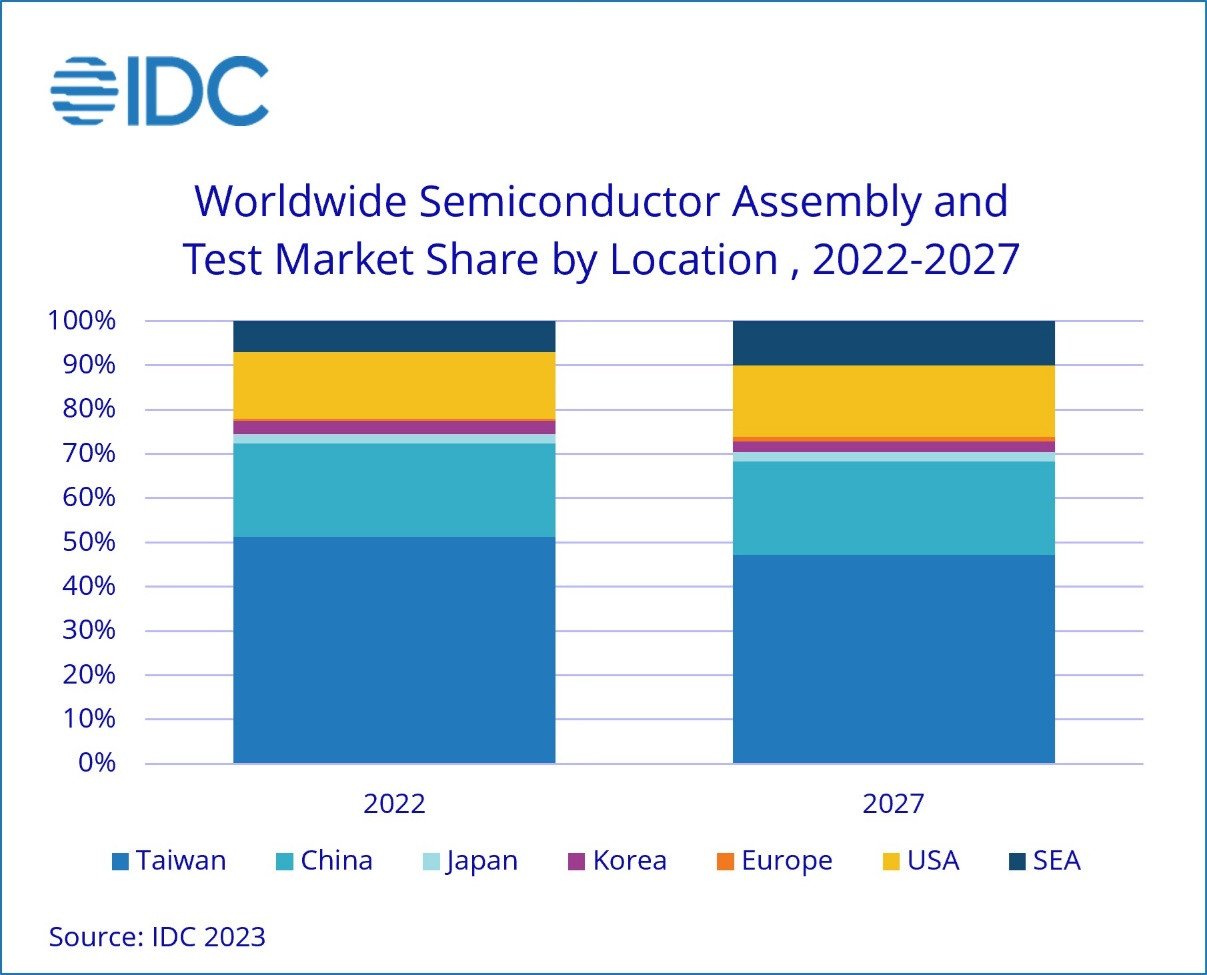

According to a recently released IDC report, Southeast Asia, especially Vietnam and Malaysia, will play an increasingly important role in the global semiconductor assembly and testing market.

IDC report assesses the impact of geopolitics on the Asian semiconductor supply chain . According to the research firm, with many countries implementing their own semiconductor and chip policies, semiconductor manufacturers are forced to come up with a “China + 1” or “Taiwan + 1” plan.

This drives a new landscape for the foundry and assembly/test industries, leading to the overall development of the entire region in the supply chain.

“Geopolitical shifts are fundamentally changing the semiconductor game. While the immediate impact may not be clear, long-term strategies are focusing more on self-reliance, security, and supply chain control. The industry is shifting from global collaboration to multi-regional competition,” said Helen Chiang, Asia-Pacific research leader at IDC.

In the semiconductor assembly and test (OSAT) industry, given the influence of geopolitics, technological development and talent, leading integrated device manufacturers (IDMs) from the US and China have begun to invest more in Southeast Asia. OSAT enterprises have also gradually shifted their attention from China to Southeast Asia.

IDC predicts that Southeast Asia will play an increasingly important role in the OSAT market. In particular, Vietnam and Malaysia are regions that deserve special attention in the future development of the semiconductor sector, as the two countries could account for 10% of the global market share by 2027.

During his recent visit to the US, Prime Minister Pham Minh Chinh had working sessions with leading semiconductor corporations. Many US semiconductor companies highly appreciated the potential for developing Vietnam's semiconductor industry, paying attention to cooperation in developing the semiconductor industrial ecosystem and locating manufacturing plants here in the long term.

In response, the Prime Minister said that the Government and ministries will create an equal and healthy business environment, creating the best conditions for foreign enterprises to invest and operate smoothly, stably, effectively and sustainably in Vietnam.

To date, Vietnam is also the convergence point of many giants in the global semiconductor supply chain such as Intel, Samsung and Synopsys.

Geopolitics is fundamentally changing the semiconductor game

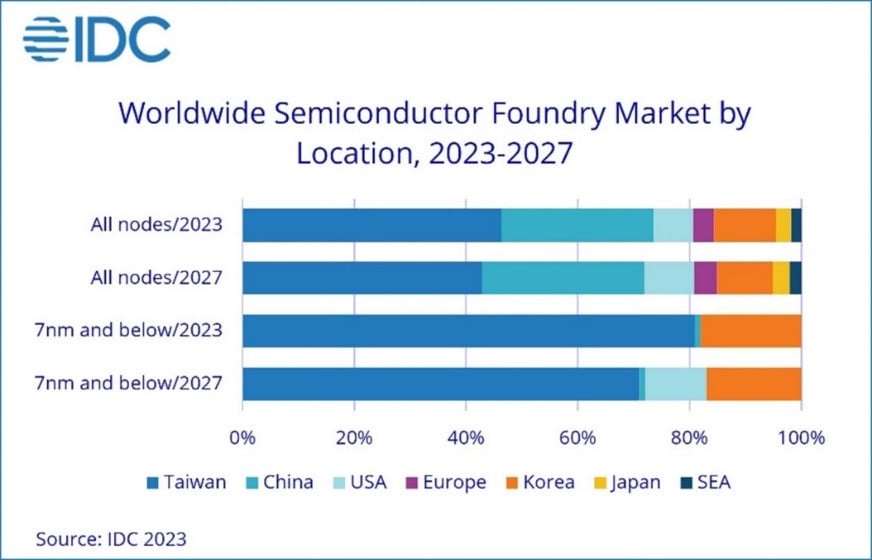

Meanwhile, IDC believes that Taiwan's market share in the chip manufacturing supply chain, including foundry, assembly and testing, will decline in the next few years amid changes in semiconductor policies and complex geopolitical competition.

Specifically, the market share of Taiwanese chipmakers in the foundry sector will fall to 43% in 2027, from 46% this year. For the OSAT sector, experts estimate the market share will fall to 47% in 2027 from 51% last year.

IDC forecasts that China's foundry and OSAT market shares are expected to reach 29% and 22.4% in the same period, up 2% and 22.1% year-on-year, respectively.

Semiconductors have become the center of an all-out technology war between the world's two largest economies, with the US imposing a series of trade sanctions aimed at thwarting Beijing's ambitions for technological autonomy.

Analysis from IDC found that China’s efforts to become self-sufficient in high-tech have made progress. “Although China faces challenges in developing advanced chip manufacturing processes, its mature processes are developing rapidly,” the report said.

Chinese chipmakers are expected to increase their market share of 12-inch wafer manufacturing capacity to 26% in 2026, up from 24% in 2022, according to a report by research firm TrendForce released in July.

Vietnam could become a source of semiconductor labor for US companies

Vietnam could become a source of semiconductor human resources for chip manufacturing companies in the US. It is expected that by 2030, Vietnam will train and provide about 50,000 semiconductor engineers.

Strategy to 'revive' Japan's semiconductor industry

In order to revive the semiconductor industry that has stagnated for decades, the Japanese government has stepped up financial support to attract the construction of manufacturing plants, while simultaneously building its own chip foundry "flag".

Vietnam will have a mechanism to promote the semiconductor industry.

Deputy Minister of Information and Communications Nguyen Huy Dung said that he will accelerate Vietnam's participation in the regional semiconductor ecosystem, attracting global semiconductor businesses to be present, produce, and conduct research and development in Vietnam.

Source

Comment (0)