In the domestic market, gold prices fell following world price movements, closing the trading week at nearly 100 million VND/tael.

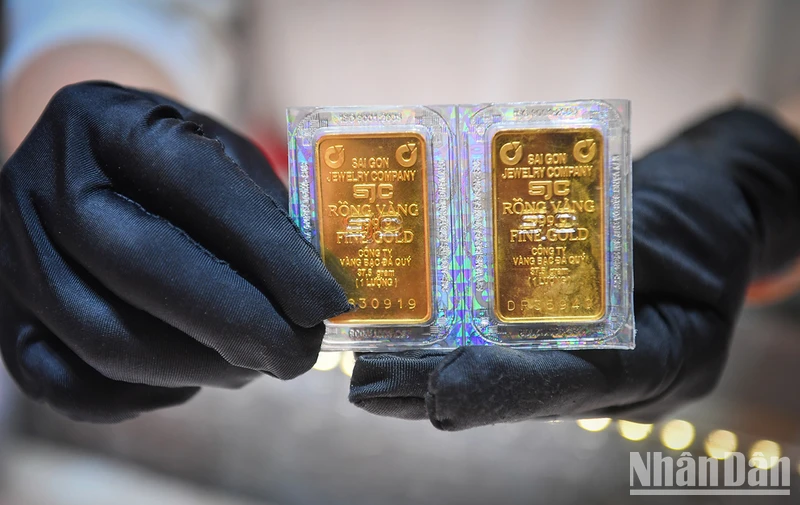

Specifically, at 10:00 a.m. on April 6, Saigon Jewelry Company (SJC) listed the buying and selling price of SJC gold bars at 97.1-101.1 million VND/tael.

The price of SJC 9999 gold ring closed the week at 97 million VND/tael for buying and 100 million VND/tael for selling.

DOJI gold bar price in Hanoi and Ho Chi Minh City is bought at 97.1 million VND/tael and sold at 101.1 million VND/tael.

This brand listed the buying and selling price of Doji Hung Thinh Vuong 9999 gold rings at the same price as gold bars at 96.7-101.1 million VND/tael.

PNJ Gold closed the week buying at 97.5 million VND/tael and selling at 101.1 million VND/tael.

As of 10:00 a.m. on April 6 (Vietnam time), the world gold price decreased by 22.1 USD compared to the previous session to 3,036.8 USD/ounce.

World gold prices continued to decline this morning despite supportive fundamentals as significant losses in the US stock market prompted investors to liquidate gold positions to create the necessary liquidity to cover losses in the stock market.

According to the latest Kitco News weekly gold survey, professionals have given up on last week’s extreme bullish trend, while retail traders are only slightly less optimistic about gold prices next week despite the recent sharp sell-off.

The sell-off yesterday and today was about raising cash to cover margin calls after the stock market plunged after US President Donald Trump announced new reciprocal tariffs on goods from many countries, said Rich Checkan, chairman and CEO of Asset Strategies International.

“Bargain hunters will rush in next week to buy cheap gold and silver, helping the precious metals to rally again,” the expert predicted.

For his part, Colin Cieszynski, chief market strategist at SIA Wealth Management, said gold had a big rally ahead of this week’s tariff announcement and the market could see another short-term correction as some traders take profits.

In the medium term, Mr. Colin Cieszynski believes that the economic and geopolitical uncertainties that drive gold's upward trend remain intact.

Adrian Day, Chairman of Adrian Day Asset Management, also commented that gold prices will decrease in the coming time, but the long-term upward trend of gold prices remains unchanged.

“Next week, gold is likely to continue its decline to $3,000, but any decline will be short and shallow as the factors that have supported gold over the past two years have not disappeared. On the other hand, gold is still under-owned, especially in North America. So next week, prices will fall, but rally strongly for the rest of the year,” Adrian Day added.

This week, 16 Wall Street analysts participated in the Kitco News Gold Survey. Five analysts, or 31%, see gold prices rising next week, while eight analysts, or 50%, see the precious metal falling. The remaining three analysts, or 19%, see prices moving sideways.

Meanwhile, 167 Main Street retail investors, or 61%, of the 273 investors who participated in a Kitco News poll expect gold prices to rise next week; another 70, or 26%, see prices falling. The remaining 36 investors, or 13%, are neutral.

This morning, the USD-Index recovered to 103.02 points; the yield on 10-year US Treasury bonds was at 3.999%; US stocks were volatile after President Donald Trump's tariff announcements; world oil prices plummeted, trading at 65.58 USD/barrel for Brent oil and 6299 USD/barrel for WTI oil.

According to NDO

Source: https://baothanhhoa.vn/vang-giam-sau-khi-thi-truong-chung-khoan-toan-cau-chao-dao-244759.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)