Exchange rate, interest rate pressure reduced but still need to be cautious

On April 2, the administration of US President Donald Trump announced a list of reciprocal tariffs on 60 countries, including a tax rate of up to 46% on goods from Vietnam, effective from April 9. This information immediately caused strong fluctuations in the global financial market.

However, on April 10, 2025, US President Donald Trump unexpectedly announced a 90-day suspension of reciprocal tariffs on more than 75 countries, except for China, which was subject to a 125% tariff increase. This decision was made after pressure from the international community and trading partners, and opened up opportunities for negotiations to ease global trade tensions.

This move not only brings temporary "relief" but also creates significant impacts on the gold market, exchange rates and domestic interest rates.

Gold prices have been volatile in the world market before the US announced the tariff delay. According to data, the price of the yellow metal increased by 3% on April 9 and recorded its best day in many years, supported by safe-haven flows amid escalating US-China trade tensions after US President Donald Trump's decision to increase tariffs on China.

However, after the tax postponement announcement, in this morning's session, the world gold price continued to increase sharply, at one point reaching 3,122 USD/ounce, an increase of 77 USD compared to the previous trading session.

While the reciprocal tariff deferral is a positive sign for the global economy, uncertainty remains. Investors may not be entirely confident about a long-term trade deal between the US and China. The sharp $77 rise in gold prices in one day shows that the market is still concerned about the global economic situation. Especially when factors such as US interest rates, monetary policies of major economies and the global debt situation are still major concerns for investors.

In Vietnam, gold prices often fluctuate according to world gold prices. However, the level of this fluctuation is also influenced by factors such as the VND/USD exchange rate and the State Bank's management policies.

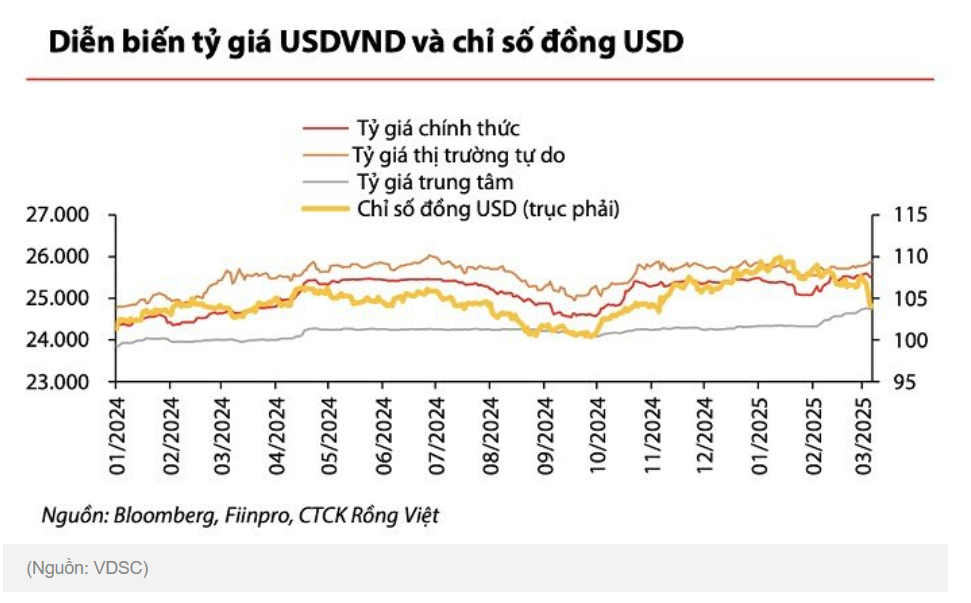

The USD/VND exchange rate is one of the most sensitive indicators to US trade policies, especially when Vietnam depends heavily on exports to this market. Before the US postponed the tax, State Bank Governor Nguyen Thi Hong warned of “complicated exchange rate developments” following President Trump’s announcement of the tax, with a 0.6% increase on the first day. The 46% tax rate expected to be imposed on Vietnamese goods could reduce export turnover, put pressure on foreign currency supply and push up the exchange rate, estimated at about 3%-5% according to analysis by some experts.

The decision to postpone the tax for 90 days helps to reduce immediate pressure on the exchange rate. With the temporary tax rate of only 10%, Vietnamese export enterprises have more time to adjust their strategies and maintain foreign currency flows from the US - a source of revenue that accounts for the majority of the trade balance. This helps the State Bank stabilize the exchange rate, avoiding the situation of overheating like the two sessions on April 8-9.

Specifically, in the afternoon session on April 8, the exchange rate at Vietcombank was listed at 25,750-26,140 VND, up 160 VND compared to the opening price in the morning. By the session on April 9, the exchange rate was from 25,792-26,182 VND/USD (buy/sell), up 42 VND compared to the previous session.

However, in the morning session of April 10, after the announcement of the postponement of the tariff rate, the exchange rate at commercial banks dropped sharply by 182 VND, currently trading at 26,000 VND/USD.

Economist Dinh Trong Thinh said that the decrease in the VND/USD exchange rate could be a sign of temporary stability in the Vietnamese economy. After the decision to postpone the tax, the international financial market reacted positively, which reduced investors' concerns about the global trade situation. As trade tensions between the US and China temporarily eased, the demand for USD reserves in Vietnam decreased, causing the exchange rate to decrease slightly. Moreover, domestic economic data showed that the Vietnamese economy was maintaining a stable growth momentum, which also contributed to reducing pressure on the exchange rate.

However, Governor Nguyen Thi Hong also emphasized: "The State Bank will closely monitor market developments to operate at a reasonable dose, considering the harmony between exchange rates and the target of reducing interest rates."

This shows that, despite the reduced pressure, the State Bank is still cautious about the risk of fluctuations from external factors, especially if the US and China escalate the trade war.

Experts believe that in the next 90 days, the USD/VND exchange rate may remain stable around the current level, but there is still a potential risk of an increase if negotiations with the US do not achieve positive results or if China retaliates strongly, causing fluctuations in global capital flows.

VND faces risk of 10% devaluation due to tariff pressure

Commenting on the exchange rate developments, Dr. Nguyen Tri Hieu, Director of the Institute for Research and Development of Global Financial and Real Estate Markets, said that the USD/VND exchange rate will be under great pressure if the US imposes a tariff of up to 46% on goods originating from Vietnam. The main reason comes from the serious decline in foreign currency revenue from export activities.

According to Mr. Hieu, in the first three months of 2025 alone, Vietnam’s import turnover has reached about 100 billion USD. Meanwhile, foreign exchange reserves are currently only about 80 billion USD – lower than the international standard that requires reserves equivalent to at least three months of imports. Exports continue to face difficulties due to tariff barriers, thereby creating increasing pressure on the exchange rate.

“In the adverse scenario, if the 46% tax rate is maintained, the USD/VND exchange rate could increase by up to 10% this year,” Dr. Hieu emphasized.

"However, the 46% tax rate is still under negotiation. Therefore, it is not possible to give a specific forecast on the exchange rate fluctuations in 2025 until Vietnam and the US reach a final agreement on tariffs," he added.

Sharing the same view, UOB Bank's report said that the tariff policy will cause Vietnamese goods to lose their competitive advantage in the US. This could negatively affect the GDP growth target of 8% this year and continue to put pressure on the exchange rate.

UOB experts maintain the view that the VND will continue to weaken, with updated forecasts of the USD/VND exchange rate at VND26,500/USD in Q2/2025, VND27,200/USD in Q3/2025, VND26,800/USD in Q4/2025, and VND26,500/USD in Q1/2026.

In the context of exchange rate pressure and no final decision on tariffs on Vietnamese goods, operating interest rates are expected to continue to create conditions to support growth.

Experts say the pressure on exchange rates mainly comes from the State Bank of Vietnam (SBV)'s ability to maintain or lower interest rates to support domestic economic growth.

In fact, the SBV has maintained the basic interest rate on open market operations (OMO) at 4% in recent periods, while the refinancing rate has been kept at 4.5%, reflecting controlled inflation and stability in 12-month deposit interest rates.

According to data from the State Bank of Vietnam, by the end of the first quarter of 2025, the new deposit interest rate level remained almost unchanged, increasing by only 0.08%, while the lending interest rate level continued to decrease by 0.4% compared to the end of 2024, demonstrating the banking system's efforts to support the economy.

However, according to UOB, if the economic and labor market conditions continue to deteriorate, the SBV may lower interest rates to the low levels seen during the COVID-19 period, ie 4%, or even 3.5%. This scenario will depend on the stability of the foreign exchange market and the interest rate cut from the US Federal Reserve.

From the perspective of expert Nguyen Tri Hieu, the State Bank has not yet officially announced a response plan, however, the operator has many policy tools that can be used in case foreign currency revenue declines.

"First, is to issue treasury bills to withdraw money from circulation, thereby reducing money supply and reducing pressure on exchange rates. Second, is to increase foreign exchange reserves through channels such as international borrowing or attracting remittances. Third, is to adjust the operating interest rate in a slightly upward direction to narrow the interest rate gap between Vietnam and the US, thereby limiting capital outflows," he said.

However, Mr. Hieu also emphasized that the 46% tax rate is an unprecedented tax rate in the history of Vietnam-US trade relations. This is a huge challenge and the State Bank may need more special measures if it wants to maintain macroeconomic stability.

Source: https://baodaknong.vn/kich-ban-nao-cho-ty-gia-khi-my-van-ap-thue-doi-ung-46-249191.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)