash also partly helped the company gain the trust of investors.

KSV shares (TKV Minerals Corporation - JSC, HNX) achieved positive business results last year, helping the market price on the stock exchange increase by 344% since the beginning of the year. In the first 9 months of this year, the company achieved revenue of VND9,165 billion and profit after tax of the parent company of VND807 billion, up 3% and 578% respectively over the same period, completing 76% and 269% of the annual revenue and profit plan.

Business results of the banking group in the fourth quarter of 2024 are expected to improve

Vietcombank Securities (VCBS) recently announced a report predicting the business results of the fourth quarter of 2024 and 2025 of many leading enterprises in the stock market.

Accordingly, the banking group with 11 units represented. TPBank (TPB, HOSE) leads with the highest pre-tax profit growth, reaching 261%, equivalent to VND 2,274 billion in the fourth quarter of 2024. In addition, the driving force to improve TPBank's profit in 2025 will appear when the proportion of loans to the personal segment is at a high level; Strategy focusing on young customers;...

Many banks are expected to see positive business results in the fourth quarter of 2024 thanks to credit growth (Illustration photo: Internet)

Next is VPBank (VPB, HOSE) with an estimated pre-tax profit of VND5,659 billion (+109%) in the fourth quarter. VCBS expects VPBank's credit to continue to grow positively thanks to the recovery of individual customers and the potential to expand the credit portfolio for the SME segment.

VCBS assesses that MBBank's (MBB, HOSE) credit growth will continue to be among the highest in the industry, so MBB is expected to achieve an estimated pre-tax profit of VND9,006 billion.

BIDV (BID, HOSE) is assessed to have solid asset quality thanks to its enhanced credit management capacity, active provisioning for bad debts and low exposure to risky sectors such as corporate bonds (TPDN) and real estate (RE). Pre-tax profit in the fourth quarter of 2024 is estimated at VND 8,778 billion (+11%).

Finally, VietinBank (CTG, HOSE) with pre-tax profit estimated at VND 8,557 billion in the fourth quarter of 2024 when owning good asset quality and a large reserve buffer.

VN-Index will reach 1,555 - 1,663 points in 2025

VCBS Research forecasts that the VN-Index could reach 1,555 points. In a more optimistic scenario, the index could even reach 1,663 points, with the expectation of a market upgrade.

Market liquidity is estimated at VND 29,500 - 30,500 billion/session on all three exchanges, with the increase concentrated from mid-Q2/2025.

The growth momentum of the market is believed to come from attracting investors' attention; Foreign investors reducing net selling; The market upgrade event, expected to bring in cash flow of 1.3 - 1.5 billion USD in Q3/2025 (before the upgrade) and the two stocks BSR and MCH moving to HoSE, which can act as catalysts for the excitement of the market.

From there, VCBS Research makes strategic recommendations for investors in 2025, focusing on Bluechips (large-cap) stocks in the first half of the year and gradually shifting to Midcaps and Smallcaps (medium and small-cap) in the second half of the year.

The portfolio of stocks has clear growth prospects in each period, investors can refer to some stocks from the real estate - construction, banking and oil and gas groups, including: NLG (Nam Long Investment, HOSE), AGG (An Gia Real Estate, HOSE), PDR (Phat Dat Real Estate, HOSE), KBC (Kinh Bac, HOSE), MBB (MBBank, HOSE), MSB (MSB, HOSE), TCB (Techcombank, HOSE), PLX (Petrolimex, HOSE), DCM (Ca Mau Petroleum, HOSE),...

Comments and recommendations

Ms. Nguyen Ngoc Khanh Thy, Consultant, Mirae Asset Securities, assessed that the short-term movement trend is not too big, the market amplitude fluctuates within 1,250 - 1,275 points with average liquidity, showing that the market is still not "lively", the cash flow is still hesitant.

Vietnam's stock market still has a lot of positive room in 2025, expected to conquer the 1,300 point threshold

A macro factor that needs special attention at this time is the DXY index (dollar strength), exchange rate pressure is forecast to persist in 2025, but in the short term, the DXY's growth momentum is slowing down compared to the growth momentum of the previous 2 weeks. Therefore, according to her, the DXY forecast may have unexpected breakthroughs, investors should be cautious and manage risks rather than increase the proportion during this slowdown in growth.

However, in the long term, the market still has positive room in 2025 thanks to: Domestic easing policies; World trade fluctuations due to the new presidential term in the US - specifically China; Vietnam's efforts to upgrade its ranking;...

The story of stock selection at the beginning of the new year will be related to the business results of the fourth quarter of 2024, typically the retail industry with the whole industry's profit expected to continue to increase strongly thanks to the gradual recovery of consumer demand and purchasing power; followed by the real estate industry with the peak handover period in the last quarter of this year. Finally, technology, chemicals and transportation.

Some stocks you can refer to: MWG (Mobile World, HOSE), FRT (FPT Retail, HOSE), DIG (DIC Group, HOSE), FPT (FPT, HOSE),...

KB Securities According to the market research, a defensive sentiment is emerging between buyers and sellers, with small and medium-cap stocks under greater downward pressure, but blue-chip stocks are still holding their green and acting as a support for the market. Therefore, the uptrend is still expected to prevail, bringing the index to further resistance levels at 1,280 - 1,305 points.

TPS Securities said, The bulls are in control, but the lack of liquidity still poses risks to the market in the short term. In the medium and long term, the VN-Index is expected to once again reach the 1,300 point threshold in the new year.

Dividend schedule this week

According to statistics, there are 13 enterprises with dividend rights from December 30, 2024 to January 3, 2025, of which 12 enterprises pay in cash and 1 enterprise pays in shares.

The highest rate is 20%, the lowest is 4%.

1 company pays by stock:

CMC Technology Group Corporation (CMG, HOSE), ex-right trading date is December 30, rate is 11%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| HCB | UPCOM | 12/30/2024 | 10/1/2025 | 15% |

| M10 | UPCOM | 12/30/2024 | 1/23/2025 | 10% |

| VTB | HOSE | 12/30/2024 | 10/1/2025 | 5% |

| VTB | HOSE | 12/30/2024 | 10/1/2025 | 4% |

| VSH | HOSE | 12/30/2024 | 20/2/2025 | 5% |

| SBM | UPCOM | 12/31/2024 | 1/23/2025 | 10% |

| PMW | UPCOM | 12/31/2024 | 17/1/2025 | 10% |

| ICN | UPCOM | 12/31/2024 | 1/21/2025 | 20% |

| PTB | HOSE | 2/1/2025 | 16/1/2025 | 10% |

| VLB | UPCOM | 3/1/2025 | 20/2/2025 | 20% |

| DPH | UPCOM | 3/1/2025 | 1/20/2025 | 17% |

| TRA | HOSE | 3/1/2025 | 1/24/2025 | 20% |

Source: https://pnvnweb.dev.cnnd.vn/chung-khoan-tuan-30-12-2024-3-1-2025-vn-index-nhieu-du-dia-tich-cuc-ky-vong-chinh-phuc-moc-1300-20241230090042581.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)